The S&P 500 fell to its lowest point in more than a year Monday as last week’s selloff retained all of its momentum and bled into just about anything that trades.

Interest-rate fears continued be the selloff’s primary driver. The 10-year Treasury briefly touched 3.2% today and, even after pulling back to 3.06%, sits around levels last seen in 2018.

“Interest rates are a hammer, not a scalpel – they are blunt tools designed to move slowly and with great force, rather than precisely,” says Andy Kapyrin, co-chief investment officer at registered investment advisory firm RegentAtlantic. “The Fed is swinging the interest rate hammer, and the financial markets are responding to the aftershocks.”

Technology (-3.9%) and consumer discretionary (-4.3%) were among the usual suspects in a trading day that saw each of the 11 S&P 500 stock sectors finish in the red. But this was a wide selloff that went well beyond just stocks and bonds.

U.S. crude oil futures, for instance, cratered by 6.1% to $103.09 per barrel, amid ongoing worries that China’s strict COVID-19 lockdowns will cramp oil prices. Indeed, energy (-8.3%) was Monday’s worst-performing sector, with even blue chips such as Exxon Mobil (XOM, -7.9%) and Chevron (CVX, -6.7%) taking it on the chin.

Gold futures? A bad day, too, off 1.3% to $1,858.60 per ounce as investors piled into the U.S. dollar.

Sign up for Kiplinger’s FREE Investing Weekly e-letter for stock, ETF and mutual fund recommendations, and other investing advice.

Cryptocurrencies haven’t provided safety, either. Bitcoin, which fell as low as $30,375 and finished off 13.4% to $31,153, has now fallen by more than 50% from its November 2021 peak. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.)

Edward Moya, senior market strategist at currency data provider OANDA, notes that institutional buyers are starting to pay close attention to Bitcoin, given that many who got in during 2021 are now losing money on their investment. “If the $30,000 level breaks, that could trigger a flash crash environment if several whales unload,” he says.

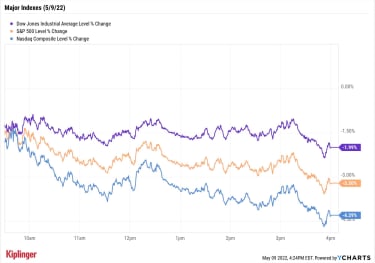

The Nasdaq Composite (-4.3% to 11,623) has re-entered bear-market territory, off nearly 28% from its January highs. The S&P 500 (-3.2% to 3,991 – its lowest close since March 31, 2021) needs to lose another 4% or so before entering a bear market, while the Dow Jones Industrial Average (-2.0% to 32,245) would have to retreat another 9%.

YCharts

Other news in the stock market today:

The small-cap Russell 2000 sank by 4.2% to 1,762.Palantir Technologies (PLTR) stock surrendered 21.3% after the data analytics company reported lower-than-expected first-quarter earnings per share (2 cents actual vs. 4 cents estimated). The company also gave current-quarter guidance below Wall Street’s estimates, adding that there is “a wide range of potential upside to our guidance, including those driven by our role in responding to developing geopolitical events.” One high note of PLTR’s financial results was its Q1 revenue of $446.4 million, up 31% year-over-year and above the average estimate.Rivian Automotive (RIVN) plummeted 20.9% after sources told CNBC that Ford Motor (F, -5.9%) will sell 8 million RIVN shares after the electric vehicle maker’s insider lockup period expired on Sunday. The news also dragged on Amazon.com (AMZN, -5.2%), which owns roughly 158.4 million RIVN shares, according to S&P Global Market Intelligence. “The news is not surprising to us, especially after the two companies terminated a partnership to jointly develop an EV last November and as Ford begins deliveries of the F-150 Lightning, a direct competitor to Rivian’s R1T pickup truck,” says CFRA Research analyst Garrett Nelson, who maintained a Hold rating on the EV stock.The Strongest Parts of a Weak MarketGreen ink was in shockingly short supply Monday – but relative success was found among the usual suspects.

“This collapse should continue the rotation into defensive dividend stocks,” says Jay Hatfield, chief investment officer of ETF manager Infrastructure Capital Management.

Consumer staples, which was only marginally lower Monday, and utilities, second-best at a 0.8% decline, are among such beneficiaries, Hatfield says.

Among their greatest qualities right now is what’s sure to be a common refrain in near-term investment advice: pricing power. In short, as inflation continues to march unimpeded, those companies that are best able to push most of those prices on to consumers should fare best – and while your average American might go a few extra months without taking a vacation or buying a new pair of Nikes, they’re unable to pull back much on basic necessities such as food and electricity.

Read on as we examine a number of stocks with exceptional pricing power – as well as highlight several names that, while good companies in their own right, will have an uphill battle as long as inflation remains white-hot.