Stock Market Today

The major benchmarks started the day in positive territory, but were bathed in red ink by the close.Choppy trading continued on Wall Street as investors balanced good news, bad news headlines.

On the economic front, weekly jobless claims edged up a seasonally adjusted 230,000 last week – more than economists were expecting – though the four-week moving average remained near a record low.

The Labor Department also said that December’s producer price index – which measures how much suppliers are charging businesses for goods – was up 9.7% annually and 0.2% sequentially. While the former was the highest annual increase since the year-over-year data were first tracked in 2010, the latter marked the slowest month-over-month rise since November 2020.

Investors also got their first look at the fourth-quarter earnings season, which kicks off in earnest tomorrow morning when several big banks report.

Sign up for Kiplinger’s FREE Investing Weekly e-letter for stock, ETF and mutual fund recommendations, and other investing advice.

This morning, though, Delta Air Lines (DAL, +2.1%) reported a larger-than-anticipated adjusted profit for its fourth quarter and its highest quarterly revenue since the pandemic began. However, for the current quarter, CEO Ed Bastian warned the omicron variant of COVID-19 “is expected to temporarily delay the demand recovery” into February.

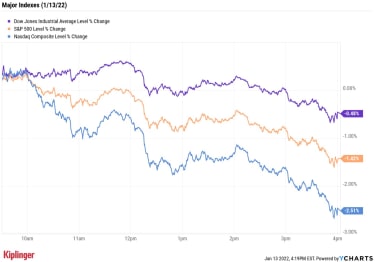

By the close, markets had erased earlier gains to end solidly in the red. The Nasdaq Composite suffered the worst, shedding 2.5% to 14,806. The S&P 500 Index lost 1.4% to 4,659 and the Dow Jones Industrial Average gave back 0.5% to 36,113.

YCharts

Other news in the stock market today:

The small-cap Russell 2000 dropped 0.8% to 2,159.A day after reporting low crude oil inventories, the Energy Information Administration said gasoline supplies had risen by 8 million barrels, much more than expected. That sent U.S. crude oil futures 0.6% lower to $82.12 per barrel.Gold futures snapped a four-day win streak, declining 0.3% to $1,821.40 per ounce.Bitcoin wasn’t immune to the selling, giving back 2.4% to $42,803.79. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.) Large-cap technology and tech-esque stocks were among the worst performers of the day. Among notable decliners were ServiceNow (NOW, -9.1%), Tesla (TSLA, -6.8%), Nvidia (NVDA, -5.1%), Microsoft (MSFT, -4.2%), Salesforce.com (CRM, -3.9%), Netflix (NFLX, -3.4%) and Broadcom (AVGO, -4.0%).KB Home (KBH, +16.5%) rocketed higher Thursday as Street-beating profits more than overshadowed a miss in revenues. KBH reported fourth-quarter sales growth of 40% year-over-year to $1.68 billion, which was slightly less than estimates for $1.71 billion. That said, profits of $1.91 per share easily topped expectations for $1.76 per share, thanks in large part to a 9% pop in average selling price, to $451,000. “We expect strong demand in 2022 as KBH’s pricing power is able to pass on higher costs to higher prices with limited supply,” says CFRA analyst Kenneth Leon, who reiterated his Buy rating on KBH shares and raised his price target to $59 per share from $49 previously.Bumps Equal Opportunities for InvestorsNow is the time for conviction. That’s according to Scott Wren, senior global market strategist at Wells Fargo Investment Institute.

As we enter the part of the economic cycle where the Federal Reserve is beginning to normalize its policy after years of providing support and concerns over growth begin to emerge, it’s understandable if investors feel unnerved.

“Investors need to go through a mental adjustment process and realize that the road ahead is likely to feature a few more bumps than the one traveled over the past 20 months,” he says. But bumps, Wren adds, also offer opportunities.

We at Kiplinger have been busy compiling plenty of potential investing ideas for the new year – including the top financial stocks and the best tech names.

We’ve also highlighted numerous high-conviction picks from the analyst community; most recently, breaking down RBC Capital Markets’ top 30 global stock investments for 2022. Despite the numerous hurdles investors are facing in the new year, industry analysts are “generally confident” these picks can clear them. Check them out.

Your Guide to Roth Conversions

Special Report

Tax Breaks

Your Guide to Roth ConversionsA Kiplinger Special Report

February 25, 2021

The 12 Best Tech Stocks to Buy for 2022

tech stocks

The 12 Best Tech Stocks to Buy for 2022The best tech-sector picks for the year to come include plays on some of the most exciting emergent technologies, as well as several old-guard mega-ca…

January 3, 2022

4 Hot Investing Trends to Watch for in 2022

investing

4 Hot Investing Trends to Watch for in 2022A lot changed in 2021, but here are a few investing trends we saw grow during this tumultuous time that investors can probably count on sticking aroun…

December 28, 2021

Stock Market Today (1/12/22): Stocks Hang On to Gains After Scorching Inflation Update

Stock Market Today

Stock Market Today (1/12/22): Stocks Hang On to Gains After Scorching Inflation UpdateThe Labor Department’s latest report showed consumer prices hit a nearly 40-year high in December.

January 12, 2022

Payments Stocks: Jefferies Likes V, MA, SQ, Cautious on PYPL

stocks

Payments Stocks: Jefferies Likes V, MA, SQ, Cautious on PYPLJefferies says it’s getting more selective in the payments-services space. It’s favorable on several blue chips, but not all.

January 12, 2022

Stock Market Today (1/11/22): Tech Leads on Turnaround Tuesday

Stock Market Today

Stock Market Today (1/11/22): Tech Leads on Turnaround TuesdayThe major benchmarks bounced off their mid-morning lows to end solidly higher.

January 11, 2022

Sweet Silicon: 5 Superb Semiconductor Stocks for 2022

stocks

Sweet Silicon: 5 Superb Semiconductor Stocks for 2022If 2021 was a good year for the chip industry, 2022 could be downright great. Here are five semiconductor stocks if you’re seeking out growth.

January 11, 2022