bonds

Investors’ personal motives for buying bonds should inform what they do next.I insist it is folly to quit sound investments because of a bad quarter, but the bond market swoon of early 2022 tests my resolve. When superb stuff such as tax-exempt toll-road bonds, taxable infrastructure municipals and BBB corporates suffer losses of 6% to 10%, that is true shock and awe.

The last time returns took a big wallop was the summer “taper tantrum” of 2013, when, despite the absence of inflation, traders overreacted to Federal Reserve plans to cut back bond purchases. That episode is remembered now as an epic buying opportunity – thus, it is tempting to interpret the current downturn in the same vein.

Not so fast. With inflation elevated, there will not be another rampaging bull market by and by. But bond specialists wager that select parts of the bond universe will level off or recover somewhat.

Jason Brady, CEO of Thornburg Investment Management, says he is starting to grab at interest-rate-sensitive IOUs. “I can buy solid investment-grade credit at 4% that not long ago was 1%,” he reasons. Megan Horneman, chief investment officer of Verdance Capital, says, “I don’t think we’ll take these types of losses in subsequent quarters.” She says bonds remain “challenged,” but urges investors to “remember why you buy fixed income.”

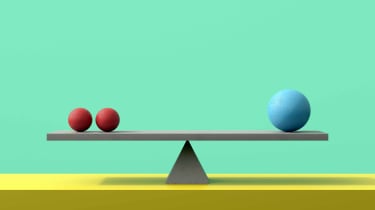

Why do you buy bonds and bond-like investments? Your answer should inform what you do next. If you use bonds for growth on top of income, you may deem it too early to buy, though it sure looks too late to sell. If cash flow and diversification predominate, consider select opportunities. It is sensible to creep into out-of-favor investments when the results are still poor but the outlook is not as dire as it was. Here’s why:

Inflation may be less than you think. The bond market pegs year-end inflation well below the consumer price index headlines. The Inflation Project of the Federal Reserve Bank of Atlanta puts 2022’s toll at 4.5%. A comparable Cleveland Fed forecast is 5.2%. You can scoff, but this eases fears that inflation will send interest rates to 1980s levels and further smash bond returns.

Yields are higher and spreads are wider. Higher coupon rates on new issues and lower bond prices offer better entry points. Municipals were expensive late last year, yielding less than 70% of the yield on Treasuries. Now, the ratio is 93% for 10-year maturities and 104% for 30-year tax-frees, which is a strong precursor for munis to outperform over the next few months.

The yield advantage on corporate bonds and mortgage-backed securities over Treasuries is also widening. People are still buying houses, but they are no longer able to refinance, conditions that are ideal if you invest in mortgage bonds.

Individual bonds are unscathed. If you own a collection or ladder of single bonds, daily market prices are irrelevant. Instead, you may find that if you reclaim matured principal, you can reinvest it for a better rate than you imagined.

Credit quality is fine. There are few defaults, and once-dicey debtors such as oil drillers and commercial real estate firms benefit from the inflation in energy prices and rents. People are paying their car loans, mortgages and credit card bills. If your priority as an investor is to get your money, it is still safe to be a lender.

Simple, Time-Tested Ways to Protect Your 401(k) from a Crash

401(k)s

Simple, Time-Tested Ways to Protect Your 401(k) from a CrashMarkets have been on edge for months, and so are retirement savers. To safeguard your savings, follow these investing golden rules.

April 20, 2022

Your Guide to Roth Conversions

Special Report

Tax Breaks

Your Guide to Roth ConversionsA Kiplinger Special Report

February 25, 2021

Kiplinger’s Weekly Earnings Calendar

stocks

Kiplinger’s Weekly Earnings CalendarCheck out our earnings calendar for the upcoming week, as well as our previews of the more noteworthy reports.

April 22, 2022

How to Navigate the Amusement Park of Rising Interest Rates

bonds

How to Navigate the Amusement Park of Rising Interest RatesUnderstanding how rising interest rates affect bond values can help you see the big picture.

April 26, 2022

Should You Harvest a Loss in Your Bond Fund or ETF?

bonds

Should You Harvest a Loss in Your Bond Fund or ETF?With bond performance this bad, it could be a good time to turn a bad situation into a power move. There’s something to be said for the flexibility it…

April 18, 2022

5 Best Bond ETFs for 2022

ETFs

5 Best Bond ETFs for 2022The bond market has struggled of late, but investors with a longer-term view should consider these bond ETFs to balance their portfolios.

April 11, 2022

7 Actively Managed ETFs to Buy for an Edge

ETFs

7 Actively Managed ETFs to Buy for an EdgeActively managed ETFs are starting to blossom in popularity. Investors unfamiliar with the space can start with these seven active funds.

April 8, 2022