Stock Market Today

A heaping helping of lousy economic data Thursday washed away any optimism traders showed after the Fed’s latest policy decision.Whatever cheer investors took from yesterday’s Federal Reserve policy announcement and Chair Jerome Powell’s presser evaporated Thursday, as the major indexes sank and the Dow Jones Industrial Average dropped to within close reach of its own bear market.

Several pieces of data out today hinted at a slowing economy:

The Philadelphia Fed Manufacturing Index dropped to -3.3, versus +5.5 expected, indicating that the region’s manufacturing activity was contracting for the first time since May 2020.Housing starts plunged 14.4% in May to 1.549 million annualized units, the lowest in 13 months.And while initial unemployment filings for the week ended June 11 were unchanged at 229,000, the prior week’s number was revised upward by 3,000 filings, and the four-week moving average of 218,500 was the highest in five months.”The labor and housing markets are normalizing after running red-hot in 2021,” says Bill Adams, Chief Economist for Comerica Bank. “Higher interest rates have broken the fever in housing, with the benchmark survey of homebuilders showing reduced foot traffic at showings. Layoffs are still historically low in the U.S., but rising. A couple of states noted layoffs in the broad industry groups that include retail, e-commerce, and temp services in the latest week’s data.”

Meanwhile, investors continue to mull the ramifications of the Federal Reserve’s 75-basis-point interest-rate cut – and how effective it might be against a major market headwind.

Sign up for Kiplinger’s FREE Investing Weekly e-letter for stock, ETF and mutual fund recommendations, and other investing advice.

“Perhaps [the rate cut] increases the Fed’s credibility, but it remains to be seen whether monetary policy is a sufficient tool to materially impact inflation that is being primarily driven by supply side constraints,” says Shawn Snyder, Head of Investment Strategy at Citi Personal Wealth Management.

Every single market sector was lower Thursday, though some had it worse than others. Energy stocks (-5.5%) were the market’s worst performer despite a 2.0% improvement in U.S. crude oil futures, to $117.58 per barrel. Tech and tech-esque stocks continued to absorb the brunt of higher-rate fears; Tesla (TSLA, -8.5%), Advanced Micro Devices (AMD, -8.1%) and Charter Communications (CHTR, -7.5%) were among some of the most notable decliners.

Consumer staples (-0.8%) offered the best defense, relatively speaking, thanks to modest gains in the likes of Walmart (WMT, +1.0%) and Procter & Gamble (PG, +0.6%).

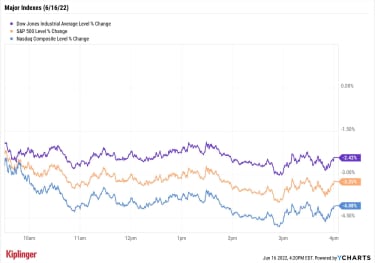

The major indexes sustained significant damage. The Nasdaq Composite (-4.1% to 10,646) led the way lower, followed by the S&P 500 (-3.3% to 3,666) and the Dow (-2.4% to 29,927). The industrial average is now just a 2.2% decline away from being 20% below its Jan. 3 closing high and entering its own bear market.

YCharts

Other news in the stock market today:

The small-cap Russell 2000 retreated by 4.7% to 1,649.Gold futures gained 1.7% to finish at $1,849.90 an ounce.Bitcoin’s decline continued, with the cryptocurrency off 3.9% to $20,841.49. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.) Fears of a potential recession dragged on a number of travel stocks today. Cruise operators Carnival (CCL, -11.1%) and Royal Caribbean (RCL, -11.4%) were among the biggest decliners, while airlines American Airlines (AAL, -8.6%) and Delta Air Lines (DAL, -7.5%) also plummeted.Kroger (KR) stock slipped 2.1% after the grocery chain reported earnings. In its first quarter, KR recorded adjusted earnings of $1.45 per share and revenue of $44.6 billion, more than the $1.30 per share and $44.2 billion a nalysts were expecting. Kroger expects full-year earnings to arrive between $3.85 per share and $3.95 per share, a slight (10-cent) improvement on the low end of its previous forecast. CFRA Research analyst Arun Sundaram maintained a Sell rating on KR stock. “Gross margin headwinds could strengthen with price competition increases and continued inflationary pressures,” the analyst says. “Lower fuel margins, less COVID-19 vaccine benefits, and moderating food-at-home demand will also likely be headwinds this year. Overall, we think it is a good time for investors to take profits considering KR shares have outperformed peers and the broader market year-to-date.”More Energy in Energy?Oil and gas stocks might have had a miserable day, but don’t assume they’re out of fuel either.

“We believe energy prices will remain elevated for the foreseeable future, as demand for fossil fuels is not declining as fast as people think and alternative energy is not as available as people think,” says David Trainer, CEO of investment research firm New Constructs. “Profits in the energy sector are rising much faster than the sector’s overall valuation, so there remains plenty of upside across the sector.”

But given energy’s still-massive run in 2022 (+41.6% YTD), investors don’t have the leeway to buy the sector indiscriminately, unlike earlier in the year.

“Investors need to do their homework in this environment and focus on the most profitable companies trading at the biggest discounts no matter what the sector is,” he says.

Investors who want to try to squeeze a little more juice from the oil patch can start their search with our seven best energy picks for the rest of the year. Each of these stocks earns high marks from the analyst community, and we highlight what sets them apart from the pack.

6 ‘Retirement Killers’ to Avoid at All Costs

retirement planning

6 ‘Retirement Killers’ to Avoid at All CostsIt’s unfortunate, but people make the same money mistakes all the time. Here are six surefire mistakes that can kill your retirement – and remedies th…

June 13, 2022

Your Guide to Roth Conversions

Special Report

Tax Breaks

Your Guide to Roth ConversionsA Kiplinger Special Report

February 25, 2021

Why Are Gas Prices Still Going Up?

spending

Why Are Gas Prices Still Going Up?The cost of a gallon of gas is at an all-time high. What’s driving the surge and will gas prices go down anytime soon?

June 13, 2022

Is the Stock Market Closed for Juneteenth?

Markets

Is the Stock Market Closed for Juneteenth?In 2021, Washington passed legislation turning Juneteenth into a federal holiday. As a result, investors will have the day off Monday.

June 17, 2022

Stock Market Today (6/15/22): Fed Goes Big, Wall Street Approves

Stock Market Today

Stock Market Today (6/15/22): Fed Goes Big, Wall Street ApprovesThe Fed’s largest rate hike in nearly three decades, and more flexibility from Chair Powell, squeezed stocks higher Wednesday.

June 15, 2022

Stock Market Today (6/14/22): Stocks Wobble Ahead of Fed’s Next Rate Decision

Stock Market Today

Stock Market Today (6/14/22): Stocks Wobble Ahead of Fed’s Next Rate DecisionTuesday’s scorching producer price index (PPI) reading might have cemented an aggressive Fed policy response at tomorrow’s FOMC meeting close.

June 14, 2022

25 Best S&P 500 Stocks of the Pandemic Bull Market

stocks

25 Best S&P 500 Stocks of the Pandemic Bull MarketWork-from-home stocks and home-improvement retailers might have been the stars of the COVID bull’s first half, but they didn’t finish on top.

June 14, 2022