Stock Market Today

The Fed announced a 50-basis-point interest-rate hike, as expected, and Powell’s suggestion that future hikes won’t be any more aggressive sent stocks flying.Stocks breathed a massive sigh of relief Wednesday afternoon after the Federal Reserve gave the markets exactly the rate hike they were betting on – and indicated that future hikes were unlikely to be more aggressive.

Specifically, the Federal Open Market Committee chalked up its first 50-basis-point increase to its benchmark Fed funds rate since 2000. Between that and March’s 25-point hike, the Fed’s target rate now sits at 0.75%-1.0%.

The central bank also said Wednesday that it would begin winding down its $9 trillion trove of bonds, mortgage-backed securities and other assets it previously bought up to stimulate the economy, starting at $47.5 billion per month and reaching $95 billion per month by September.

Both announcements were right in line with many strategists’ expectations.

“There were no major bombshells in the press release today, and the plan for quantitative tightening was mildly dovish,” says Cliff Hodge, chief investment officer for registered investment advisory firm Cornerstone Wealth. “[The FOMC’s statement that it would be ‘highly attentive to inflation risks’] provides some flexibility to adjust policy in light of new data. Overall, [the announcement was] about as dovish as could be expected while still showing that the Fed is serious about fighting inflation.”

However, Jamie Cox, managing partner at Harris Financial Group, noted that Fed Chair Jerome Powell “had a third mandate today – and that was to dispel the notion of a 75-basis-point rate increase.”

Mission accomplished.

Sign up for Kiplinger’s FREE Investing Weekly e-letter for stock, ETF and mutual fund recommendations, and other investing advice.

“A 75-basis-point increase is not something we’re actively considering,” Powell said in his post-meeting press conference. “Our framework is for 50-basis-point increments at the next two meetings.”

That good news helped to counter a couple drags from the economic data feed. The ADP payrolls survey for April came in well below expectations, with 247,000 jobs added versus 380,000 estimated. Also, the Institute for Supply Management’s April non-manufacturing survey reading was 58.3, down from 57.1 in March, showing expansion was slowing.

“Like the manufacturing report earlier this week there was a big drop in the employment component, which, along with the ADP report this morning points to a potentially weaker employment report on Friday,” says Michael Reinking, senior market strategist for the New York Stock Exchange.

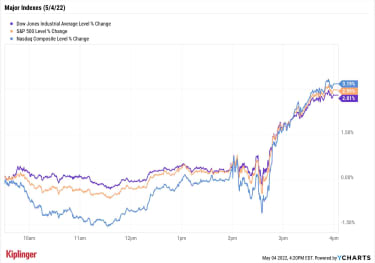

Stocks ripped higher following Powell’s press conference. All 11 S&P 500 sectors finished well in the green, sending the index up 3.0% to 4,300. The Nasdaq Composite was a touch better, up 3.2% to 12,964. And the Dow Jones Industrial Average closed with a 2.8% gain to 34,061.

“This is not the Federal Reserve of the 1970s, where every excuse was given about why inflation was high,” Cox says. “This Fed, under the direction of Chair Powell, is owning inflation as a problem and is intent upon fixing it. The first and most important tool of inflation fighting is credibility – and Chair Powell established that today.”

YCharts

Other news in the stock market today:

The small-cap Russell 2000 jumped 2.7% to 1,949.Reports of the European Union’s proposal to phase out Russian oil imports over the next six months sent U.S. crude oil futures surging 5.3% to $107.81 per barrel.Gold futures slipped 0.1% to settle at $1,868.80 an ounce.Bitcoin roared to life, with a 5.7% improvement to $39,849.19. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.)As we noted in today’s free A Step Ahead e-newsletter, shares of Lyft (LYFT, -29.9%) plummeted as the ride-sharing company’s lower-than-expected rider numbers and weak current-quarter guidance due to higher spending overshadowed top- and bottom-line beats for its first quarter ($876 million in revenue vs. $846 million estimate; 7 cents per share in earnings vs. expectations for a 7 cents-per-share loss). “We are clearly disappointed by LYFT’s need to spend more aggressively to improve driver supply, partly to better compete with Uber, as it puts into question the profitability potential of LYFT’s business model,” says CFRA Research analyst Angelo Zino, who maintained a Buy rating on the stock. “Still, we are encouraged by the broader recovery in ridesharing, with higher pricing airport volume improving/commuter travel returning, and like LYFT’s increasing emphasis in bikes/scooters.” Uber Technologies (UBER) also declined post-earnings, ending the day down 4.7%.Starbucks (SBUX) gained 9.8% despite the coffee company’s mixed earnings report. In its fiscal second quarter, SBUX reported better-than-expected revenue of $7.6 billion on in-line earnings of 59 cents per share. However, the company also said same-store sales in China slumped 23% on a year-over-year basis. It also suspended its full-year guidance due to COVID-related lockdowns in China, red-hot inflation and higher spending for investments. “While we recognize near-term challenges, we view SBUX as one of the highest quality growth companies in restaurants, believe the company’s investments in people and technology are the right areas to support long-term growth, and suspect guidance around incremental investments should remove an overhang on the stock,” says Credit Suisse analyst Lauren Silberman, who maintained an Outperform (Buy) rating on the stock. “At current valuation, we believe shares offer an attractive risk/reward.”The Gameplan for Rising RatesWhile interest rates might not end up rising as quickly as some pundits feared, they’re still rising. That means investors still need a plan to find upside in a rising-rate environment.

Gargi Chaudhuri, head of iShares Investment Strategy America, says her firm favors “a multi-asset approach for navigating the current market environment and adding potential resiliency in a portfolio.”

What does that look like?

“In equities, we believe companies that are best able to pass on higher prices to consumers could outperform in this environment.” (So, for examples, look to this list of stocks that are either well- or poorly equipped to handle rising prices.)”We also favor the quality technology and healthcare sectors, which show better pricing ability.””Finally, we believe dividend stocks are a good way for investors to earn income and target companies with a more robust cash flow.”There are myriad ways to secure equity dividends – we provide several suggestions in our 37 Ways to Earn 9% – but it’s difficult to match the security you can lock down by investing in Wall Street’s dividend royalty: the S&P 500 Dividend Aristocrats.

This elite group of stocks with decades-long track records of increasing dividends have been busy of late, as earnings season is one of the most popular times for companies to announce that, for yet another year, they’re upping the stakes on their payouts. For weeks, we’ve been furiously updating this growing, living list.

Read on to check out the full roster of S&P 500 Dividend Aristocrats, including their most recent hikes.