Stock Market Today

Casino stocks were a pocket of strength after Macau said it will ease COVID-related travel restrictions in November.Selling in the stock market picked right back up Monday, and despite a brief mid-morning push into positive territory, the major indexes still ended lower.

“Despite a quiet global economic data front, this weekend and Monday morning have been anything but quiet as global yields are surging to record highs,” said Stefanos Bazinas, execution strategist at the New York Stock Exchange. Indeed, both the 2-year Treasury yield (+10.5 basis points to 4.319%) and the 10-year Treasury yield (+20.3 basis points to 3.90%) continued to climb, hitting levels not seen in over a decade.

And this, Bazinas says, comes after the U.K. last week announced the biggest tax cuts in more than 50 years and indicated more were to come. This sent the British pound to an all-time low against the U.S. dollar earlier today. The dollar, for its part, hit its highest level since early 2002.

Most sectors finished lower, led by sharp losses for real estate (-2.7%) and utility (-2.4%) stocks. And while consumer discretionary (-0.2%) also ended in the red, its loss wasn’t nearly as deep thanks to strength in Las Vegas Sands (LVS, +11.8%) and Wynn Resorts (WYNN, +12.0%). The casino stocks rallied after Macau, a huge destination for Asian gambling, said it is planning on relaxing COVID-related travel restrictions as soon as November.

Sign up for Kiplinger’s FREE Investing Weekly e-letter for stock, ETF and mutual fund recommendations, and other investing advice.

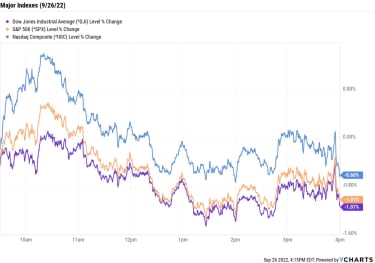

As for the major indexes, the Dow Jones Industrial Average ended the day down 1.1% at 29,260, falling into its first bear market since 2020. The S&P 500 Index (-1.0% at 3,655) and the Nasdaq Composite (-0.6% at 10,802) also finished the day notably lower.

YCharts

Other news in the stock market today:

The small-cap Russell 2000 fell 1.4% to 1,655.U.S. crude futures slumped 2.6% to end at $76.71 per barrel.Gold futures shed 1.3% to settle at $1,633.40 an ounce.Bitcoin gained 1.9% to $19,186.36. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.) News that Beijing will extend a tax break on electric vehicles (EVs) through the end of 2023 boosted several U.S.-listed Chinese EV stocks. Li Auto (LI, +5.6%) and Xpeng (XPEV, +4.8) were among the biggest gainers.Planet Fitness (PLNT) rose 1.2% after Raymond James analyst Joseph Altobello upgraded the fitness chain to Strong Buy from Market Perform (Neutral). “Our bullish stance on the shares of Planet Fitness reflects the company’s highly resilient business model and value gym positioning, ample store growth opportunity (just over halfway toward its current 4,000 stores target in the U.S.), and what we believe is an attractive valuation,” Altobello says. The analyst points to PLNT’s “recession-resistant business model” and healthy growth opportunity in 2023. “Further, PLNT has no interest rate risk and very little near-term debt maturities, while current valuation is well below its recent historical average,” he adds.The Pros’ Favorite Retail Stocks Right NowThere’s a lot that to look forward to in October, including an early start to the holiday shopping season. Amazon.com (AMZN) will kick things off by hosting a second Prime Day mid-month, called Amazon Prime Early Access.

It’s been a rough year for the retail sector amid several headwinds, including stubbornly high inflation, slowing demand and excess inventory. However, in spite of these hurdles, consumer spending has stayed steady, as evidenced by an unexpected rise in retail sales last month. “August retail sales show consumers’ resiliency to spend on household priorities despite persistent inflation and rising interest rates,” says Matthew Shay, president and CEO of the National Retail Federation. “As we gear up for the holiday season, consumers are seeking value to make their dollars stretch.” In other words, consumers are willing to spend, but will seek out the best deals to get the most bang for their buck.

As for investors, they can find plenty of deals in both the consumer discretionary and consumer staples sectors at the moment. For a short list of the best retail stocks around, consider these five picks, each of which sports top ratings from Wall Street analysts.

What Are the Income Tax Brackets for 2022 vs. 2021?

tax brackets

What Are the Income Tax Brackets for 2022 vs. 2021?Depending on your taxable income, you can end up in one of seven different federal income tax brackets – each with its own marginal tax rate.

September 20, 2022

Your Guide to Roth Conversions

Special Report

Tax Breaks

Your Guide to Roth ConversionsA Kiplinger Special Report

February 25, 2021

65 Best Dividend Stocks You Can Count On in 2022

dividend stocks

65 Best Dividend Stocks You Can Count On in 2022Yield isn’t everything when it comes to finding the best dividend stocks. Income investors know there’s no substitute for regular dividend increases o…

September 22, 2022

As the Market Falls, New Retirees Need a Plan

retirement

As the Market Falls, New Retirees Need a PlanIf you’re in the early stages of your retirement, you’re likely in a rough spot watching your portfolio shrink. We have some strategies to make the be…

September 26, 2022

5 First-Rate Retail Stocks the Pros Still Love

stocks

5 First-Rate Retail Stocks the Pros Still LoveConsumers continue to open their wallets despite higher prices, and these top-rated retail stocks could benefit from the steady stream in spending.

September 26, 2022

Stock Market Today (9/23/22): Dow Plummets 486 Points, Nears Bear Market

Stock Market Today

Stock Market Today (9/23/22): Dow Plummets 486 Points, Nears Bear MarketThe selling wasn’t confined to the equities market, with crude oil, gold and Bitcoin all suffering steep losses.

September 23, 2022

Kiplinger’s Weekly Earnings Calendar

stocks

Kiplinger’s Weekly Earnings CalendarCheck out our earnings calendar for the upcoming week.

September 23, 2022