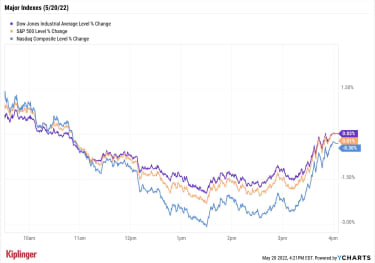

The S&P 500 made its closest brush with a new bear market yet, falling more than 20% from its all-time highs during Friday’s intraday action before reversing course and actually finishing with a marginal advance.

Specifically, the 500-company index dropped as low as 3,810 – well below the 3,837 level that would mark a 20% drawdown from its Monday, Jan. 3, record highs and put it in an official bear market – but rebounded late in the session to eke out a gain of less than a point, to 3,901.

Among the stocks weighing on the market Friday was Tesla (TSLA, -6.4%), which sank to its lowest level since August 2021 following a Business Insider report claiming that CEO Elon Musk’s privately held SpaceX “paid a flight attendant $250,000 to settle a sexual misconduct claim against Musk in 2018.” Musk decried the article as “political,” but it nonetheless acted as the cap on a difficult week for Tesla, which was just kicked out of the S&P 500’s ESG index and is facing COVID lockdown headaches at its operations in China.

Meanwhile, Deere (DE, -14.1%) was clobbered despite topping both sales and earnings forecasts and raising its full-year profit outlook. The major criticism of its report? The farm-equipment manufacturer’s sales outlook relies on having a strong second half of 2022, which isn’t a certainty.

The Dow, like the S&P 500, closed with a marginal gain to 31,261. The Nasdaq declined 0.3% to 11,354 but finished well off its intraday lows.

Sign up for Kiplinger’s FREE Investing Weekly e-letter for stock, ETF and mutual fund recommendations, and other investing advice.

Dan Wantrobski – the technical strategist and associate director of research at Janney Montgomery Scott who said earlier this week that he was “encouraged” by Wednesday’s washout – notes that while this drawdown might have lower to go, longer-term investors can begin sharpening their knives.

“At 3,800, we do believe that the S&P 500 resides in a price range (3,600-4,000) that can lead to some attractive returns over the coming years,” he says.” He’s not calling a bottom for short-term traders, but “investors who hold a long-term view can start to deploy sideline cash in small increments and build long positions for the intermediate- to longer-term timeframe.”

YCharts

Other news in the stock market today:

The small-cap Russell 2000 declined 0.2% to 1,773.U.S. crude oil futures gained 0.4% to settle at $110.28 per barrel.Gold futures ended the day unchanged at $1,842.10 an ounce.Bitcoin put together a small afternoon relief rally but still finished down $29,265.24. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.)Deckers Outdoor (DECK) jumped 12.6% after the maker of Ugg boots reported earnings. For its fiscal fourth quarter, DECK reported earnings of $2.51 per share on $736.0 million, up 113% and 31.2%, respectively, year-over-year. Both figures easily surpassed analysts’ expectations, as well. “The company was able to offset supply chain disruptions by leveraging SG&A [selling, general and administrative expenses] in the quarter,” says CFRA Research analyst Zachary Warring, who upgraded the retail stock to Buy from Hold. “The company continues to repurchase shares aggressively while maintaining a debt free balance sheet. We see this as an attractive entry point for shares as the company continues to execute and grow its HOKA brand well over 25% annually.”Ross Stores (ROST) followed in the footsteps of fellow retailers Walmart (WMT) and Target (TGT), plunging in the wake of its quarterly results. Shares spiraled 22.5% after the off-price apparel and home fashions retailer reported lower-than-expected earnings and revenue in its first quarter (97 cents per share actual vs. $1.00 per share est.; $4.3 billion actual vs. $4.5 billion est.), while same-store sales slumped 7% over the three-month period. However, the “big news from ROST’s first-quarter earnings report was the company lowered its fiscal 2022 earnings per share guidance to $4.34-4.58 vs. $4.71-$5.12 prior and the Street’s $5.01 view,” says UBS Global Research analyst Jay Sole (Neutral). “The midpoint of the new range is 8% below ROST’s full-year 2021 earnings per share and 3% below its full-year 2019 result.” Sole adds that he does not believe today’s pullback represents a buying opportunity, and that more guidedowns could be in store as inflation negatively impacts lower-income consumer demand. Quarterly results from retailers will continue to be in focus next week, with Best Buy (BBY) and Dollar General (DG) among the many names on the earnings calendar.Make Your Portfolio Pay You Every MonthRegular readers of Closing Bell will note that this week, we’ve been pounding the table about the role dividends can play in helping investors absorb volatile downturns like the one we’ve suffered in 2022.

We’re not alone. Several strategists suggest loading up on dividend stocks in the current environment, including Gargi Chaudhuri, head of iShares investment strategy. “We see dividend stocks as an alternative source of quality, offering outperformance over the broad market, attractive yield for income, and diversified exposure to sectors benefiting from the current macro regime of high inflation and slowing growth,” she says.

Most of our recommendations across the week have focused on dividend growth – namely, the S&P 500 Dividend Aristocrats, as well as their counterparts in Canada and Europe. That said, investors more interested in high current yield might find that the Aristocrats are a bit stingy. The ProShares S&P 500 Dividend Aristocrats (NOBL) exchange-traded fund, for instance, yields just 2% at current prices.

Those looking to load their cart with juicier yields might be better off eyeballing a different cohort: monthly dividend payers. Most U.S. dividend stocks tend to pay on a quarterly basis, but there are a select group of equities and funds that conveniently pay you just as frequently as you receive your bills – that is, once each month. Many of these monthly payers also tend to come from special classes, such as real estate investment trusts (REITs) and business development companies (BDCs) that pay much higher dividends than your average blue-chip stock.

Read on as we review a dozen of these generous monthly dividend names.