Stock Market Today

Stocks largely traded flat Friday amid a slow news day and a trickle of economic datapoints.U.S. equities slipped into the weekend on a quiet note, especially compared to how much noise the market has been making of late.

Traders finished the week’s heavy menu of Fed rate-hike talk and developments in Ukraine with just a bite of economic news and little else to digest Friday.

Among the data, the University of Michigan Index of Consumer Sentiment declined for a third straight month in March. At 59.4, it was the survey’s lowest reading in more than a decade.

Meanwhile, a combination of low inventories, higher prices and rising mortgage rates caused pending home sales to drop by 4.1% in February, surprising economists who forecast a gain of 1.0%. The reading took a toll on homebuilders and housing-related stocks, including PulteGroup (PHM, -1.7%), Lowe’s (LOW, -2.9%) and Pool Corp. (POOL, -4.3%).

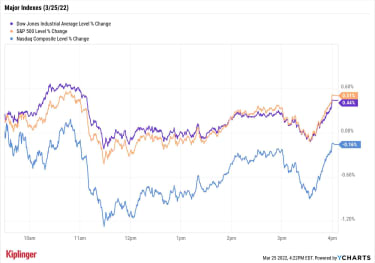

The Dow Jones Industrial Average (+0.4% to 34,861) logged a modest increase, putting it 0.3% higher for the week. The S&P 500 (+0.5% to 4,543) and the Nasdaq Composite (-0.2% to 14,169) closed the week more solidly in the green, up 1.8% and 2.0%, respectively.

Sign up for Kiplinger’s FREE Investing Weekly e-letter for stock, ETF and mutual fund recommendations, and other investing advice.

YCharts

Other news in the stock market today:

The small-cap Russell 2000 finished with a 0.1% gain to 2,077.U.S. crude futures rose 1.4% to settle at $113.90 per barrel amid reports of a Yemen rebel attack on a Saudi Arabia oil facility, bringing their weekly advance to 10.5%.Gold futures slipped 0.4% to finish at $1,954.20 an ounce. For the week, gold futures gained 1.3%.Bitcoin continued its advance, up 1.2% Friday to bring its gains since Monday morning to 7.8%. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.)News that the House of Representatives will vote next week on a bill that would remove cannabis from the list of federally controlled substances and end criminal measures associated with it lit a fire under marijuana stocks today. The House passed a similar bill in December 2020, though it did not advance in the Senate. Among the day’s big gainers were Aurora Cannabis (ACB, +10.4%), Canopy Growth (CGC, +10.0%) and Tilray Brands (TLRY, +22.8%).Tesla (TSLA, -0.3%) rival Nio (NIO) fell 9.4% after the company reported earnings. In its fourth quarter, the Chinese electric vehicle maker reported higher-than-expected revenue of $1.55 billion and deliveries of 25,034. However, NIO guided for current-quarter revenue to arrive between $1.51 billion and $1.57 billion, lower than the $1.66 billion analysts, on average, are expecting. The firm’s first-quarter delivery guidance also came in below the consensus estimate. Still, Mizuho Securities analyst Vijay Rakesh says Nio is “is positioned well for the long-term with solid roadmap execution and new launches,” and maintained a Buy rating on the stock.Two Fresh Faces in the Kip 25The pros largely remain bullish despite potential near-term turbulence.

We mentioned yesterday that we’ve begun the third year of the post-COVID-19 bull market, and year threes have historically been rocky. Earnings guidance for the current quarter could be a sign of what’s to come.

As of today, 95 S&P 500 firms have issued first-quarter earnings per share (EPS) guidance, says John Butters, senior earnings analyst for FactSet. Of those, 66 issued negative guidance (higher than the five-year average of 59), while just 29 issued positive guidance (well below the five-year average of 40).

That could make for a tumultuous Q1 earnings season ahead, though pros looking out across the full year are still optimistic. Butters says analysts’ S&P 500 price targets imply a 16.8% gain for the index over the next 12 months.

Investors looking to maintain their sanity until the proverbial storm clouds lift might find comfort in placing their capital in skilled and experienced hands. A small but growing group of actively managed exchange-traded funds (ETFs) can be a great place to start, and new options are emerging by the day. Just look at Capital Group’s recent entry into the space for proof.

As for folks looking to invest anywhere – be it through their brokerages, IRAs or 401(k)s – they might want to pay attention to our recently updated Kip 25. Kiplinger’s 25 favorite low-fee mutual funds fill just about every portfolio need. From core stock funds to tactical products to fixed-income offerings, each and every fund features human portfolio managers, low annual fees and zero sales charges.

Don’t Let the Market Ruin Your Retirement

retirement

Don’t Let the Market Ruin Your RetirementWhen portfolio losses hit at the same time as withdrawals, it’s a double whammy. Here’s how to mitigate the risk.

March 23, 2022

Your Guide to Roth Conversions

Special Report

Tax Breaks

Your Guide to Roth ConversionsA Kiplinger Special Report

February 25, 2021

10 Most Tax-Friendly States for Retirees

retirement

10 Most Tax-Friendly States for RetireesMoving to a low-tax state in retirement can help make your retirement savings last longer.

March 21, 2022

Kiplinger’s Weekly Earnings Calendar

stocks

Kiplinger’s Weekly Earnings CalendarCheck out our earnings calendar for the upcoming week, as well as our previews of the more noteworthy reports.

March 25, 2022

140 Companies That Have Pulled Out of Russia

stocks

140 Companies That Have Pulled Out of RussiaThe list of private businesses announcing partial or full halts to operations in Russia is ballooning, increasing economic pressure on the country.

March 25, 2022

Stock Market Today (3/24/22): 53-Year-Low Jobless Claims Lift the Market

Stock Market Today

Stock Market Today (3/24/22): 53-Year-Low Jobless Claims Lift the MarketWeekly unemployment claims add to a bevy of positive economic data points, driving a wide rebound across the major indexes.

March 24, 2022

Income Investors Should Look Beyond the Ukraine Invasion

stocks

Income Investors Should Look Beyond the Ukraine InvasionUnless you invested in a Russian-themed ETF or an emerging markets index fund, the destruction of Moscow’s capital markets is a distraction for invest…

March 24, 2022