Stock Market Today

U.S. officials warned a Russian invasion of Ukraine could come “at any time.”Geopolitical tensions heated up on Friday amid reports that Russia is positioning more troops near the Ukraine border.

Additionally, U.S. Secretary of State Antony Blinken cautioned earlier that an invasion could come “at any time,” including during the Beijing Winter Olympics, which are set to end on Feb. 20 – a warning echoed by U.S. National Security Advisor Jake Sullivan at this afternoon’s White House press briefing.

“The Russia-Ukraine tensions have hovered over already shaky investor sentiment,” says John Lynch, chief investment officer for Comerica Wealth Management. “Investors have been counting on a diplomatic resolution, but recent developments indicate this may be wishful thinking and therefore, not fully priced into the markets.”

Today’s Russian-Ukraine news “delivered another body-blow to markets, which were already reeling from stubborn inflation numbers and uber hawkish comments from Fed officials,” says Cliff Hodge, chief investment officer for Cornerstone Wealth.

“The flight to safety is on, as long-end Treasury yields fall, gold rises and the dollar spikes. We may have more downside risk over the coming weeks as markets react to headlines, but investors should put together their shopping list, as there are some interesting opportunities to begin to pick through the wreckage,” he adds.

Sign up for Kiplinger’s FREE Investing Weekly e-letter for stock, ETF and mutual fund recommendations, and other investing advice.

Adding fuel to the fire was news that Pfizer (PFE, +0.4%) and BioNTech (BNTX, +2.0%) will delay a request to the Food and Drug Administration (FDA) to expand authorization of their COVID-19 vaccines to children under 5 until early April as they await more data.

Stocks reacted to the headlines in kind, with markets making a beeline lower in afternoon trading, led by sharp losses in the technology (-3.1%), consumer discretionary (-2.9%) and communication services (-2.2%) sectors.

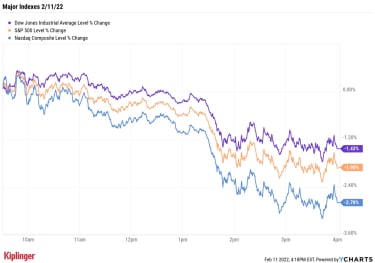

By the close, the Nasdaq Composite was down 2.8% at 13,791, the S&P 500 Index was off 1.9% to 4,418 and the Dow Jones Industrial Average was 1.4% lower at 34,738.

YCharts

Other news in the stock market today:

The small-cap Russell 2000 gave back 1% to end at 2,030.Rising Russia-Ukraine tensions sent U.S. crude futures spiking 3.6% to $93.10 per barrel. “Crude prices surged after reports that the U.S. is expecting the Russians to move forward with invading Ukraine,” says Edward Moya, senior market strategist at OANDA. “Oil prices will remain extremely volatile and sensitive to incremental updates regarding the Ukraine situation.” Gold futures closed up 0.3% to end at $1,842.10 per ounce, and continued to rise in electronic trading. “Gold could rally above the $1,900 level if troop movements occur,” Moya adds. “Gold traders would not want to be short heading into the weekend.”Bitcoin slid 4% to $42,345.75. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.) Keep your eyes out for cryptocurrency commercials during Super Bowl LVI on Sunday. “Cryptocurrency platforms Coinbase (COIN), FTX and Crypto.com, might catch your eye as they spend millions on commercials,” says Lindsey Bell, chief money & markets strategist at Ally Invest. “FTX is even giving away Bitcoin to four lucky winners. The ads could momentarily shift the conversation from big price moves in crypto to whether the commercials were a flop or not. Regardless, showcasing crypto commercials during a Super Bowl is a testament to how mainstream the topic has become.” Defense stocks unsurprisingly earned a bid, with Lockheed Martin (LMT, +2.8%), Northrop Grumman (NOC, +4.5%) and L3Harris Technologies (LHX, +3.6%) all finishing solidly in the green.DraftKings (DKNG, +2.4%) also went against the grain, finishing higher amid excitement ahead of Sunday’s big game. CEO Jason Robins told CNBC that this year’s edition will be “the biggest Super Bowl that we’ve ever had.” He added that the “vast majority” of the $7.6 billion bet this year is illegal – presenting a huge opportunity to grow the legal market. Also Friday, Morgan Stanley analyst Thomas Allen reiterated an Overweight rating (equivalent of Buy) on the stock, asserting that the company can achieve 23% margins by 2025. Note that DraftKings reports earnings next week.Keep an Eye on Commodity PricesYes, these headlines are frightening, but markets typically move past them quickly after an initial negative reaction.

“You can’t minimize what today’s news could mean in that part of the world and the people impacted, but from an investment point of view, we need to remember that major geopolitical events historically haven’t moved stocks much,” says Ryan Detrick, chief market strategist for LPL Financial.

The independent broker-dealer examined equity markets’ reactions to a number of geopolitical events going back to the Pearl Harbor attack in December 1941, the majority of which “didn’t put much of a dent in stocks, with any losses made up quite quickly,” Detrick adds. Case in point: The six months following a one-day 2.8% drawdown in the wake of President John F. Kennedy’s assassination in 1963 were “one of the strongest and least volatile periods in history.”

Still, it’s understandable if investors seek out safety amid the unsettling reports, and you’ll often find it in yield-friendly sectors like consumer staples, energy and utilities.

Commodity prices may also accelerate, led by oil and gold, Comerica’s Lynch adds. Investors who want to invest in hard assets broadly, including oil and gold, can do so through commodity exchange-traded funds (ETFs), which provide liquidity, low expenses and ease of use.

Those seeking to invest specifically in and around the yellow metal have a wealth of gold-specific options, from ETFs that are actually backed by physical gold to funds that hold gold miners. Here, we examine seven such ETFs.

The 22 Best Stocks to Buy for 2022

stocks to buy

The 22 Best Stocks to Buy for 2022A chaotic past two years has taught investors to be ready for anything. Our 22 best stocks to buy for 2022 reflect several possible outcomes for the n…

February 4, 2022

Your Guide to Roth Conversions

Special Report

Tax Breaks

Your Guide to Roth ConversionsA Kiplinger Special Report

February 25, 2021

The “Gray Resignation” with Liz Windisch

Making Your Money Last

The “Gray Resignation” with Liz WindischPandemic pressures (and high stock and real estate values) are leading many to try to move up retirement. Plus, tax-filing season gets under way.

January 25, 2022

7 Low-Cost Gold ETFs

gold

7 Low-Cost Gold ETFsThese seven gold ETFs provide investors with numerous ways to play the metal, from direct exposure to stock-related angles, on the cheap.

February 11, 2022

‘Super Bowl Indicator’ Says Investors Should Root For …

stocks

‘Super Bowl Indicator’ Says Investors Should Root For …A decades-old indicator suggests investors should have a palpable interest in Sunday’s game between the Rams and Bengals.

February 11, 2022

Kiplinger’s Weekly Earnings Calendar

stocks

Kiplinger’s Weekly Earnings CalendarCheck out our earnings calendar for the upcoming week, as well as our previews of the more noteworthy reports.

February 11, 2022

3 Luxury Stocks to Seize Sizable Opportunities

stocks

3 Luxury Stocks to Seize Sizable OpportunitiesAnalysts expect double-digit growth for luxury stocks this year. Here are three that could take a piece of that pie.

February 11, 2022