Stock Market Today

Russia reportedly is opening the door to negotiations, sparking a broad-based rally Friday that saw all 11 sectors finish well in the green.News about the conflict in Eastern Europe was contradictory as the trading week came to a close, but markets surged as Wall Street grasped for good news.

On Friday, Russian troops reportedly were closing in on the Ukrainian capital of Kyiv. Yet on the same day, the Kremlin said Russian President Vladimir Putin had agreed to send a delegation to the Belarusian capital of Minsk to negotiate with Ukraine.

Chinese President Xi Jinping reportedly also gave a nod toward a peaceful resolution, saying “China supports Russia and Ukraine to resolve issues through negotiations” after a conversation with Putin, according to state-owned CCTV.

But some of Friday’s bullishness might also have come from changing expectations for Federal Reserve action this year.

“Wall Street anticipates central bank reluctance to go overly aggressive with tightening monetary policy, so they could provide a cushion for a growth hit that will stem the Russia-Ukraine developments,” says Edward Moya, senior market strategist at currency data provider OANDA.

Sign up for Kiplinger’s FREE Investing Weekly e-letter for stock, ETF and mutual fund recommendations, and other investing advice.

Back on the homefront, America’s core personal consumption expenditures price index showed consumer spending up 5.2% in January, according to the Commerce Department. That was slightly better than expectations for 5.1%.

“The strong consumer numbers come at a time when many economists were worried about an economy that was weaning itself of government stimulus in the latter part of 2021, and whether the consumer would be able to carry the torch in 2022,” says Peter Essele, head of portfolio management for Commonwealth Financial Network.

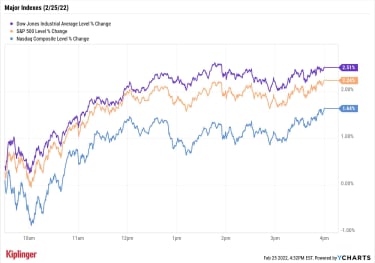

The Dow Jones Industrial Average – led by advances in Johnson & Johnson (JNJ, +5.0%), 3M (MMM, +4.7%) and Procter & Gamble (PG, +4.3%) – jumped 2.5% to 34,058, its best performance since a roughly 3% gain on Nov. 9, 2020. The S&P 500 (+2.2% to 4,384) and Nasdaq Composite (+1.6% to 13,694) also posted sizable gains, putting both indexes into positive territory for the week.

Still, the impressive market comeback of the past couple of days doesn’t mean the market is out of the woods yet.

Yesterday, the CBOE Volatility Index, or VIX, crossed above 30 amid Russia’s invasion of Ukraine. “VIX above 30 indicates that investors are unusually anxious about what comes next, and that they are hedging stock portfolios to protect against further declines,” say Michael Oyster and Steven Sears of asset-management firm Options Solutions. “Market fears have abated somewhat, with the CBOE VIX below 30, but as it remains near the highest 10% level of all time, the options market is hardly signaling an all-clear.”

YCharts

Other news in the stock market today:

The small-cap Russell 2000 popped 2.3% to 2,040.U.S. crude oil futures slumped 1.3% to finish at $91.59 per barrel, but still ended the week up 1.5%.

Gold futures shed 2% to settle at $1,887.60 an ounce, bringing its weekly decline to 0.6%.Bitcoin continued clawing its way back to $40,000, rising 1.7% to $39,130.32. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.)Etsy (ETSY) stock soared 16.2% after the online marketplace reported top- and bottom-line beats in its fourth-quarter. For the three-month period, ETSY brought in earnings of $1.11 per share on $717 million. While the company did offer lower-than-expected current-quarter revenue and gross merchandise sales guidance, Chief Financial Officer Rachel Glaser said this was due to tough year-over-year pandemic-related comparisons. “ETSY is one of few names surviving the pandemic online bubble with initiatives to drive top line at core brand and the subs,” says Needham analyst Anna Andreeva, who reiterated a Buy rating on the retail stock.

Foot Locker (FL) sat out today’s broad-market rally, shedding 29.8% after earnings. In its fiscal third-quarter, the athletic apparel retailer reported adjusted earnings of $1.67 per share on $2.34 billion in revenue, higher than the $1.44 per share and $2.33 billion expected by analysts. However, FL also warned that revenue will likely be down between 4% and 6% and same-store sales will contract 8% to 10% in fiscal 2022. This is due in part to the company selling less products from Nike (NKE). “In Q4 ’21 Nike represented 65% of vendor spend which FL plans to reduce to 55% moving forward,” says CFRA Research analyst Zachary Warring (Hold). “We do not like the positioning of FL as companies shift to direct-to-consumer and they continue to have higher exposure to malls but see limited downside as FL currently trades at 6.0x 2023 EPS and a clean balance sheet.”Where Can Opportunists Put Money to Work?In times of market crisis, some people look for protection, while others scout out opportunities.

Rhys Williams – chief strategist at Spouting Rock Asset Management and a former journalist at the Moscow office of The Sunday Times – has a dour outlook on the geopolitical situation:

“Putin seems to have made his choice, and it looks like he has settled on regime change,” Williams said, adding that in the medium-term, he’s not quite sure how business gets back to usual.

But there are some market implications for investors looking to buy on this dip.

“I think Big Tech will get a bid after a significant correction, as they have a lot of cash and consumer staples-like qualities. They also don’t lose much business in Russia and the Ukraine relative to overall revenues,” he says. These 12 stocks represent some of our best ideas in the broader sector, though specific industries such as cybersecurity are becoming a trendy pick.

Rhys also likes higher-dividend-yielding stocks, “as perhaps this caps interest rates for a while.”

You can start with this nine-pack of stocks dishing out 5% or more in annual income – though more importantly, they haven’t been selected only for their large headline yields. These picks broadly feature conservative payout ratios, stronger balance sheets and business models that generate predictable cash flow, meaning their dividends aren’t just generous … they’re sustainable over the long haul.