Stock Market Today

Lingering concerns over the Fed’s rate-hike timeline dragged the major indexes lower for a fourth straight day.Stocks once again erased early gains to end lower for a fourth straight session as investors continued to fret about an extended rate-hike campaign from the Federal Reserve.

Wednesday’s decline came after Cleveland Fed President Loretta Mester said during this morning’s speech in Dayton, Ohio, that “it is far too soon to say that inflation has peaked.” Mester, a voting member of the Federal Open Market Committee (FOMC), added that she does not anticipate any rate cuts this year or next.

Wall Street also got another read on the labor market, with this morning’s ADP employment report estimating the U.S. added a lower-than-expected 132,000 private-sector jobs in August, down from July’s reading of 270,000. This comes ahead of Friday’s nonfarm payrolls report – the last major check on employment ahead of the Fed’s September meeting.

“So it begins,” says Edward Moya, senior market strategist at currency data provider OANDA. “The labor market is cooling as private payrolls clearly showed a more conservative pace of hiring. ADP’s new methodology was in place and showed job growth slowed for a second consecutive month as companies added the fewest jobs since early 2021.”

The Friday jobs report is likely to continue this narrative. The consensus estimate is for 300,000 jobs, compared to the 528,000 new positions added in July. “A slower pace of hiring still gives the Fed the greenlight for more aggressive rate hikes over the next couple of FOMC meetings,” Moya adds.

Sign up for Kiplinger’s FREE Investing Weekly e-letter for stock, ETF and mutual fund recommendations, and other investing advice.

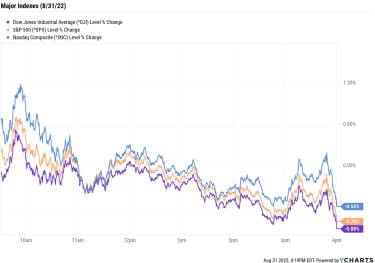

At today’s close, the Nasdaq Composite was down 0.6% at 11,816, with the S&P 500 Index (-0.8% at 3,955) and the Dow Jones Industrial Average (-0.9% at 31,510) also ending lower. All three indexes finished August with monthly losses of more than 4%.

YCharts

Other news in the stock market today:

The small-cap Russell 2000 shed 0.5% to 1,846.U.S. crude futures fell 2.3% to finish at $89.55 per barrel, bringing their monthly decline to 9.2%. This marked the third straight monthly decline for oil prices, the longest such streak since early 2020.Gold futures ended the day down 0.6% at $1,726.20 an ounce, and ended the month off 3.1%. It was the fifth consecutive monthly drop for gold prices, the lengthiest losing streak since 2018.Bitcoin rose 1.3% to $20,212.29. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.)Bed Bath & Beyond (BBBY) plunged 21.3% after the homegoods retailer unveiled a strategic update, which includes plans for a 12 million common stock offering, the closing of roughly 150 underperforming stores and a round of layoffs. BBBY also said it is pausing store remodels and updates for the remainder of its fiscal year as it looks to lower capital expenditures to around $250 million from $400 million. Even with today’s decline, the meme stock ended the month up 90%.Cost-cutting plans sent social media stock Snap (SNAP, +9.7%) higher today. The Snapchat parent last night unveiled a restructuring plan that includes cutting roughly 20% of its workforce and ending several projects including its Snap Originals premium show lineup. “We are restructuring our business to increase focus on our three strategic priorities: community growth, revenue growth, and augmented reality,” CEO Evan Spiegal said in a memo. The announcement comes just weeks after Snap posted its weakest quarter of revenue growth ever.Check Out These Cheap Stocks Under $10Investors would be wise to stay on their toes for just a bit longer. “September and October are traditionally dangerous months for the market,” says Anthony Denier, CEO of trading platform Webull. “So, people should expect choppy waters. Obviously, investors need to watch the economic indicators. Is inflation rising or falling? Will GDP growth be negative in the third quarter, confirming that we are in a recession? Will the job market start to cool off?”

We’ve used this space before to mention ways investors can shore up their portfolio against volatility risk. This includes focusing on traditional safety plays like utilities and consumer staples stocks, or honing in on low-volatility stocks.

However, some investors prefer the thrill of a roller-coaster ride – and what better way to experience the excitement than with cheap stocks. Many people avoid low-priced stocks because they are extremely risky and volatile, but others appreciate their affordability factor and ability to return big gains in short order. Here, we’ve compiled a list of 10 cheap stocks under $10, each with something to offer investors. But buyer beware: as quickly as these low-priced stocks can go up, they can go down. Don’t invest more than you can afford to lose.

Watch Out! RMDs Can Trigger Massive Medicare Means Testing Surcharges

retirement planning

Watch Out! RMDs Can Trigger Massive Medicare Means Testing SurchargesSaving too much in tax-deferred retirement accounts could mean you’ll pay hundreds of thousands more than necessary on Medicare premiums in retirement…

August 29, 2022

Your Guide to Roth Conversions

Special Report

Tax Breaks

Your Guide to Roth ConversionsA Kiplinger Special Report

February 25, 2021

What Are the Income Tax Brackets for 2022 vs. 2021?

tax brackets

What Are the Income Tax Brackets for 2022 vs. 2021?Depending on your taxable income, you can end up in one of seven different federal income tax brackets – each with its own marginal tax rate.

August 15, 2022

10 Cheap Stocks to Buy for $10 or Less

stocks

10 Cheap Stocks to Buy for $10 or LessIf you’re willing to take on the risk of owning cheap stocks, these 10 picks are all priced under $10.

August 31, 2022

Stock Market Today (8/30/22): Stocks Sink on Strong Economic Data

Stock Market Today

Stock Market Today (8/30/22): Stocks Sink on Strong Economic DataThe major indexes erased early gains after the latest jobs and consumer confidence data were released.

August 30, 2022

Stock Market Today (8/29/22): Markets End Lower Again as Tech Stocks Drag

Stock Market Today

Stock Market Today (8/29/22): Markets End Lower Again as Tech Stocks DragThe effects of Fed Chair Powell’s hawkish Jackson Hole speech lingered Monday, but stocks finished off their session lows.

August 29, 2022

Analysts Are Split on HPQ Stock Ahead of Earnings

stocks

Analysts Are Split on HPQ Stock Ahead of EarningsOur preview of the upcoming week’s earnings reports includes HP (HPQ), Best Buy (BBY) and Lululemon Athletica (LULU).

August 29, 2022