Stock Market Today

Other big gains in technology and communication services lead the Nasdaq to a brisk improvement in Monday’s session.A widespread rally in technology and tech-esque stocks started Wall Street’s week off on the right foot.

Monday opened with a splash, with Twitter (TWTR, +27.1%) shares booming on news that Tesla (TSLA, +5.6%) CEO Elon Musk was taking a massive 9.2% stake in the stock.

While the move swirled up conversation about what Musk might do next – he has previously criticized both the social media platform and its current chief, Parag Agrawal – it was nonetheless also seen as a clear catalyst for the communication services firm’s long-underperforming shares.

Also booming were numerous large-cap tech companies such as semiconductor stock Qualcomm (QCOM, +4.6%) and software names Salesforce (CRM, +3.1%) and Intuit (INTU, +4.5%).

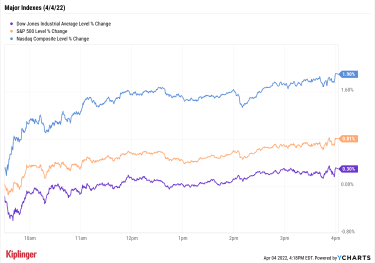

The surge in tech and communications names boosted the Nasdaq 1.9% higher to 14,532, while the S&P 500 (+0.8% to 4,582) and Dow Jones Industrial Average (+0.3% to 34,921) were more modestly in the green.

Sign up for Kiplinger’s FREE Investing Weekly e-letter for stock, ETF and mutual fund recommendations, and other investing advice.

While Monday’s advance was otherwise short on catalysts, Lindsey Bell, chief markets and money strategist for Ally Invest, points to a potential driver of additional second-quarter gains.

“What many people aren’t talking about is the underappreciated opportunity the consumer presents,” she says. “The job market is strong and excess cash has allowed consumers to absorb higher pricing. Companies and corporate profits have benefitted. I’m expecting earnings season will surprise the consensus, which expects guidance to fall significantly.”

YCharts

Other news in the stock market today:

The small-cap Russell 2000 improved 0.2% to 2,095.Fresh calls from Europe for harsher sanctions on Russia sent U.S. crude futures (+4.0% to $103.28 per barrel) back above the $100 mark.Gold futures climbed 0.5% to $1,934.00 per ounce.Bitcoin slid 1.0% to $45,923.33. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.)Starbucks (SBUX, -3.7%) declined against the grain after interim CEO Howard Schultz announced the company would suspend share buybacks. “This decision will allow us to invest more profit into our people and our stores — the only way to create long-term value for all stakeholders,” said Schultz, who enters the company at a time where several locations have begun to unionize. Investors should note that SBUX did not repurchase any shares last year but had previously pledged $20 million toward both its dividend program (which will remain intact) and buybacks through 2024.Rising Rates? These Stocks Don’t Sweat ‘EmIn a couple of days we’ll get more clarity on the Federal Reserve’s upcoming tightening measures.

“The big catalyst for this week is the Fed minutes on Wednesday afternoon, which is expected to shed some light on the balance sheet reduction process,” says Michael Reinking, senior market strategist for the New York Stock Exchange. “There is still some uncertainty as to how aggressively Fed officials want to kick off this process.

“As I’ve laid out previously I’m looking for an initial announcement to start in the $60 billion to $85 billion range, which is less than some of the more aggressive projections out there.”

From there, the market is likely to revert its focus back to the Fed’s benchmark interest rate, which the central bank is expected to hike several more times this year. The exact number of increases (and their velocity) is still up in the air, but investors continue to tweak their portfolios to absorb more interest-rate pain – and in many cases, profit off it.

For instance, these seven exchange-traded funds (ETFs) hold either assets that are largely immune to rising rates or actually feed off it. But investors looking to make a more aggressive, concentrated bet to benefit from the Federal Reserve’s expected hawkishness might do better in individual stocks.

Here, we look at 10 of the best stocks amid tighter monetary policy in 2022.

Kyle Woodley was long CRM as of this writing.

Why Now Might Be a Good Time to Sell Your Investment Real Estate

real estate investing

Why Now Might Be a Good Time to Sell Your Investment Real Estate Today’s rental property owners are facing challenges and pressures they have never seen before. Luckily, there are alternative investment strategies t…

April 1, 2022

Your Guide to Roth Conversions

Special Report

Tax Breaks

Your Guide to Roth ConversionsA Kiplinger Special Report

February 25, 2021

SECURE Act 2.0: 14 Ways the Proposed Law Could Change Retirement Savings

retirement plans

SECURE Act 2.0: 14 Ways the Proposed Law Could Change Retirement SavingsThe House-passed bill would automatically enroll some workers in retirement plans, raise the mandatory age for RMDs, and much more.

April 1, 2022

10 Best Stocks for Rising Interest Rates

stocks

10 Best Stocks for Rising Interest RatesThe Federal Reserve has signaled in no uncertain terms that interest rates will head higher in 2022. Here are 10 of the best stocks for this environme…

April 4, 2022

Musk’s Stake in Twitter Stock: Coup … or Coup d’Etat?

stocks

Musk’s Stake in Twitter Stock: Coup … or Coup d’Etat?Tesla CEO’s 9.2% ownership in TWTR sends Twitter’s stock surging but opens up a basket of questions about the social media platform’s future.

April 4, 2022

Stock Market Today (4/1/22): Seesawing Stocks Start Q2 With Small Gains

Stock Market Today

Stock Market Today (4/1/22): Seesawing Stocks Start Q2 With Small GainsThe March jobs report was short of Wall Street expectations but not short on positive signals, leading to modest gains for the major indexes.

April 1, 2022

Kiplinger’s Weekly Earnings Calendar

stocks

Kiplinger’s Weekly Earnings CalendarCheck out our earnings calendar for the upcoming week, as well as our previews of the more noteworthy reports.

April 1, 2022