Stock Market Today

Fed Governor Brainard says a rapid shrinking of the central bank’s balance sheet is in order, sending rates higher and stocks well into the red Tuesday.Fresh reason to believe that the Federal Reserve could put the pedal to the metal as it fights high inflation cooled U.S. equities Tuesday.

Ahead of tomorrow’s Federal Open Market Committee minutes release, Fed Governor Lael Brainard – who typically espouses looser monetary policies – suggested the central bank needed swift and aggressive action to beat back rocketing consumer prices.

In addition to suggesting rate hikes could occur at greater than a quarter percentage point at a time, Brainard also stressed the Fed’s need to quickly unload some of the nearly $9 trillion in Treasuries, mortgage-backed securities and other assets it previously bought up to stimulate the economy.

“I expect the balance sheet to shrink considerably more rapidly than in the previous recovery,” she said.

“It is undeniable that the Fed must rein in inflation, even with the risk of upsetting the stock market,” says Greg Marcus, managing director at UBS Private Wealth Management. “The Federal Reserve under Jerome Powell has proven to be results-oriented and flexible. While it is a tall task, we believe the Fed is up for the challenge of engineering a ‘soft landing.'”

Sign up for Kiplinger’s FREE Investing Weekly e-letter for stock, ETF and mutual fund recommendations, and other investing advice.

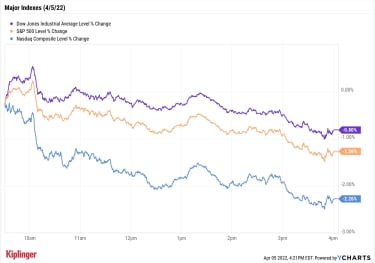

Brainard’s comments sent the 10-year Treasury yield to as high as 2.567%, snuffing rebounds in the very same technology (-2.1%) and communication services (-1.3%) sectors that anchored Monday’s rally.

That in turn clipped the Nasdaq Composite (-2.3% to 14,204), Tuesday’s worst-performing major index. The S&P 500 declined 1.3% to 4,525, while the Dow Jones Industrial Average was off 0.8% to 34,641.

YCharts

Other news in the stock market today:

The small-cap Russell 2000 slumped 2.4% to 2,046.U.S. crude futures retreated 1.3% to end at $101.96 per barrel.Gold futures slipped 0.3% to settle at $1,927.50 an ounce.Bitcoin edged 0.2% higher to $46,021.50. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.)Twitter (TWTR, +2.0%) has a new board member: Elon Musk. One day after Musk disclosed a large stake in Twitter, the social media company announced the CEO of Tesla (TSLA) will join its board of directors. “We applaud the decision by TWTR to add him to the Board and believe the move was inevitable given Musk’s sizable position and likely desire to do so,” says CFRA Research analyst Angelo Zino (Buy). “Overall, we believe Musk is a true visionary who can add valuable input/provide idea generation to help support new initiatives.” Zino adds that by adding Musk to the board, it removes the option for an all-out acquisition of Twitter by Musk, considering, as a Class II director, he can only hold a maximum 14.9% equity stake during his term (which will expire in 2024).Carvana (CVNA) plunged 8.7% after RBC Capital Markets analyst Brad Erickson downgraded the stock to Sector Perform from Outperform (the equivalents of Hold and Buy, respectively). The analyst believes investors are “discounting in significant long-term growth” – especially amid a slower-growth environment – which allows less room for potential upside in the shares. This could possibly tilt the risk/reward profile in a less favorable direction “in the event of execution mishaps,” he adds.Let’s Get Ready to Travel!U.S. consumers are ready to get out of the house. That’s the predominant mindset, anyway, based on the recently released results of a BofA Securities online travel survey conducted in March to measure online travel agency and behavior trends.

Among the most salient findings:

Travel will be elevated compared to 2019 (as in, pre-pandemic) levels over the next 12 months.62% of respondents said they expect to travel more than usual over the next 12 months.41% of respondents said they plan to make up for previously canceled travel either this year or next.While “alternative accommodations” (think AirBnb or Vrbo) are gaining acceptance, all age groups still favor hotels.While there’s certainly risks to these expectations – higher prices could dampen enthusiasm, and another COVID outbreak is always a wild card now – consumers’ hopes of hitting the road, seas and skies could put some real wind into the sails of various travel stocks, including these five hotel picks and these five restaurant plays.

For a wider smattering of potential travel winners, however, consider this list spanning cruise lines, auto rental businesses, air carriers and more:

Why Now Might Be a Good Time to Sell Your Investment Real Estate

real estate investing

Why Now Might Be a Good Time to Sell Your Investment Real Estate Today’s rental property owners are facing challenges and pressures they have never seen before. Luckily, there are alternative investment strategies t…

April 1, 2022

Your Guide to Roth Conversions

Special Report

Tax Breaks

Your Guide to Roth ConversionsA Kiplinger Special Report

February 25, 2021

SECURE Act 2.0: 14 Ways the Proposed Law Could Change Retirement Savings

retirement plans

SECURE Act 2.0: 14 Ways the Proposed Law Could Change Retirement SavingsThe House-passed bill would automatically enroll some workers in retirement plans, raise the mandatory age for RMDs, and much more.

April 1, 2022

5 Restaurant Stocks Rising Above the Rest

stocks

5 Restaurant Stocks Rising Above the RestInflation and labor shortages are just two challenges facing restaurant stocks, but these five picks are well-positioned to ride out the storm.

April 5, 2022

7 Travel Stocks to Buy as COVID Cases Retreat

stocks

7 Travel Stocks to Buy as COVID Cases RetreatAfter living through two years of a pandemic, consumers are ready to hit the open road – and these top-rated travel stocks could reap the rewards.

April 5, 2022

Stock Market Today (4/4/22): Soaring Twitter Spearheads Stocks’ Success

Stock Market Today

Stock Market Today (4/4/22): Soaring Twitter Spearheads Stocks’ SuccessOther big gains in technology and communication services lead the Nasdaq to a brisk improvement in Monday’s session.

April 4, 2022

10 Best Stocks for Rising Interest Rates

stocks

10 Best Stocks for Rising Interest RatesThe Federal Reserve has signaled in no uncertain terms that interest rates will head higher in 2022. Here are 10 of the best stocks for this environme…

April 4, 2022