Stock Market Today

The 10-year Treasury yield is closing in on levels not seen since November.Monday’s fairly broad market rally turned into more of a two-pronged move Tuesday as economic data and rising interest rates sparked gains in cyclical stocks.

The Institute for Supply Management’s purchasing managers’ index reading for December declined 2.3 points to 58.7, well below estimates for 60.0 (anything above 50 represents expansion). However, Barclays economist Jonathan Millar saw in the numbers “significant easing of supply pressures, which is an encouraging sign with disruptions from the omicron variant likely not fully reflected in December.”

Also dragging on stocks was another hike in the 10-year Treasury, whose yield reached 1.68% to close in on highs not seen since November. That helped spark cyclical sectors including financials (+2.6%), energy (+3.5%) and industrials (+2.0%), but it proved a weight on technology (-1.1%) and consumer discretionaries (-0.6%).

“If this all sounds familiar that’s because it is as we’ve seen these bouts of Treasury volatility drive massive rotations within equity markets throughout much of last year,” says Michael Reinking, senior market strategist with the New York Stock Exchange.

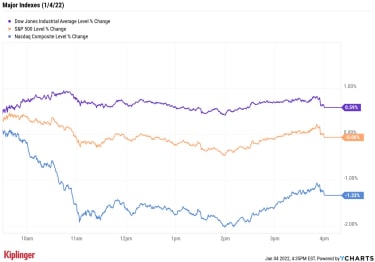

As for the major indexes?

Sign up for Kiplinger’s FREE Investing Weekly e-letter for stock, ETF and mutual fund recommendations, and other investing advice.

The Dow Jones Industrial Average gained 0.6% to easily rewrite the record books with a close at 36,799, while the S&P 500 Index slightly dipped from yesterday’s new high, to 4,793. The Nasdaq Composite took a dive, however, off 1.3% to 15,622.

YCharts

Other news in the stock market today:

The small-cap Russell 2000 jumped 1.1% to 2,268.U.S. crude oil futures rose 1.2% to settle at $76.99 per barrel.Gold futures edged up 0.8% to $1,814.60 per ounce.Bitcoin tacked on 0.8% to $46,256.15. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.)Ford Motor (F) stock surged 11.8% after the Detroit automaker said it would almost double annual production of its electric F-150 pickup by mid-2023. The company is slated to start taking orders for the pickup tomorrow, Jan. 5.Fellow carmaker General Motors (GM) was another big mover today, jumping 7.5%. This came after GM said dealer inventories totaled 199,662 at the end of the fourth quarter, up 55% from the record low of 128,757 at the end of the third quarter. Nevertheless, CFRA Research analyst Garrett Nelson maintained a Hold rating on GM, saying “we remain skeptical that GM’s new EV offerings will be as successful from a sales perspective as those of competitors such as Ford and Tesla, noting that most models will not be coming to market until 2023 or beyond.”Buckle Up, We Could Be in for a Bumpy RideThe early innings of 2022 could be a doozy, especially if you’re overweight a few sectors in particular.

“Given the rising threat of the omicron variant and its potential impact on economic conditions and consumer behavior, the first quarter of 2022 will likely feature the elevated volatility that we saw in the fourth quarter of 2021,” says David Keller, chief market strategist at StockCharts.com.

“The deepest pullback in the S&P 500 [in 2021] was only about 6%, while most years will experience at least one drawdown of over 10%. Higher volatility also suggests a higher probability of deeper corrective phases, so 2022 may return back to the normal routine of at least one steeper drawdown of over 10%. … I would not be surprised if that deeper pullback occurs in the first quarter.”

Two sectors stand out as particularly vulnerable given both their sensitivity to interest-rate moves of late and their sky-high valuations: technology firms and consumer discretionary companies, which are the priciest pockets of the markets based on expected earnings for the year to come.

The latter is number one with a bullet, at a multiple of 31.1 versus 21.1 for the S&P 500. Such high prices can act as a natural handicap against returns, especially in a volatile market, so individual-stock investors will have to be particularly discriminating when evaluating opportunities for the year ahead.

As we near the end of our sector-by-sector look-ahead, check out our latest: the top consumer discretionary picks for 2022.

Your Guide to Roth Conversions

Special Report

Tax Breaks

Your Guide to Roth ConversionsA Kiplinger Special Report

February 25, 2021

What’s Your Retirement Number?

Financial Planning

What’s Your Retirement Number?To cross the finish line when you want, find the right target for your retirement savings and follow our training regimen.

December 22, 2021

Best Things to Buy at Dollar Tree for the Holidays

shopping

Best Things to Buy at Dollar Tree for the HolidaysYou might be surprised by some of the items you can (and should) purchase for just a buck.

December 16, 2021

Stock Market Today (1/3/21): Apple Leads Sweet Start for Stocks in 2022

Stock Market Today

Stock Market Today (1/3/21): Apple Leads Sweet Start for Stocks in 2022Apple became the first company to reach $3 trillion in market value Monday, helping to lift the Dow and S&P 500 to new closing highs.

January 3, 2022

Stock Market Today (12/31/21): Stocks Slip on NYE, Still Deliver a Terrific 2021

Stock Market Today

Stock Market Today (12/31/21): Stocks Slip on NYE, Still Deliver a Terrific 20212021’s final session had little in the way of fireworks, but stocks nonetheless locked in a stellar year of gains.

December 31, 2021

The 25 Best-Performing Stocks of 2021

stocks

The 25 Best-Performing Stocks of 2021The stock market’s top performers of 2021 are a timeline of sorts, made up of meme stocks, oil plays and other major themes from across the year.

December 31, 2021

Kiplinger’s Weekly Earnings Calendar

stocks

Kiplinger’s Weekly Earnings CalendarCheck out our earnings calendar for the upcoming week, as well as our previews of the more noteworthy reports.

December 31, 2021