Jamie Golombek: Start gathering the receipts you’ll need if you’re hoping to claim the medical expense tax credit

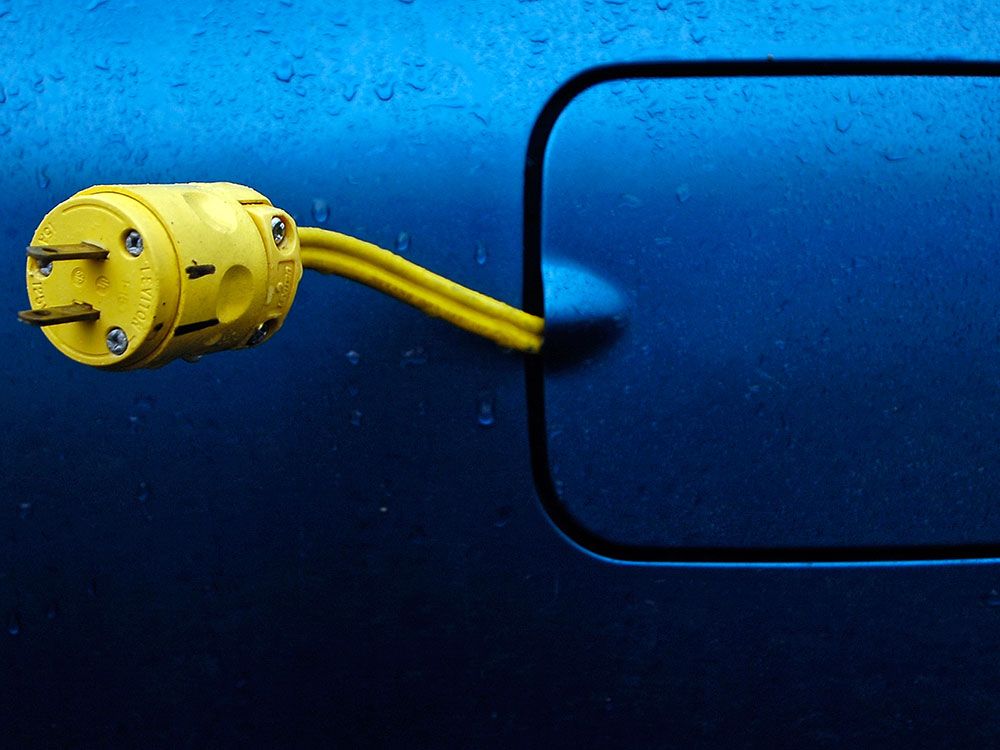

In order to deduct transportation as a medical expense, the medical services must not be available in the local community. Photo by Arlen Redekop/PNG files It’s too early to begin filing your 2022 personal tax return — electronic filing of T1 returns only opens on Feb. 20 — but now is the perfect time to start gathering the receipts you’ll need, including those related to medical expenses if you’re hoping to claim the medical expense tax credit (METC).

Advertisement 2 This advertisement has not loaded yet, but your article continues below.

The METC is a non-refundable credit worth 15 per cent federally, with each province and territory offering its own additional credit. Federally, you can claim an METC provided your total family’s medical expenses exceed a minimum threshold equal to the lesser of three per cent of your net income or $2,635 (for 2023). The provincial/territorial minimum income thresholds vary slightly.

Financial Post Top Stories Sign up to receive the daily top stories from the Financial Post, a division of Postmedia Network Inc.

By clicking on the sign up button you consent to receive the above newsletter from Postmedia Network Inc. You may unsubscribe any time by clicking on the unsubscribe link at the bottom of our emails or any newsletter. Postmedia Network Inc. | 365 Bloor Street East, Toronto, Ontario, M4W 3L4 | 416-383-2300

The tax rules allow you to claim an METC for expenses you incurred for yourself, your spouse or partner, and your kids under age 18. To qualify, the medical service or item must be specifically listed as an “eligible” medical expense under the Income Tax Act. In certain limited situations, you may also be entitled to deduct the cost of “reasonable travel expenses” such as transportation, meals and accommodation if you have to travel to obtain these medical services.

Advertisement 3 This advertisement has not loaded yet, but your article continues below.

But in order to deduct transportation as a medical expense, the medical services must not be available in the local community, the place of travel must be located more than 40 kilometres from the patient’s home (80 km if you want to deduct travel expenses other than transportation), the route taken must be a direct one and “it must be reasonable for the taxpayer to travel to that place to obtain the services.” In certain cases, a companion’s travel expenses may also qualify for an METC provided a medical practitioner has certified the taxpayer can’t travel without assistance.

A tax case decided earlier in January involved an Alberta taxpayer’s attempt to claim an METC of $853 for hospital parking expenses that his wife, a retired nurse, paid during the 2018 tax year. In that year, the taxpayer’s wife travelled three times per week to obtain kidney dialysis treatment at an Edmonton hospital. On a dialysis day, the taxpayer’s wife would drive from their home to the hospital, where she would park the car, and then, upon completion of her treatment session, drive home, which was approximately 22 km from the hospital.

Advertisement 4 This advertisement has not loaded yet, but your article continues below.

The taxpayer testified that these dialysis treatments “were life-saving and without same his spouse would have died.” The taxpayer equated her parking expense to a medical treatment expense as she needed to be able to park her car to receive treatments and, thus, they should properly be allowed as a medical expense for the purposes of claiming an METC.

The taxpayer was essentially challenging the 80-km distance requirement in the Tax Act as being discriminatory and contrary to the Canadian Charter of Rights and Freedoms. “My wife has to park to obtain dialysis,” the taxpayer explained. “(The law) discriminates against people who have to travel less than 80 km for necessary medical treatment” as it only allows such parking expenses to be deducted for individuals who travel greater than 80 km to obtain treatment.

Advertisement 5 This advertisement has not loaded yet, but your article continues below.

Recommended from Editorial The CRA is cracking down on COVID-19 benefit payments as this taxpayer found out Massive TFSA recontribution mistake puts taxpayer in CRA’s crosshairs 11 tax changes and new rules that will affect your finances in 2023 The judge turned to the wording of the charter itself, which, under the Equality Rights heading, states: “Every individual is equal before and under the law and has the right to the equal protection and equal benefit of the law without discrimination and, in particular, without discrimination based on race, national or ethnic origin, colour, religion, sex, age or mental or physical disability.”

The judge said this was not a case where there was any discrimination between individuals as it relates to claiming an METC. It’s true that the Tax Act specifies a limitation of “not less than 80 km,” but this limitation is not based on, nor is it applied on the basis of, differences of individuals themselves. It is applied on the basis of whether any specific individual travels less than 80 km to obtain medical services. In other words, the act, which makes a distinction for one-way travel distances of “not less than 80 km applies equally to any and all individuals seeking to claim a METC.”

This advertisement has not loaded yet, but your article continues below.

Article content The judge noted Parliament chose to recognize hospital parking costs (being part of “reasonable travel expenses”) as a medical expense for one-way travel of not less than 80 km. But that does not mean Parliament is discriminating by not granting the same recognition of parking costs for one-way travel of any lesser distance. After all, Parliament is entitled to make such distinctions in the act for reasons such as “protecting the fisc” without it constituting discrimination.

“Parliament is under no obligation to create a particular benefit,” the Supreme Court of Canada has previously stated, “(and) is free to target the social programs it wishes to fund as a matter of public policy, provided the benefit itself is not conferred in a discriminatory manner.”

The judge, therefore, dismissed the taxpayer’s claim for the METC, but chose not to award any costs to the Crown considering the circumstances.

Jamie Golombek, CPA, CA, CFP, CLU, TEP, is the managing director, Tax & Estate Planning with CIBC Private Wealth in Toronto. Jamie.Golombek@cibc.com.

_____________________________________________________________

If you liked this story, sign up for more in the FP Investor newsletter.

_____________________________________________________________