Stock Market Today

An earnings bust from Cisco and higher-than-expected jobless claims helped nudge the S&P 500 toward the bear-market cliff.If there was any good news Thursday, it was that the market’s downward momentum from yesterday largely fizzled out. But the S&P 500 still edged ever nearer to bear-market territory in a mixed day for U.S. equities.

The Department of Labor reported that initial unemployment claims for the week ending May 14 rose to 218,000 – their highest level since January, well more than expectations for 200,000 filings, and up from last week’s revised 197,000.

Bill Adams, chief economist for Comerica Bank, said later Thursday that he believes job growth looks ready to slow across 2022. “Major retailers are reporting margin pressure and softer consumer demand … This will lead to slower job growth in the retail and e-commerce industries in the rest of 2022,” he says. Adams adds that companies in other sectors could become more cautious about hiring if the stock market selloff further dampens business sentiment.

Also Thursday, the National Association of Realtors reported that April existing-home sales fell 2.4% month-over-month (and 5.9% year-over-year) to an annualized rate of 5.61 million.

The earnings calendar once again featured a blue-chip bust. This time it was Dow component Cisco Systems (CSCO, -13.7%), which edged out quarterly profit estimates (87 cents per share vs. 86 est.) but reported disappointing revenues ($12.8 billion vs. $13.3 billion est.) and forecast an unexpected drop in sales for the current three-month period.

Kohl’s (KSS, +4.4%) added to a stack of weak retail reports, delivering a wide miss on profits and slashing its full-year financial forecast; KSS shares still improved after the company said it expects several buyout bids to be submitted in the next few weeks.

Sign up for Kiplinger’s FREE Investing Weekly e-letter for stock, ETF and mutual fund recommendations, and other investing advice.

BJ’s Wholesale (BJ, +7.4%) was a pleasant outlier, however, rising on its own earnings merits; revenues, comparable-store sales and earnings all topped analysts’ views.

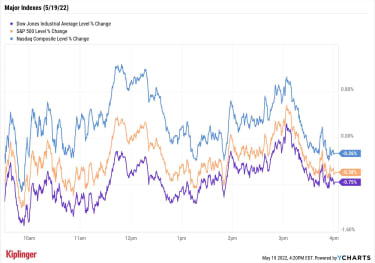

The major indexes all managed to bounce back a little from yesterday’s drubbing. The Nasdaq Composite was down 0.3% to 11,388, while the Dow Jones Industrial Average dropped 0.8% to 31,253. The S&P 500, meanwhile, fell 0.6% to 3,900 – a close below 3,837.25, just a 1.6% decline from here, would put the index in a bear market.

Another area to watch is around 3,800, where the S&P 500 could find stock-chart support, says Dan Wantrobski, technical strategist and associate director of research at Janney Montgomery Scott. Wantrobski adds that he was “encouraged” by yesterday’s washout and felt “it brings us closer to an eventual low for the year.”

YCharts

Other news in the stock market today:

The small-cap Russell 2000 bucked the trend, finishing marginally higher to 1,776.U.S. crude oil futures gained 2.7% to finish at $109.89 per barrel.Gold futures rose 1.7% to settle at $1,841.20 an ounce.Bitcoin’s back-and-forth ways continued, with the digital currency up 2.4% to 29,934.68. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.)Harley-Davidson (HOG) shed 9.3% after the company said it will halt production and delivery of its motorcycles for two weeks. “This decision, taken out of an abundance of caution, is based on information provided by a third-party supplier to Harley-Davidson late on Tuesday (5/17) concerning a regulatory compliance matter relating to the supplier’s component part,” HOG said in a statement.Several rail stocks fell today after Citi analyst Christian Wetherbee cut his ratings on a number of names in the industry. The analyst lowered his outlook for CSX (CSX, -4.3%), Norfolk Southern (NSC, -4.0%) and Union Pacific (UNP, -3.8%) to Neutral (Hold) from Buy, suggesting a slowing economy will drag on consumer demand for goods. Wetherbee said that while Citi is not “full baking in a recession” across their coverage, “an environment in which the U.S. avoids a recession” includes one where “consumer spending pivots meaningfully toward services and goods are sluggish.”Canada: Go for the Poutine, Stay for the DividendsIf you’re searching for safety from 2022’s market losses and volatility, don’t duck for cover – climb up to Canada.

While the S&P 500 has spent the past week aggressively flirting with bear-market territory (20%-plus decline from a high), the S&P TSX Composite Index – a major Canadian stock-market benchmark – hasn’t even fallen into a correction (10%-plus drop).

Part of this outperformance admittedly comes from how differently that index is structured than the S&P 500. Says Credit Suisse: “Perhaps most notably, the Canadian market benefits from large index weights in financials (generally positive with rising rates), energy (Canada is one of the world’s largest oil and natural gas producers) and materials (multiple commodities with a renewed focus on potash and continued interest in ags, copper and gold).”

Nonetheless, Canadian stocks might be worth a look – especially if you’re interested in securing reliable sources of rising income.

Earlier this week, we mentioned that the U.S. isn’t the only part of the world that boasts Dividend Aristocrats – you can find a similar elite group in Europe, and yes, Canada has its own Dividend Aristocrats as well.

Again, like the European Aristocrats, these Canadian dividend growers have slightly different rules for inclusion than their U.S. counterparts. But they’re nonetheless a great starting point for income hunters looking for fresh places to put new money to work – and we’ve singled out 20 of the best Canadian Dividend Aristocrats for American investors.

15 Stocks Warren Buffett Is Buying (And 7 He’s Selling)

stocks

15 Stocks Warren Buffett Is Buying (And 7 He’s Selling)Berkshire Hathaway CEO Warren Buffett is a bull once more! The Oracle and his team entered eight new positions and added to others in a big way.

May 17, 2022

Your Guide to Roth Conversions

Special Report

Tax Breaks

Your Guide to Roth ConversionsA Kiplinger Special Report

February 25, 2021

Should You Consider a Roth Conversion While the Market is Down?

Roth IRA Conversions

Should You Consider a Roth Conversion While the Market is Down?Investors who are hurting right now as the stock market takes a hit may want to console themselves with a possible tax bargain created by a Roth conve…

May 16, 2022

10 Best Utility Stocks for the Rest of 2022

stocks

10 Best Utility Stocks for the Rest of 2022Income investors like utility stocks for their stability and generous dividends. Here are 10 top-rated ones to watch amid a turbulent market.

May 19, 2022

Stock Market Today (5/18/22): Dow Sinks 1,164 Points in Worst Day Since June 2020

Stock Market Today

Stock Market Today (5/18/22): Dow Sinks 1,164 Points in Worst Day Since June 2020The S&P 500 and Nasdaq each lost over 4% in a broad-market selloff.

May 18, 2022

Stock Market Today (5/17/22): Wall Street Rallies Around Reassuring Retail Data

Stock Market Today

Stock Market Today (5/17/22): Wall Street Rallies Around Reassuring Retail DataAirlines, semiconductors among several pockets of relative strength in an overall strong Tuesday session for the broader indexes.

May 17, 2022

The Berkshire Hathaway Portfolio: All 47 Warren Buffett Stocks Ranked

stocks

The Berkshire Hathaway Portfolio: All 47 Warren Buffett Stocks RankedThe Berkshire Hathaway portfolio is a diverse set of blue chips, and increasingly, lesser-known growth bets. Here’s a look at every stock picked by Wa…

May 17, 2022