Stock fell 12 per cent on investor fears Elon Musk may sell shares to complete his US$44-billion takeover of Twitter

Author of the article:

Bloomberg News

Thyagaraju Adinarayan and Esha Dey

Publishing date:

Apr 26, 2022 • 15 hours ago • 2 minute read • 5 Comments

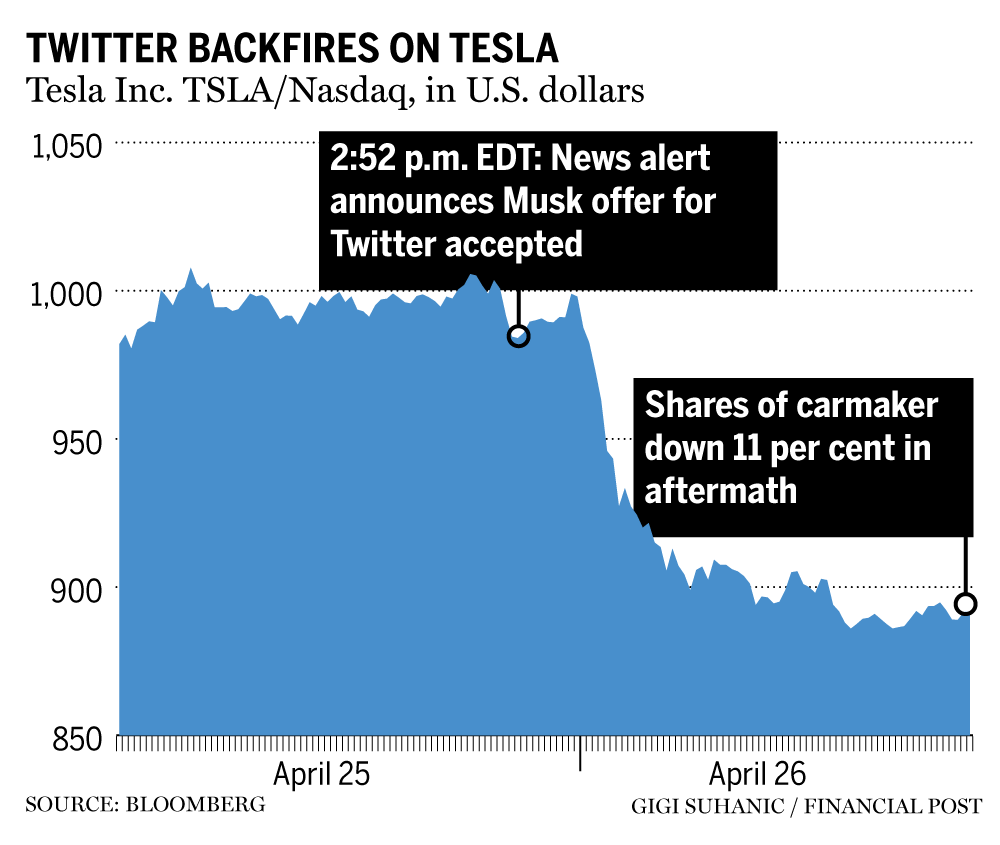

Tesla cars sit parked in a lot at the company’s factory in Fremont, California. Photo by Justin Sullivan/Getty Images Tesla Inc. wiped roughly US$126 billion off its valuation Tuesday as the stock fell 12 per cent on investors’ concern that Elon Musk may sell shares to complete his US$44-billion takeover of Twitter Inc.

Advertisement 2 This advertisement has not loaded yet, but your article continues below.

The electric-vehicle maker’s market capitalization is now down more than US$275 billion since April 4, when Musk disclosed that he increased his Twitter stake. That’s a drop of roughly 23 per cent. The dollar value of Musk’s 17 per cent stake in Tesla has shrunk by more than US$40 billion, almost double the equity portion he pledged in the Twitter transaction.

Tesla’s stock price is sinking amid a broader selloff in equity markets around the world due to slower economic expansion and persistent inflation. In addition, investors have fled high-growth companies as the Federal Reserve prepares to embark on a series of significant rate hikes.

But Musk isn’t doing Tesla any favours by providing scant details on how he will cover the US$21-billion equity piece that he personally guaranteed. What’s known is that Musk is using Tesla shares as collateral in the transaction. That has led to investor worry that the Tesla chief executive may sell some of his stake to fund the Twitter acquisition. Those concerns are “causing a bear festival in the name,” Wedbush analyst Daniel Ives said.

Advertisement 3 This advertisement has not loaded yet, but your article continues below.

“Tesla has three strikes against it today,” said Arthur Hogan, chief market strategist at National Securities Corp. “Apart from the worries about a share sale and a wider selloff in growth stocks, Tesla shares are also reflecting some concern that Elon Musk could be spreading himself and/or his bench too thin taking on this new challenge.”

More On This Topic Five reasons you should care about Elon Musk buying Twitter Elon Musk clinches deal to buy Twitter for $44 billion Are you ‘passionate’ about sustainable energy? Tesla is hiring in Canada Elon Musk launches $41.39 billion hostile takeover of Twitter To be sure, Tesla did report blockbuster quarterly results last week. And prior to Tuesday, its shares were the best performers among the high-profile growth stocks in the NY FANG+ Index this year.

Still, the risks to Tesla’s stock price remain as the uncertainty surrounding the shares continues.

“Musk is taking a good deal of risk by using Tesla shares as collateral,” AJ Bell’s Russ Mould said. “If the electric carmaker’s shares were to unexpectedly crater, that could create a lot of discomfort.”

Bloomberg.com

Financial Post Top Stories Sign up to receive the daily top stories from the Financial Post, a division of Postmedia Network Inc.

By clicking on the sign up button you consent to receive the above newsletter from Postmedia Network Inc. You may unsubscribe any time by clicking on the unsubscribe link at the bottom of our emails. Postmedia Network Inc. | 365 Bloor Street East, Toronto, Ontario, M4W 3L4 | 416-383-2300