Stock Market Today

A round of well-received bank earnings boosted the stock market to start Monday, but investors’ enthusiasm waned as the day wore on.The major indexes opened Monday solidly higher amid a round of well-received bank earnings, but chipped away at these gains to eventually end lower.

Garnering the most attention from this morning’s earnings calendar was Goldman Sachs (GS, +2.5%), which reported double-digit percentage declines in its top and bottom lines, though both figures beat analysts’ consensus estimates. The blue-chip financial firm also said Q2 trading revenue soared 32% year-over-year to $6.5 billion – offsetting a 41% decline in investment banking revenue.

Also in focus today was the National Association of Home Builders (NAHB)/Wells Fargo housing market index – a measure of builder confidence – which fell to 55 in July from 67 in June, its seventh-straight decline and biggest month-over-month drop since April 2020.

“Most concerning, traffic of prospective buyers fell to the lowest since May 2020, suggesting that the housing market has more downside to go as interest rates trek higher and inflation chisels away consumer purchasing power,” says Jeffrey Roach, chief economist for independent broker-dealer LPL Financial.

Sign up for Kiplinger’s FREE Investing Weekly e-letter for stock, ETF and mutual fund recommendations, and other investing advice.

A continued slowdown in the residential real estate market “hinges on the duration of historic inflationary pressures for homebuilders from high raw material prices and a tight labor market,” Roach says.

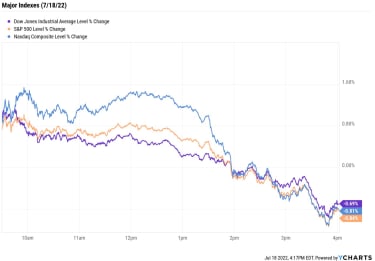

After being up as much as 1.5% earlier, the Nasdaq Composite ended the day down 0.8% at 11,360. The Dow Jones Industrial Average and S&P 500 Index also erased early leads to close lower (-0.7% at 31,072; -0.8% at 3,830).

YCharts

Other news in the stock market today:

The small-cap Russell 2000 fell 0.3% to 1,738.U.S. crude futures jumped 5.1% to settle at $102.60 per barrel.Gold futures rose 0.4% to finish at $1,710.20 an ounce.Bitcoin climbed 2.2% to $21,600.70. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.) Bank of America (BAC, +0.03%) reported a 32% year-over-year decline in earnings to 73 cents per share in its second quarter, due in part to a $523 million credit-loss provision. On an adjusted basis, the bank recorded earnings of 78 cents per share. Revenue rose 5.6% to $22.8 billion, while net interest income jumped 22% to $12.4 billion. “We were positive on the net interest income, which was driven by higher net interest margin,” says David Wagner, portfolio manager at investment firm Aptus Capital Advisors. “While trading and investment banking revenues appear a little light relative to peers that have reported already, positive year-over-year operating leverage (even including the regulatory charges) supports our belief that the advantages of scale will differentiate BAC in the medium-term.”Energy stocks rallied alongside crude oil prices today. Among the big gainers were ConocoPhillips (COP, +2.6%), Devon Energy (DVN, +3.6%) and Marathon Oil (MRO, +3.5%).What to Watch For This Earnings SeasonThe second-quarter earnings calendar really gets rolling this week. While financial stocks like Goldman have been the main focus so far, over the next several weeks, we’ll begin to see how other sectors fared during a period that included inflation rising at its fastest pace in 40 years and the Federal Reserve initiating its most aggressive rate-hiking cycle in almost three decades.

Megan Horneman, chief investment officer for independent financial firm Verdence Capital Advisors, highlights several things investors should watch for this earnings season, including updates on the supply chain. “The global supply chain has been a hamper to earnings as materials are not available to make products to sell,” she says. “What we will be watching closely is sentiment around the global supply chain and any more indication of companies that may have overstocked and face an inventory overhang.”

Horneman adds that the impact of the foreign exchange markets on Q2 earnings will also be noteworthy, particularly as the U.S. dollar index climbed 6.5% over the three-month period. “Currency markets are an important factor to consider when analyzing earnings, especially for those multinational corporations,” she says. “A strong U.S. dollar not only makes American goods less competitive, but when the foreign currency is converted back into U.S. dollars, it can serve as a drag on earnings.”

Indeed, forex headwinds could be the “swing factor” for healthcare giant Johnson & Johnson’s (JNJ) Q2 earnings report says BofA Global Research analyst Geoff Meacham. JNJ reports before tomorrow’s open and is one of several companies whose quarterly earnings we’re previewing, including Twitter (TWTR), which has been at the center of much drama over Elon Musk’s aborted takeover attempt.

Karee Venema was long BAC as of this writing.

3 Main Reasons Why the Government Denies Social Security Disability Benefits

personal finance

3 Main Reasons Why the Government Denies Social Security Disability BenefitsTo help improve your chances at being approved for SSDI benefits, it helps to better understand why so many applicants get turned down.

July 16, 2022

Your Guide to Roth Conversions

Special Report

Tax Breaks

Your Guide to Roth ConversionsA Kiplinger Special Report

February 25, 2021

3 Investing Truths to Live By (Right Now and Always)

investing

3 Investing Truths to Live By (Right Now and Always)With the volatility we’ve seen in today’s bear market, many investors are feeling the urge to time the market. Here’s why that is a mistake and what y…

July 15, 2022

Twitter Earnings on Tap, But All Eyes on Musk Court Battle

stocks

Twitter Earnings on Tap, But All Eyes on Musk Court BattleOur preview of the upcoming week’s earnings reports includes Twitter (TWTR), Netflix (NFLX) and Johnson & Johnson (JNJ).

July 18, 2022

Could Buffett Buy Out Occidental (OXY)?

stocks

Could Buffett Buy Out Occidental (OXY)?All in, Berkshire Hathaway now owns nearly a third of energy firm Occidental Petroleum. One analyst thinks Buffett might make a play for the rest.

July 16, 2022

Stock Market Today (7/15/22): Dow Jumps 658 Points After Stellar Retail Sales Report

Stock Market Today

Stock Market Today (7/15/22): Dow Jumps 658 Points After Stellar Retail Sales ReportRetail sales were up 1% in June, while consumer sentiment edged higher in July.

July 15, 2022

Kiplinger’s Weekly Earnings Calendar

stocks

Kiplinger’s Weekly Earnings CalendarCheck out our earnings calendar for the upcoming week, as well as our previews of the more noteworthy reports.

July 15, 2022