Stock Market Today

Warnings that Russia is heading toward an ‘imminent invasion’ of Ukraine sent investors back toward the exits Thursday.Ukraine-Russia tensions wrested control of investor sentiment from the Fed in a difficult session for the broader markets, which was exacerbated by a few pieces of disappointing economic news.

On Thursday, both U.S. President Joe Biden and British Prime Minister Boris Johnson warned that the shelling of a kindergarten in Ukraine’s eastern Donbas region might be a “false-flag operation” meant to give Russia an excuse to invade the country.

“The evidence on the ground is that Russia is moving toward an imminent invasion,” Linda Thomas-Greenfield, U.S. Ambassador to the United Nations, told reporters. “This is a crucial moment.”

Also sending stocks in the wrong direction were a few weak reports, led by initial unemployment claims that came in at 248,000 for the week ended Feb. 12 – well ahead of expectations for 219,000 filings and up from last week’s upwardly revised 225,000.

Also Thursday, January housing starts came in shy of estimates, as did a February reading of Philadelphia-area manufacturing activity.

Sign up for Kiplinger’s FREE Investing Weekly e-letter for stock, ETF and mutual fund recommendations, and other investing advice.

“Some of January’s dip in housing starts reflects especially tough winter weather. The January industrial production report released yesterday showed utilities output jumped nearly 10% from December, even after accounting for normal seasonal swings. The severe winter weather that hit much of the country in January held back housing starts,” says Bill Adams, chief economist for Comerica Bank. “But supply chain problems also continue to restrain housing activity; one illustration of the ongoing dysfunction in supply chains is the 25% monthly increase of softwood lumber prices in the January producer price index.

Investors skittered away from cyclical and growth sectors alike, with technology (-3.0%) and financials (-2.5%) leading the way down.

There was appetite for defense plays, however, with consumer staples (+0.8%) the day’s best-performing sector.

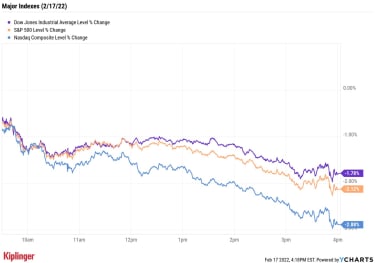

Losses accelerated later in the day, sending the Nasdaq Composite 2.9% lower to 13,716, followed by the S&P 500 Index (-2.1% to 4,380) and Dow Jones Industrial Average (-1.8% to 34,312).

“The S&P 500 has found some footing in recent days but the options market remains skittish,” says Michael Oyster, chief investment officer for asset-management firm Options Solutions. “The CBOE Volatility (VIX), often referred to as the market’s ‘fear gauge’ is in the top 15% of its history signaling concern among sophisticated investors. Both weekly and monthly options expire this Friday, which could further spike volatility.”

YCharts

Other news in the stock market today:

The small-cap Russell 2000 gave back 2.5% to finish at 2,028.U.S. crude futures tanked 2% to settle at $91.76 per barrel.Gold futures jumped 1.6% to end at $1,902 an ounce.Bitcoin plunged 7.2% to $40,948.32. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.)DoorDash (DASH) jumped 10.7% after the food delivery firm posted a 34% year-over-year jump in revenue to $1.3 billion and a 35% increase in total orders to 369 million. Plus, the company’s net loss narrowed from the year prior, to $155 million. “We think DASH is seeing sustained demand within the food delivery space while momentum in new verticals (convenience, grocery, and pets) (about 14% of sales) coupled with new merchants on the platform will support growth,” says CFRA Research analyst Angelo Zino. Still, the analyst kept a Hold rating on DASH.Walmart (WMT) was just one of a handful of Dow Jones stocks to finish in the green, jumping 4.0% following the discount mega-retailer’s earnings report. In its fourth quarter, WMT reported adjusted earnings per share of $1.53 on $152.9 billion in revenue. Analysts, on average, were expecting earnings of $1.49 per share on $151.1 billion in sales. “We expect this momentum to continue in 2022 as consumers likely become increasingly price conscious, with inflation being at a 40-year high, noting WMT’s average price gap relative to the competition continues to widen versus pre-pandemic levels,” says CFRA Research analyst Arun Sundaram (Buy). “We also believe investors are underappreciating WMT’s evolving business model, including omnichannel transformation and its high-margin alternative profit streams (e.g., advertising is now over $2B in annual revenues).”Find Opportunity in the Market UpheavalThe market is teeming with too many risks for volatility to just magically disappear. So for now, your best options are to defend against it – or use the dips as an opportunity to invest in longer-term trends on the cheap.

Among those trends on the skids is green energy, which despite generally growing long-term growth estimates has suffered of late; several popular green energy funds are off 40%-50% over the past year.

So why now?

“Inflation and economic reopening have increased fossil-fuel prices, and alternative and clean energy returns typically rise in parallel with increasing oil costs,” says exchange-traded fund provider ProShares. “Clean energy was also a priority in the initial $2.2 billion White House infrastructure proposal, and policy tailwinds for increased spending remain.”

If you’re looking for somewhere to begin, consider this short list of 10 green energy stocks that might be down now – but are nonetheless poised to profit from an expected boom in expanded energy capacity for years to come.

Your Guide to Roth Conversions

Special Report

Tax Breaks

Your Guide to Roth ConversionsA Kiplinger Special Report

February 25, 2021

The 22 Best Stocks to Buy for 2022

stocks to buy

The 22 Best Stocks to Buy for 2022A chaotic past two years has taught investors to be ready for anything. Our 22 best stocks to buy for 2022 reflect several possible outcomes for the n…

February 4, 2022

Financial Advice for Millionaires: 5 Strategies for 2022

retirement

Financial Advice for Millionaires: 5 Strategies for 2022How millionaires can potentially save a lot in taxes and how to help protect the assets you leave your family and help keep them in your family bloodl…

February 7, 2022

10 Best Green Energy Stocks for 2022

stocks

10 Best Green Energy Stocks for 2022The future for green energy is bright, and these 10 top-rated stocks are poised to profit on the growing trend toward sustainability.

February 17, 2022

Stock Market Today (2/16/22): S&P 500 Swings Higher After Fed Minutes

Stock Market Today

Stock Market Today (2/16/22): S&P 500 Swings Higher After Fed MinutesThe major market indexes spent most of the day lower on the latest Russia-Ukraine news.

February 16, 2022

Stock Market Today (2/15/22): Stocks Sizzle on Russian Troop Withdrawal Reports

Stock Market Today

Stock Market Today (2/15/22): Stocks Sizzle on Russian Troop Withdrawal ReportsOil prices, on the other hand, plummeted on news Moscow is pulling back some troops from the Ukrainian border.

February 15, 2022

The Berkshire Hathaway Portfolio: All 42 Warren Buffett Stocks Ranked

stocks

The Berkshire Hathaway Portfolio: All 42 Warren Buffett Stocks RankedThe Berkshire Hathaway portfolio is a diverse set of blue chips, and increasingly, lesser-known growth bets. Here’s a look at every stock picked by Wa…

February 15, 2022