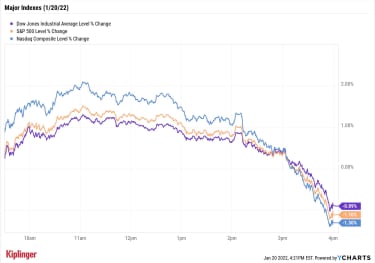

Stocks suffered another failure to launch on Thursday as a brisk morning run in the major indexes crumbled in the afternoon, resulting in another disappointing finish in the red, and a deeper turn into correction territory for the Nasdaq Composite.

Initial claims for unemployment benefits were in focus today. Filings for the week ended Jan. 15 climbed by 55,000, to 286,000 – the highest level since late October.

“Thursday’s rise in weekly jobless claims show that the labor market is starting to reflect the negative economic impacts from the Omicron wave,” says Robert Schein, chief investment officer of Blanke Schein Wealth Management, adding that “we still believe the labor market is strong enough for the Federal Reserve to proceed with its expected rate-hike plans in 2022.”

Existing-home sales for December also disappointed, off 4.6% month-over-month and down 7.1% year-over-year amid scarce inventory.

Stocks nonetheless seem primed for a bounce off recent declines (even if only of the dead-cat variety), perhaps encouraged by Street-beating earnings from the likes of Travelers (TRV, +3.2%) and Union Pacific (UNP, +1.1%).

But what momentum there was faded fast.

Sign up for Kiplinger’s FREE Investing Weekly e-letter for stock, ETF and mutual fund recommendations, and other investing advice.

The Dow Jones Industrial Average, up 1.3% at its highs, reversed to finish 0.9% lower to 34,715, with the S&P 500 (-1.1% to 4,482) following suit. The Nasdaq, already in correction territory, watched a 2.1% intraday climb turn to ash, closing down 1.3% to 14,154.

While the short-term collapse of the Nasdaq seems somewhat sudden, John Lynch, chief investment officer for Comerica Wealth Management, highlights some underlying rot: “Though the Composite entered correction territory yesterday, performance at the stock level had already weakened significantly,” he says. “The Nasdaq-100 members have already experienced an average decline of 22.0% from their 52-week highs.

“As investors reprice the risk of Fed rate hikes, the indexes simply need to catch up to their average stock. We believe solid growth in the economy and profits should preclude anything more than a 10.0% correction in the major equity indexes.”

YCharts

Other news in the stock market today:

The small-cap Russell 2000 plunged 1.9% to 2,024.U.S. crude oil futures eased back 0.3% to $85.55 per barrel.Gold futures posted a marginal loss, ending at $1,842.60 an ounce.Bitcoin actually put together a solid return of 2.6%, to $42,726.19. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.) Peloton Interactive (PTON) slumped 23.9% after CNBC reported that the company is suspending production of its connected fitness Bike exercise bike and Tread+ treadmills for the next two months. The move comes amid decreased demand, according to internal documents obtained by CNBC. Since closing at a record high of $162.72 in December 2020, PTON shares have surrendered more than 85%.American Airlines Group (AAL) slid 3.2% after the travel name reported earnings. In its fourth quarter, AAL reported higher-than-expected revenue of $9.43 billion, but adjusted earnings of $1.42 fell short of the consensus estimate and the airline said it expects first-quarter revenue to be down 20% to 22% when compared to Q1 2019. CFRA Research analyst Colin Scarola kept a Hold rating on AAL after earnings, saying inflation is starting to drive up costs. “Notably, AAL’s labor costs are approaching 2019 levels, even with headcount still down 9% vs. the same point in 2019,” Scarola writes in a note. “And the price of jet fuel is currently about 23% higher than the average price during 2019.”Give Europe a GlanceInvestors concerned about U.S. stocks’ sluggish start to 2022 might want to look overseas.

European equities have long underperformed their American counterparts and the same was true in 2021. But 2022 is shaping up as the year in which returns from across the pond might finally outpace those seen here at home, notes BCA Research.

Although European equities face persistent headwinds, including sensitivity to the Chinese economy, the trajectory of COVID-19 and tensions over Ukraine, “these risks are likely to fade over the year and will give way to an improvement in the outlook for eurozone equities,” BCA strategists say. “The Eurozone economy is still operating below potential. This implies that the European economy has more room to catch up, which will support earnings and therefore risk assets.”

Europe is also fruitful ground for investors seeking value stocks, with the region sporting “much more attractive” valuations at the moment, adds BCA.

Value is the primary focus of our examination of the best European stocks to buy for 2022, but we also highlight a few growthier options. And one trait these names pretty much all share is they generally deliver greater income than their U.S. cousins. (Indeed, a few are even members of the European Dividend Aristocrats.)