Stocks spent the last day of March much as they’ve spent the past few months – trading in negative territory.

Today’s decline followed an onslaught of economic reports. On the inflation front, data from the Commerce Department showed that the personal consumption expenditures (PCE) index – which measures the price change of goods and services purchased by consumers – rose 0.6% month-over-month and 6.4% year-over-year in February, the quickest annual increase since 1982.

Meanwhile, consumer spending ticked up 0.2% from January, though this missed economists’ consensus estimate.

And ahead of tomorrow’s monthly jobs data, a Labor Department report showed weekly jobless claims rose 14,000 last week to 202,000, slightly more than was expected.

Investors also eyed President Joe Biden’s plan to tap into strategic oil reserves – releasing a record 180 million barrels – to combat red-hot gas prices. This sent U.S. crude futures down 7% to $100.28 per barrel – their lowest settlement since March 16.

Still, the ” release of oil from the Strategic Petroleum Reserve will face two key logistical challenges,” says Peter McNally, vice president of Global Sector Lead at Third Bridge. “The first is getting the oil out of the underground storage. This will take months to complete a release of 180 million barrels. The second challenge is converting the crude oil into fuel for consumers.”

Sign up for Kiplinger’s FREE Investing Weekly e-letter for stock, ETF and mutual fund recommendations, and other investing advice.

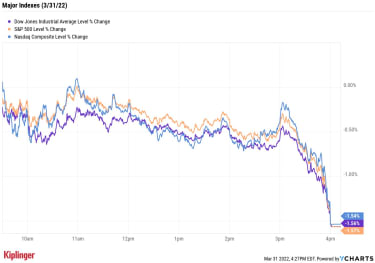

Selling picked up into the close, with the Dow Jones Industrial Average ending down 1.6% at 34,678, the Nasdaq Composite off 1.5% at 14,220 and the S&P 500 Index giving back 1.6% to 4,530.

For the month, the three indexes gained 2.3%, 3.4% and 3.6%, respectively. As for the first quarter of 2022, the Dow (-4.6%), Nasdaq (-9.1%) and S&P 500 (-5.0%) all finished solidly in the red, marking their worst quarter since Q1 2020.

YCharts

Other news in the stock market today:

The small-cap Russell 2000 shed 1% to 2,070. For the month, the index rose 2.1%, paring its first-quarter loss to 6.9%.Gold futures rose 0.8% to settle at $1,954 an ounce, bringing their quarterly gain to 6.9%.Bitcoin wasn’t immune to today’s selling, sinking 3.2% to $45,616.75. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.)Walgreens Boots Alliance (WBA) was the worst Dow Jones stock today, shedding 5.7% after earnings. In its fiscal second quarter, the drugstore chain reported adjusted earnings of $1.59 per share on $33.8 billion in revenue, beating analysts’ consensus estimates. And while the company reiterated its full-year forecast, it warned of slowing demand for COVID-19 testing and vaccines and said investments it made to become more healthcare-oriented, like opening hundreds of doctor’s offices, will take time to pay off.Advanced Micro Devices (AMD) tumbled 8.3% after Barclays analyst Blayne Curtis downgraded the semiconductor stock to Equalweight from Overweight (the equivalents of Hold and Buy, respectively). Curtis cited increasing competition from Intel (INTC). The analyst also questioned AMD’s “growth trajectory coming out of this potential correction,” and said he is staying on the sidelines until there is “better clarity as to the magnitude of these corrections and what the competitive landscape will look like as Intel catches up and ARM takes more share.”Energy Stocks, Oil Prices Rack Up Big Q1 GainsSure, it was an ugly quarter for most stocks, but not all. The energy sector surged 37.7% in the first three months of 2022 thanks in part to a 33% gain in U.S. crude oil futures. According to Dan Wantrobski, technical strategist and associate director of research at Janney Montgomery Scott, this run in oil prices could have legs.

True, crude futures have pulled back recently from the $125-per-barrel mark touched earlier this month, but Wantrobski calls out a major theme driving inflation these days: “Too much liquidity relative to available assets and investment vehicles” – or, more simply put, “too much money chasing too little of anything.”

And given that there’s plenty of excess liquidity still lingering in the market, Wantrobski believes the longer-term outlook on oil prices remains bullish.

Investors looking to squeeze more profits from the oil patch aren’t hurting for options – our top energy stocks for 2022 include a wide array of operators, or you can dig into specific niches such as these three refiners or these high-yielding midstream energy plays.

But those who prefer to spread their risk across 20 or 30 stocks rather than two or three might consider these seven exchange-traded funds (ETFs) amid rising oil prices. The funds featured here allow you to invest in the overall energy sector, in specific industries and even in oil futures.