The small-cap Russell 2000 fell into bear-market territory Thursday as Lucy yanked the ol’ football away from Charlie Brown yet again. For the fourth consecutive day, what markets did in the morning looked nothing like how they finished.

Today’s session started off cheerily enough on the back of a pair of positive economic releases. The Commerce Department’s Bureau of Economic Analysis said U.S. fourth-quarter gross domestic product (GDP) swelled by an annualized 6.9% quarter-over-quarter, smashing expectations for 5.5% expansion.

Contributing most to Q4’s growth was a sharp rise in business inventories and consumer spending, especially in services.

“Helped by inventory rebuilding, the economy remained strong in the final quarter of last year,” says Sal Guatieri, senior economist for BMO Capital Markets. “While omicron will lead to weaker growth in the first quarter, activity is expected to rebound nicely once the latest pandemic wave abates and supply-chain glitches ease.

“The Fed will need to be ‘humble and nimble’ as it navigates underlying economic strength, worsening labour shortages, and stubbornly high inflation.”

Also encouraging were initial jobless claims for the week ended Jan. 22, which declined to 260,000 from an upwardly revised 290,000 the week prior, coming in under estimates for 265,000.

“The first decline so far this year in seasonally adjusted new jobless claims is a welcome sign after three consecutive gains,” says Bankrate.com Senior Economic Analyst Mark Hamrick. “Job security has been bolstered by significant improvement in the unemployment rate and solid rise in payrolls over the past year. Remarkably, worker pay has been losing ground against the steepest inflation in decades.”

Sign up for Kiplinger’s FREE Investing Weekly e-letter for stock, ETF and mutual fund recommendations, and other investing advice.

Investors clearly glommed onto these results in the morning, when they drove all of the major indexes higher … but like yesterday, the momentum faded.

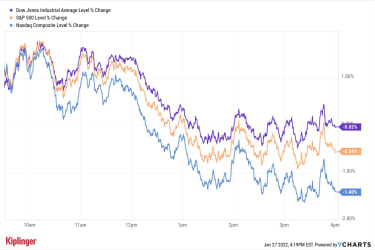

The S&P 500 gained as much as 1.8% before closing down 0.5% to 4,326, putting it 10 points, or a mere 0.2% decline, away from officially falling into a correction. The Dow Jones Industrial Average similarly let a big lead slip away but closed with a marginal loss to 34,160. The Nasdaq Composite (-1.4% to 13,352) slipped further into correction territory.

In far more dire straits was the Russell 2000, which plunged 2.3% to 1,931 – officially in a bear market, having dropped more than 20% from its Nov. 8 closing high. It’s the fifth bear market for the Russell 2000 since 2009, with the others coming in 2011, 2016, 2018 and 2020 (its worst, at a nearly 42% decline).

YCharts

Other news in the stock market today:

U.S. crude oil futures slipped nearly 0.9% to end at $86.61 per barrel.Gold futures fell 2% to settle at $1,795.00 an ounce.Bitcoin came off the rails again, declining a full 4.0% to $35,570.86. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.) Netflix (NFLX) jumped 7.5% after Bill Ackman said Wednesday his hedge fund, Pershing Square, acquired a stake in the streaming giant. The announcement follows the stock’s rough start to 2022, with NFLX shedding 40% from its Dec. 31 close through its Jan. 26 close. “Beginning on Friday and over the last several days, we acquired more than 3.1 million shares of Netflix, making us a top-20 shareholder in the company,” Ackman wrote in a Jan. 26 letter to Pershing Square shareholders.Tesla (TSLA) took an 11.6% spill after earnings, with investors most concerned over the electric carmaker’s warning that global supply-chain issues could negatively impact production levels in 2022. This overshadowed the company’s higher-than-expected adjusted earnings of $2.52 per share and $17.7 billion in revenues. Still, Argus Research analyst Bill Selesky reaffirmed a Buy rating on TSLA in the wake of earnings, saying “the growth story is very much on target.” Despite the supply-chain warning, Selesky expects “Tesla to continue to post strong revenue growth, to report lower operating expenses, and to improve automotive gross margins, setting the stage for significant profit acceleration” in 2022.Intel (INTC, -7.0%) also plunged after its quarterly earnings report. While the company announced record revenues of $19.5 billion and adjusted earnings of $1.09 per share, a weak March-quarter profit forecast spooked investors. “Unprecedented demand continues to be tempered by supply chain constraints as shortages in substrates, components, and foundry silicon has limited our customers’ ability to ship finished systems,” says CEO Pat Gelsinger.The Way to Buy Bonds Right NowTypically in times of broader stock-market tumult, investors can rely on tried-and-true defensive plays. For those who want to stay in equities, that often means utility and consumer staples, but many try to fight off stock volatility by pouring into bonds – which have had their own difficulties in 2022.

We’re in a “stubbornly substandard income environment, says State Street Global Advisors, thanks to the Fed tightening its monetary policy while many international central banks are sticking with loose, crisis-related approaches.

But, SSGA says, some areas of fixed income can still do the trick.

“With rate risk elevated, focusing on mitigating the impacts of rising rates may serve investors well from a total return perspective,” the fund provider says, noting that ultra-short duration bonds with variable and floating yields could blunt this risk.

SSGA adds that while inflation still is a concern, it can be offset with junk debt and other high-yield fixed income, as well as Treasury Inflation-Protected Securities (TIPS).

You can easily access these strategies and others that are better-positioned for an aggressive Fed via these seven top bond funds for 2022. These funds provide diversified (and typically affordable) access to dozens, hundreds or even thousands of bonds in a range of flavors meant to minimize the impact of rising rates and inflation.