Stock Market Today

Selling ramped up in the bond market too, which sent the yield on the 10-year note to its highest level in years.Anxiety got the better of Wall Street on Tuesday, with the stock market tumbling ahead of tomorrow’s policy announcement from the Federal Reserve.

Many of Wall Street’s top minds are weighing in on how big the Fed rate hike will be. Among them is Brad McMillan, chief investment officer for Commonwealth Financial Network, who, like almost everyone, believes the central bank will hike rates by 75 basis points. A basis point is one-one hundredth of a percentage point.

“Where things get interesting is in the follow-up comments, where the market tries to parse what this means for the Fed’s policy decisions through the rest of the year,” McMillan says, referring to the press conference Fed Chair Jerome Powell will hold immediately after the announcement. “Expectations are very hawkish, and the Fed can come out just as expected and still be more dovish than expected. That likely limits the market downside from this meeting and just may provide some upside going forward.”

Sign up for Kiplinger’s FREE Investing Weekly e-letter for stock, ETF and mutual fund recommendations, and other investing advice.

But today, investors envisioned higher rates ahead, which weighed on bond prices – and sent the 10-year Treasury yield up 7.2 basis points to 3.561%, its highest perch since 2011.

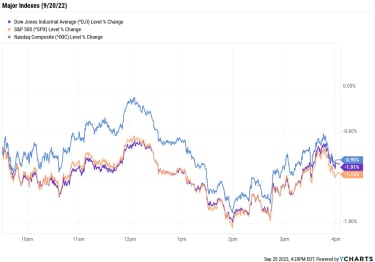

Broad selling was seen in the equities market too, with all 11 sectors finishing in the red. As for the major indexes, the Dow Jones Industrial Average plunged 1.0% to 30,706, the S&P 500 Index gave back 1.1% to 3,855, and the Nasdaq Composite shed 1.0% to 11,425.

YCharts

Other news in the stock market today:

The small-cap Russell 2000 surrendered 1.4% to 1,787.U.S. crude futures fell 1.5% to finish at $84.45 per barrel.Gold futures shed 0.4% to settle at $1,671.10 an ounce.Bitcoin gave back 2.9% to $19,006.96. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.) PayPal Holding (PYPL) tumbled 3.6% after Susquehanna Financial Group analyst James Friedman downgraded the fintech stock to Neutral from Positive, the equivalents of Hold and Buy, respectively. “Braintree is quickly gaining share within PYPL’s total payment volume, creating negative leverage from mix,” Friedman writes in a note. PYPL acquired the e-commerce web payments processor in 2013. “As Braintree is likely to continue driving PYPL as a whole, its unit economics may drag on PYPL’s consolidated results. Consensus may underestimate the yield and transaction expense pressure which PYPL may experience. And margin leverage from headcount management and the potential externalization of PYPL’s consumer credit book may not be enough to offset,” the analyst adds.Deutsche Bank analyst Sidney Ho downgraded Western Digital (WDC) to Hold from Buy, sending shares down 3.0%. “We believe WDC’s fiscal first-quarter revenue and EPS are tracking below the low end of guidance, and fiscal second-quarter outlook are also likely to be meaningfully below current Street estimates,” Ho says. The analyst points to deteriorating demand and falling average selling prices for flash that will likely continue through the next two quarters. “Consequently, we recommend investors move to the sidelines until we have better visibility into when supply demand balance returns,” Ho adds.What Corporate Warnings Could Mean for InvestorsOne notable decliner today was Ford Motor (F), which tumbled 12.3% after it became the latest company to warn that broad-market headwinds will weigh on its third-quarter results. The automaker late Monday said it expects Q3 earnings before interest and taxes to arrive between $1.4 billion and $1.7 billion, about half of analysts’ consensus estimate. This is due to “continued supply-chain issues, with 40,000 to 45,000 ‘vehicles on wheels’ remaining in inventory as they are waiting on parts,” says Michael Reinking, senior market strategist at the New York Stock Exchange. “While those sales are pushed out to the fourth quarter, the company also increased its inflation-related supplier costs.” (Ford now expects costs to run about $1 billion more than what was previously expected.)

The strategist notes that while Ford’s announcement doesn’t “paint a similar backdrop” to last week’s FedEx (FDX) earnings warning, it does call into question how big of an impact macroeconomic trends like inflation and slowing growth will have on the upcoming earnings season. Here, we take a closer look at what these caution signs from corporate America could mean for investors.

Karee Venema was long F as of this writing.

10 Electrifying EV Stocks Worth Watching

investing

10 Electrifying EV Stocks Worth WatchingLike many areas of the market, electric vehicle stocks have had a rough year. But if you’re looking to gain exposure to this growing industry, here ar…

September 16, 2022

Your Guide to Roth Conversions

Special Report

Tax Breaks

Your Guide to Roth ConversionsA Kiplinger Special Report

February 25, 2021

Amazon Warehouse: Where Amazon Prime Returns Become Your Next Online Bargains

Amazon Prime

Amazon Warehouse: Where Amazon Prime Returns Become Your Next Online BargainsAmazon Warehouse products have a wide range of imperfections, but that leads to some often wildly discounted prices.

September 16, 2022

FedEx Earnings Warning: Recession Harbinger or Single-Stock Hiccup?

Markets

FedEx Earnings Warning: Recession Harbinger or Single-Stock Hiccup?When a firm as big and broad-reaching as FedEx forecasts a sharp earnings drop, the market’s going to react. What’s this say for upcoming earnings?

September 20, 2022

Stock Market Today (9/19/22): Stocks Score a Hard-Fought Win to Start the Week

Stock Market Today

Stock Market Today (9/19/22): Stocks Score a Hard-Fought Win to Start the WeekPrice action will likely stay choppy ahead of Wednesday’s Fed decision.

September 19, 2022

Stock Market Today (9/16/22): FedEx Warning Amplifies Wall Street Jitters

Stock Market Today

Stock Market Today (9/16/22): FedEx Warning Amplifies Wall Street JittersThe delivery giant said its fiscal Q1 results will come in lower than expected and withdrew its full-year guidance as demand slows.

September 16, 2022

Kiplinger’s Weekly Earnings Calendar

stocks

Kiplinger’s Weekly Earnings CalendarCheck out our earnings calendar for the upcoming week.

September 16, 2022