Stock Market Today

Wall Street also weighed a five-month high in weekly jobless claims.Stocks extended this week’s decline on Thursday amid another choppy trading session. The focus today was on the latest European Central Bank (ECB) meeting – which comes ahead of next week’s policy update from the Federal Reserve. While the ECB maintained the status quo for now, it unveiled plans to raise rates, likely by 25 basis points (a basis point is one-one hundredth of a percentage point), or 0.25%, in July and again in September. It also said it would end its bond-buying program on July 1.

Meanwhile, back at home, data from the Labor Department showed that weekly jobless claims rose 27,000 to a seasonally adjusted 229,000 in the week ended June 3 – their highest level since mid-January.

“The market has been searching for some direction amid a relatively quiet week on the economic data front,” says Mike Loewengart, managing director of Investment Strategy at E*TRADE. “A bump up in jobless claims may not be the catalyst, but in a perverse way, a rise in jobless claims could be one indicator that the Fed’s rate-hike plan is slowing demand and could stick the landing. But with a Fed decision on the horizon and with the ECB signaling rate hikes in its future, investors will likely continue to be in ‘wait and see’ mode.”

Sign up for Kiplinger’s FREE Investing Weekly e-letter for stock, ETF and mutual fund recommendations, and other investing advice.

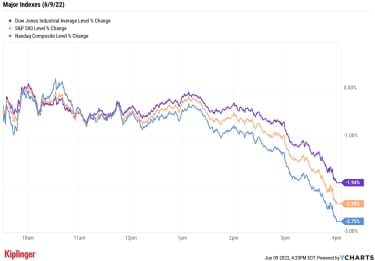

The “wait and see” mode was evident early on in today’s trading, but losses for the broad-market indexes accelerated as the session wore on ahead of tomorrow morning’s release of the latest consumer price index (CPI). The selling was widespread too, with all 11 sectors finishing in the red, led by big drops for financials (-2.5%) and technology (-2.7%).

At the close, the Dow Jones Industrial Average was down 1.9% to 32,272, the S&P 500 Index fell 2.4% to 4,017 and the Nasdaq Composite – which briefly traded in positive territory mid-morning – plunged 2.8% to 11,754.

YCharts

Other news in the stock market today:

U.S. crude futures fell 0.3% to settle at $121.63 per barrel.Gold futures slipped 0.2% to end at $1,852.80 an ounce.Bitcoin edged down 0.3% to $29,989.54. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.) It’s been a rough stretch for Target (TGT), with the consumer discretionary stock down more than 30% in the past month following a negative earnings reaction and current-quarter operating margin warning. The retailer today tried to right the ship by announcing that it is hiking its quarterly dividend by 20% to $1.08 per share, but shares still slid 1.4%. Despite the recent woes, Argus Research analyst Chris Graja maintained his Buy rating. While risks remain, such as reduced consumer spending amid elevated inflation and higher commodity costs, “we believe that Target has the right strategy and has made the right investments to gain market

share over time,” Graja writes in a note.Cruise stocks were some of the biggest decliners on Wall Street today, with Carnival (CCL), Royal Caribbean Cruises (RCL) and Norweigian Cruise Line Holdings (NCLH) shedding 9.3%, 8.3% and 9.2%, respectively. Time to Jump Back Into Small Caps?Small-cap stocks also suffered significant losses in today’s trading, with the Russell 2000 index shedding 2.1% to end at 1,850. The benchmark has lagged its larger-cap peers over the past 12 months, down 19.3% (compared to losses of 6.7% for the Dow, 5.0% for the S&P 500 and 15.6% for the Nasdaq). Given this lengthy stretch of underperformance, are the tides set to turn for small caps?

“Small-cap stocks tend to be relatively high beta, implying that they outperform when the economic environment is improving,” BCA Research says in a note. “Slowing global growth is therefore a headwind for small-cap stocks. Moreover, they are more vulnerable to negative dynamics from inflationary pressures due to their typically smaller profit margins.”

However, the investment research firm asserts that the longer-term underperformance of small caps could suggest that many of these growth concerns are already priced in. Plus, many smaller cap stocks are now “extremely attractive on a valuation basis, which could support their performance going forward,” BCA adds.

Investors who are looking to dip their toes into small caps – but are still wary of potential risks – may want to consider these exchange-traded funds (ETFs), which help provide more diversified exposure. But for those ready to dive right in, here are 12 of Wall Street’s favorite small-cap stocks right now. We scoured the Russell 2000 to find the top-rated picks among small companies, and each name featured here is projected to deliver outsized returns over the next 12 months or so. Check them out.

20 Dividend Stocks to Fund 20 Years of Retirement

dividend stocks

20 Dividend Stocks to Fund 20 Years of RetirementEach of these high-quality dividend stocks boast attractive yields, and you can expect them to grow their payouts even more. That’s a powerful 1-2 com…

June 3, 2022

Your Guide to Roth Conversions

Special Report

Tax Breaks

Your Guide to Roth ConversionsA Kiplinger Special Report

February 25, 2021

How Amy Schumer’s Openness on Trichotillomania Made Me Inject Purpose into My Estate Plan

estate planning

How Amy Schumer’s Openness on Trichotillomania Made Me Inject Purpose into My Estate PlanIf a charity holds a special place in your heart, here are three practical ways you can support it through your estate plan.

June 7, 2022

Stock Market Today (6/8/22): Growth Concerns Get Bears Back on Board

Stock Market Today

Stock Market Today (6/8/22): Growth Concerns Get Bears Back on BoardEnergy was the only sector in the black Wednesday as the broader stock market continued its up-and-down ways.

June 8, 2022

Stock Market Today (6/7/22): Energy Sector Leads Equity Comeback

Stock Market Today

Stock Market Today (6/7/22): Energy Sector Leads Equity ComebackOil stocks helped the broader stock market ignore a troubling retail signal and more rate-hike fears Tuesday.

June 7, 2022

20 Stocks Billionaires Are Selling

stocks

20 Stocks Billionaires Are SellingBillionaires, hedge funds and other high-net-worth investors did plenty of selling in Q1. Here are 20 stocks they unloaded over the most recent three-…

June 7, 2022

Stock Market Today (6/6/22): Stocks Nudge Higher as Treasury Yields Spike

Stock Market Today

Stock Market Today (6/6/22): Stocks Nudge Higher as Treasury Yields SpikeStocks pared this morning’s lofty gains as interest rates rose, but still managed to hold on for a win.

June 6, 2022