Stocks were crushed Tuesday as the latest inflation update showed consumer prices remained elevated in August – dashing hopes that price pressures had peaked.

Looking at the numbers, the Labor Department this morning said its consumer price index (CPI), which tracks what consumers are paying for goods and services, was up 8.3% year-over-year in August. While this was down from the annual increases seen in both June (+9.1%) and July (+8.5%), the core CPI, which excludes more volatile energy and food prices, was up 6.3% from the year-ago period – more than the 5.9% jump seen in each of the two prior months. And month-over-month, core CPI accelerated 0.6%, much quicker than July’s 0.3%.

“Like the payroll report a couple of weeks ago, today’s CPI report showed that this year’s trends of persistent inflation and an excessively tight labor market are taking longer to move towards the Fed’s targeted levels than originally expected,” says Rick Rieder, BlackRock’s chief investment officer of global fixed income.

Today’s data will give the central bank “fodder to make another historically large rate hike of 75 basis points [at next week’s policy meeting],” Rieder said. “The Fed’s desire to take a vacation from raising rates almost definitively can’t happen until the holiday season, and maybe a bit longer now.”

Dustin Thackeray, chief investment officer at Crewe Advisor, echoes this outlook. “With today’s higher-than-expected CPI data, the Fed’s goal of attempting a soft landing just got more difficult,” he says. “In an attempt to maintain the price stability target, the Fed will need to continue its stance of aggressive rate hikes, balance sheet reduction and hawkish rhetoric.”

Sign up for Kiplinger’s FREE Investing Weekly e-letter for stock, ETF and mutual fund recommendations, and other investing advice.

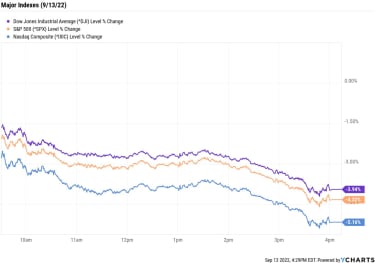

The sizzling inflation update triggered a stock market selloff on Wall Street, with the major market indexes spiraling. The Nasdaq Composite plunged 5.2% to 11,633, while the S&P 500 Index (-4.3% to 3,932) and the Dow Jones Industrial Average (-3.9% to 31,104) suffered massive declines of their own. It was the market’s worst day since June 2020.

“Markets will likely continue to experience elevated volatility as this new information is digested and as the Fed continues in its attempt to tame higher than target inflation,” Thackeray adds.

YCharts

Other news in the stock market today:

The small-cap Russell 2000 plunged 3.9% to 1,831.U.S. crude futures slipped 0.5% to $97.31 per barrel.Strength in the U.S. dollar sent gold futures down 1.3% to $1,717.40 an ounce.Bitcoin wasn’t immune to the selling, with the cryptocurrency shedding 9.4% to $20,309.23. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.)Large-cap tech stocks spiraled after this morning’s inflation update sent the 10-year Treasury yield spiking 4.8 basis points to 3.41%. Apple (AAPL, -5.9%), Amazon.com (AMZN, -7.1%), Meta Platforms (META, -9.4%) and Netflix (NFLX, -7.8%) were among the day’s biggest decliners.Rent the Runway (RENT) plummeted 38.7% after the online clothing retailer reported earnings. While RENT recorded a narrower-than-expected per-share loss of 53 cents on higher-than-anticipated revenue of $76.5 million, active subscribers were down 8% quarter-over-quarter. The company also said it is slashing 24% of its workforce by the end of the fiscal year. “We thought Q2 could showcase solid consumer trial amid a multi-year peak in social events (weddings, parties, travel),” says Credit Suisse analyst Michael Binetti, who downgraded RENT to Neutral (Hold). “The significant deterioration in Active Customer trends in the quarter suggest that RENT is more susceptible to macro pressure on the aspirational consumer than we expected.”Use Fixed-Income Plays to Protect Against InflationOne of the biggest concerns that cropped up in today’s inflation report was that 0.6% rise in core CPI, says Gargi Chaudhuri, head of iShares investment strategy. The increase was driven primarily by housing costs, she adds, and this sticky inflation point could linger for longer, with rents expected to rise even more as the market for buying houses cools. “Housing and rental prices comprise 42% of core CPI inflation, the largest weighting of the CPI measure, because of their outsized share in most people’s budgets,” Chaudhuri continues.

But the strategist says that investors have options to combat persistently high inflation, with products such as short-duration Treasury Inflation Protected Securities, or TIPS, which are bonds that are indexed to inflation via the CPI. “Investors should also consider investing in short-term bonds as a replacement for cash or a driver of income in their portfolios,” she adds.

Those looking to bulk up the fixed-income section of their portfolios can do so through bond mutual funds and bond exchange-traded funds (ETFs). On both fronts, many of our recommendations are designed to counter the effects of higher prices. And better yet, our bond ETF picks do so at a low cost to investors. Check them out.

Karee Venema was long AAPL and AMZN as of this writing.