Stock Market Today

The major benchmarks bounced off their mid-morning lows to end solidly higher.Markets opened Tuesday in the red, suggesting another day of selling on Wall Street ahead, but bounced off their mid-morning lows to blaze a trail higher into the close.

One potential catalyst for the rebound in stocks was Fed Chair Jerome Powell’s reconfirmation hearing in front of the Senate Banking Committee this morning, where he told lawmakers that the central bank is prepared to “raise interest rates more over time” if inflation continues to run high.

Powell’s testimony comes ahead of the latest inflation update: December’s consumer price index is due out tomorrow morning. Gargi Chaudhuri, head of iShares Investment Strategy, Americas, thinks the data will show a broad-based increase in prices and come in well above the Fed’s comfort level.

“We expect to see core inflation breach 5% – the highest in 30 years – as well as headline inflation above 7%, the highest in almost 40 years,” she adds.

Sign up for Kiplinger’s FREE Investing Weekly e-letter for stock, ETF and mutual fund recommendations, and other investing advice.

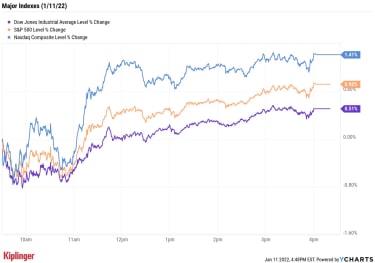

The tech-heavy Nasdaq Composite led the charge higher, gaining 1.4% to end at 15,153 – thanks in part to a big earnings boost for genome sequencing stock Illumina (ILMN, +17.0%). The S&P 500 Index rose 0.9% to 4,713, and the Dow Jones Industrial Average added 0.5% to 36,252.

YCharts

Other news in the stock market today:

The small-cap Russell 2000 gained 1.1% to end at 2,194.U.S. crude oil futures jumped 3.8% to $81.22 per barrel, sparking gains in the likes of Exxon Mobil (XOM, +4.2%) and APA (APA, +8.8%).Gold futures also finished solidly higher, up 1.1% to $1,818.50 per ounce.Bitcoin spiked 2.6% to $42,818.79. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.) International Business Machines (IBM, -1.6%) was off Tuesday following a downgrade from UBS analyst David Vogt. Despite the company’s spinoff of its legacy IT lines in Kyndryl Holdings (KD, +0.7%) to focus on higher-growth businesses, Vogt says “our detailed bottom-up analysis of IBM’s remaining segments supports our view that roughly 50% of IBM’s top line is unlikely to grow long-term and could decline.” The analyst also cited “an elevated valuation that leaves the shares vulnerable over the next 12 months” in cutting the stock to Sell from Neutral (equivalent of Hold) and dropping his price target to $124 per share from $136.E-commerce stocks, which have largely been battered over the past few months, enjoyed a brisk relief rally on Tuesday. Amazon.com (AMZN, +2.4%) was the largest such name with the wind at its back; PayPal (PYPL, +4.7%), Chinese e-commerce firm JD.com (JD, +10.3%) and Latin American marketplace MercadoLibre (MELI, +10.7%) were among other notable industry names making advances.A day after Moderna (MRNA, -5.3%) popped after its CEO said the biotech firm was working on a vaccine booster targeting the omicron variant, the stock suffered a bout of outsized profit-taking on no other news.Keep an Eye on Chip StocksOne of the biggest pockets of strength today was in semiconductors, which surged 1.7%, and there could be more where that came from.

True, chipmakers have sold off alongside their fellow tech stocks in 2022, but several Wall Street firms see big things for the industry.

iShares’ Chaudhuri, for one, says “Investors may need to be increasingly selective in their equity allocations, with a preference for value and quality, as well as industries with pricing power, such as semiconductors,” adding that “semiconductors are the backbone of powerful emerging technologies including artificial intelligence and digital payments, and the subsector offers a relatively high free cash flow yield.”

Meanwhile, BofA Global Research strategists “see a worthwhile 2022 setup” and highlights several “top themes” to watch out for, including cloud – gaming and the metaverse, for instance – and automotive, namely electric vehicles (EVs).

For those looking for opportunity among semiconductor stocks, consider this list of names that are poised for growth this year and beyond. While some are established leaders, others offer investors the chance to find under-the-radar gems.

Your Guide to Roth Conversions

Special Report

Tax Breaks

Your Guide to Roth ConversionsA Kiplinger Special Report

February 25, 2021

25 Top Stock Picks That Billionaires Love

stocks

25 Top Stock Picks That Billionaires LoveBillionaire investors were busy during the third quarter of 2021. Here are 25 companies, of various shapes and sizes, that were some of their most rec…

December 23, 2021

Early Retirement: How To Protect Your Hidden Retirement Asset

retirement

Early Retirement: How To Protect Your Hidden Retirement AssetCongratulations, you’re ready to leave the grind for early retirement. But even if your savings are rock solid, an early exit from your career puts on…

December 23, 2021

Sweet Silicon: 5 Superb Semiconductor Stocks for 2022

stocks

Sweet Silicon: 5 Superb Semiconductor Stocks for 2022If 2021 was a good year for the chip industry, 2022 could be downright great. Here are five semiconductor stocks if you’re seeking out growth.

January 11, 2022

Stock Market Today (1/10/22): Rising Rates Put Another Scare Into Stocks

Stock Market Today

Stock Market Today (1/10/22): Rising Rates Put Another Scare Into Stocks Another push higher in Treasury yields threatened a deep-red day for stocks, but the major indexes escaped with slight declines and even gains.

January 10, 2022

Wells Fargo Stock: Earnings Season Kicks Off With WFC in Focus

stocks

Wells Fargo Stock: Earnings Season Kicks Off With WFC in FocusOur preview of the upcoming week’s earnings reports includes Wells Fargo (WFC), BlackRock (BLK) and Delta Air Lines (DAL).

January 10, 2022

Stock Market Today (1/7/22): Tech Drubbed; Nasdaq Has Worst Week in 11 Months

Stock Market Today

Stock Market Today (1/7/22): Tech Drubbed; Nasdaq Has Worst Week in 11 MonthsThe 10-year Treasury yield hit its highest level since early 2020 on Friday.

January 7, 2022