Stock Market Today

Stocks remained in the red for another session Thursday but at least largely slowed their downward momentum.Investors didn’t get a full reprieve from yesterday’s heavy selling, but they were at least allowed to catch their breath in a calmer Thursday session that saw the major indexes finish modestly lower.

The first unemployment-benefits data of the new year was a tad disappointing, with the Labor Department reporting 207,000 initial claims for the week ending Jan. 1, higher than estimates for 195,000.

Treasury yields also continued to rise, with the 10-year touching 1.75% from 1.68% yesterday; that helped lift the financial sector (+1.5%), primarily regional bank companies such as Fifth Third Bancorp (FITB, +4.2%) and PNC Financial Services (PNC, +3.9%).

Heading in the other direction were health insurers, which tumbled as a group after Humana (HUM, -19.4%) drastically lowered its membership-growth expectations for Medicare Advantage products, to 150,000 to 200,000 members from 325,000 to 375,000 previously. Names including UnitedHealth Group (UNH, -4.1%), Cigna (CI, -3.8%) and Anthem (ANTM, -4.1%) fell in sympathy.

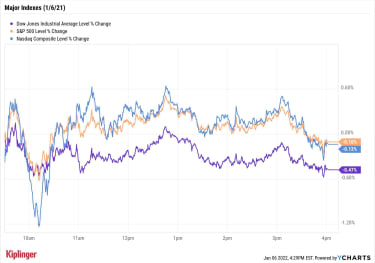

The indexes were far less rowdy. The Dow Jones Industrial Average led the decline, off 0.5% to 36,236, while the S&P 500 (-0.1% to 4,696) and Nasdaq Composite (-0.1% to 15,080) also slipped again.

Sign up for Kiplinger’s FREE Investing Weekly e-letter for stock, ETF and mutual fund recommendations, and other investing advice.

YCharts

Other news in the stock market today:

The small-cap Russell 2000 was up 0.6% to 2,206.Gold futures plunged 2% to end at $1,789.20 an ounce after Wednesday’s minutes from the latest Federal Open Market Committee (FOMC) meeting suggested the central bank could hike interest rates sooner than anticipated.Bitcoin dropped yet again, by 1.8% to $43,217.10, amid unrest in Kazakhstan, which is actually the world’s second-largest source of bitcoin mining. That mining was disrupted as Kazakh President Kassym-Jomart Tokayev ordered the national telecom provider to shut down internet service, taking numerous miners offline. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.)Bed Bath & Beyond (BBBY) stock jumped 8.0%, even after the home goods retailer reported dismal fiscal third-quarter results. Over the three-month period, BBBY recorded an adjusted per-share loss of 25 cents versus analysts’ consensus estimate for the company to breakeven on a per-share basis. On the top line, Bed Bath & Beyond brought in $1.88 billion, falling short of the $1.95 billion analysts’ were expecting. Pouring salt on the proverbial wound, same-store sales fell 10% year-over-year and the retailer lowered its full-year forecast to account for continued supply-chain headwinds.MGM Resorts International (MGM) improved by 3.0% after Credit Suisse analysts Benjamin Chaiken and Sarah Murray named the casino stock a “top pick” for 2022. “We see upside to MGM based on accelerating trends in Vegas, a more simplified operating structure that should aid valuation, an attractive capital structure (net cash position), upside to 2023 estimates and improving investor sentiment,” they wrote in a note. With today’s pop, MGM stock is now up more than 46% on a 12-month basis.A Big Year for Energy Ahead?Tops today, though, were energy stocks (+2.2%), which were the best S&P sector in 2021 with 53% total returns (price plus dividends) and are again leading the way with a 9.0% gain this year.

Thursday’s gains came on the back of crude oil futures’ 2.1% gain to $79.46 per barrel amid the aforementioned turmoil in major oil producer Kazakhstan, where protests over fuel prices have turned into broader anti-government riots.

It’s a temporary tailwind for a sector most of Wall Street was bullish about heading into 2022 – though the pros had their own, longer-term reason. Specifically, an eventual full reopening of the global economy whenever COVID finally fades is expected to bolster energy demand, which should keep prices on the upward trajectory they traveled throughout 2021.

Today, we provide the last of our 11 annual sector look-aheads – our best energy stocks to buy for 2022. The energy sector often moves in unified fashion, with a rising tide of high commodity prices typically lifting most boats. But a few stocks seem better positioned than others to leverage those prices into shareholder gains in 2022.

Your Guide to Roth Conversions

Special Report

Tax Breaks

Your Guide to Roth ConversionsA Kiplinger Special Report

February 25, 2021

What’s Your Retirement Number?

Financial Planning

What’s Your Retirement Number?To cross the finish line when you want, find the right target for your retirement savings and follow our training regimen.

December 22, 2021

As You Approach Retirement, C.A.N. You Handle a Market Downturn?

retirement planning

As You Approach Retirement, C.A.N. You Handle a Market Downturn?You know what they say about what goes up. Well, if you’re nervous about what comes next with today’s precipitously climbing stock market, this acrony…

December 20, 2021

Stock Market Today (1/7/22): Tech Drubbed; Nasdaq Has Worst Week in 11 Months

Stock Market Today

Stock Market Today (1/7/22): Tech Drubbed; Nasdaq Has Worst Week in 11 MonthsThe 10-year Treasury yield hit its highest level since early 2020 on Friday.

January 7, 2022

Kiplinger’s Weekly Earnings Calendar

stocks

Kiplinger’s Weekly Earnings CalendarCheck out our earnings calendar for the upcoming week, as well as our previews of the more noteworthy reports.

January 7, 2022

Stock Market Today (1/5/22): Fed Shows Its Teeth, Tech Shows Its Tail

Stock Market Today

Stock Market Today (1/5/22): Fed Shows Its Teeth, Tech Shows Its TailThe Fed’s most recent meeting minutes hinted at yet another stimulus wind-down, which yanked hard on technology and real estate shares.

January 5, 2022

Stock Market Today (1/4/22): Dow Hits New Record, Nasdaq Takes a Spill

Stock Market Today

Stock Market Today (1/4/22): Dow Hits New Record, Nasdaq Takes a SpillThe 10-year Treasury yield is closing in on levels not seen since November.

January 4, 2022