Stock Market Today

The 10-year Treasury yield rose for a sixth straight day to hit a new three-year high.Tech stocks underperformed in today’s session, much as they’ve done over the last few months.

The technology sector gave back 1.4% as the 10-year Treasury yield climbed 5.2 basis points (a basis point is one-one hundredth of a percentage point) to 2.71% – a level not seen since March 2019. The longer-dated bond yield is up six days in a row amid expectations the Federal Reserve will undergo an aggressive monetary policy tightening campaign with 50-basis-point rate hikes and the sale of $95 billion in assets each month.

Energy, meanwhile, was the best-performing sector, rising 2.8% as U.S. crude futures jumped 2.3% to $98.26 per barrel. Financials (+1.0%) and material stocks (+0.6%) were other pockets of strength in today’s trading.

Sign up for Kiplinger’s FREE Investing Weekly e-letter for stock, ETF and mutual fund recommendations, and other investing advice.

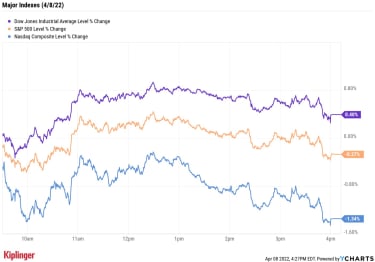

At the close, the Nasdaq Composite was down 1.3% at 13,711, with chip stocks Nvidia (NVDA, -4.5%) and Marvell Technology (MRVL, -3.8%) among the day’s biggest decliners. The S&P 500 Index (-0.3% to 4,488) also ended lower, while the Dow Jones Industrial Average (+0.4% to 34,721) finished the day in the green.

For the week, the Nasdaq shed 3.9%, the S&P 500 gave back 1.3% and the Dow slipped 0.3%.

YCharts

Other news in the stock market today:

The small-cap Russell 2000 shed 0.8% to 1,994.Gold futures rose 0.4% to finish at $1,945.60 an ounce.Bitcoin fell 1.5% to $42,777. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.)EPAM Systems (EPAM) was one of the biggest gainers today, adding 9.9% after the software development company said it is ending operations in Russia. Stifel analyst David Grossman maintained a Buy rating on the tech stock in the wake of the news. “We interpret today’s announcement as a positive as it removes the most visible overhang from a customer standpoint and accelerates EPAM’s initiative to geographically diversify its labor base,” Grossman writes in a note.HP (HPQ, -7.1%) was downgraded to Neutral (Hold) from Buy at UBS Global Research. This came on the heels of yesterday’s announcement that Warren Buffet bought HPQ stock and occurred amid a “confluence of factors including incremental signs of softness in low-end Consumer PCs following recent checks over the past month along with the likelihood of a slower buyback next year following the expected close of the Plantronics deal in late calendar-year 2022,” writes UBS analyst David Vogt.Stock Selection is Becoming Increasingly ImportantNext week, we’ll start to get a look at the latest inflation figures with Tuesday’s release of the consumer price index. Plus, the start of earnings season will offer an initial gauge of how corporate America fared during a period of scorching prices.

This will be especially important to investors looking to target firms that have been able to withstand red-hot inflation thanks to rock-solid balance sheets.

A focus on quality stocks will give them a better shot at building resilience in their portfolios, according to Tony DeSpirito, CIO of BlackRock’s U.S. Fundamental Active Equities. He says that stock selection is becoming more important as investors “must discern which companies are most impacted by rising costs, and which have the pricing power to pass those higher costs through to consumers and maintain their profit margins.”

But stock picking isn’t for everyone, and some investors may want to leave making these judgments to the pros. Those looking for a human touch could check out the Kip 25 – Kiplinger’s list of our favorite low-fee mutual funds. Another great place to look is the small but expanding group of actively managed exchange-traded funds (ETFs). This list of equity and fixed-income ETFs aligns with a variety of risk tolerances and investing horizons, and all are run by seasoned stock pickers.

How to Create a Retirement Income Stream

Investing for Income

How to Create a Retirement Income StreamReplacing your paycheck in retirement takes planning. Here are two popular approaches to creating an income stream and the types of assets required to…

April 7, 2022

Your Guide to Roth Conversions

Special Report

Tax Breaks

Your Guide to Roth ConversionsA Kiplinger Special Report

February 25, 2021

What to Do When the Rent Is Too High

Inflation

What to Do When the Rent Is Too HighRent prices are soaring nationally, and housing shortages are compounding the crisis. While the options for consumers are limited, there are some thin…

April 4, 2022

Kiplinger’s Weekly Earnings Calendar

stocks

Kiplinger’s Weekly Earnings CalendarCheck out our earnings calendar for the upcoming week, as well as our previews of the more noteworthy reports.

April 8, 2022

7 Actively Managed ETFs to Buy for an Edge

ETFs

7 Actively Managed ETFs to Buy for an EdgeActively managed ETFs are starting to blossom in popularity. Investors unfamiliar with the space can start with these seven active funds.

April 8, 2022

Stock Market Today (4/7/22): Stocks Scratch Out Meager Gains

Stock Market Today

Stock Market Today (4/7/22): Stocks Scratch Out Meager GainsLowest jobless claims number since 1968 gives the major indexes just enough oomph to avoid a third straight session in the red.

April 7, 2022

Here’s Why Warren Buffett Bought HPQ Stock

Warren Buffett

Here’s Why Warren Buffett Bought HPQ StockBerkshire Hathaway’s 11.4% HP stake is a stereotypically yawn-worthy position … and thus a classic Buffett value bet.

April 7, 2022