stocks

Lehman Brothers and Enron are notorious for destroying shareholder wealth, but they can’t compete with these 20 names.When folks think of the worst stocks of the past 30 years, Lehman Brothers, Enron or Arthur Andersen are but three among legions of notorious names that might immediately come to mind.

Yet somehow, those corporate catastrophes don’t come near cracking the top 20 stocks that destroyed the most shareholder wealth in recent history.

That’s partly due to the depressing fact that there’s simply too much competition.

The respective popping of the tech and real estate bubbles in the U.S. and Japan; an appalling catalog of corporate malfeasance, malpractice and fraud; and the Great Financial Crisis make for a crowded field when it comes to the wholesale destruction of shareholder wealth since 1990.

But before we get to these all-time drags on shareholder performance, let’s start by defining our terms for wealth creation and destruction.

What Is “Wealth Destruction”?Hendrik Bessembinder, a finance professor at Arizona State University’s W.P Carey School of Business, takes a different tack when it comes to studying the best and worst performing equities.

The idea isn’t to figure out stocks’ straight-up returns, be they positive or negative, over some defined time period. Rather, as Dr. Bessembinder writes in his research:

“We measure for each stock the dollar amount by which the wealth of shareholders in aggregate was enhanced by their decision to take on the risk of stock investing rather than investing in low risk U.S. Treasury bills.”

Put another way, Bessembinder measures long-term shareholder outcomes both in terms of compound returns and relative improvement to shareholders’ wealth.

Sign up for Kiplinger’s FREE Closing Bell e-letter: Our daily look at the stock market’s most important headlines, and what moves investors should make.

To oversimplify a bit: Imagine an investor back in 1990. Rather than buy shares in, say, Apple (AAPL), what if he or she instead sunk their capital into risk-free one-month U.S. Treasury bills?

Think of Apple’s “return” in this case as essentially the change in market capitalization adjusted for things such as dividends, share repurchases or new equity issuance, when compared against the compound return of risk-free one-month U.S. Treasury bills over the same time period.

The T-bills are a kind of stand-in for opportunity cost. And the difference over time between the two investment choices, when positive, is wealth creation. It’s the enhancement.

In Apple’s case, the enhancement happens to be tops among the 30 best stocks of the past 30 years. Apple created $2.67 trillion in shareholder wealth, or 23.5% annualized, from 1990 to 2020, according to Bessembinder’s research.

But what happens when the enhancement is negative? That’s when you get wealth destruction.

“Wealth destruction is not simply a decline in market cap, though in many instances this will be the largest contributor,” Bessembinder says. “My calculations all take the one-month Treasury bill rate as the opportunity cost.”

A firm that generated a zero return would be destroying wealth, at least in those months where T-bill rates are positive, Bessembinder adds. His calculations also implicitly account for any share repurchases or new equity issuances.

“If a firm’s market capitalization falls, but the reason is a share repurchase, then no wealth is destroyed,” Bessembinder says.

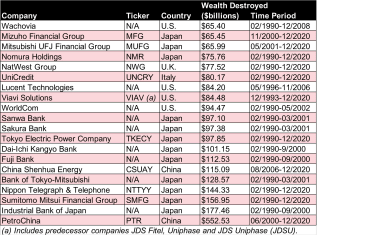

The 20 Biggest Wealth Destroyers of the Past 30 YearsHave a look at the top 20 stocks of the past 30 years in terms of how much shareholder wealth they destroyed:

“Long-term shareholder returns: Evidence from 64,000 global stocks” by Hendrik Bessembinder, W.P. Carey School of Business, Arizona State University, et al.

Note that 12 of the wealth destroyers in the table above are Japanese firms – and 10 of those names are banks. Japan’s banking crisis, which ran from 1991 to 2005 following a collapse in stock, real estate and other asset prices, is to blame.

The U.S. has the dubious distinction of making four contributions to the list. Wachovia, which fell apart amid the GFC, is today part of Wells Fargo (WFC). WorldCom, among the most infamous accounting scandals of its day, emerged from bankruptcy in 2003 under the name MCI. Parts of that business survive today within Verizon’s (VZ) Verizon Business division.

However, the greatest wealth destroyer of the past three decades by far is PetroChina (PTR). The Chinese oil-and-gas company is the listed arm of state-owned China National Petroleum Corporation. From June 2000 through December 2020, its Shanghai- and Hong Kong-listed shares destroyed more than a half-trillion U.S. dollars in shareholder wealth, Bessembinder found.

The Takeaway for InvestorsPerhaps the most salient aspect of Bessembinder’s research is that the vast majority of stocks are duds. Indeed, all of the $76 trillion in net global stock market wealth created over the past 30 years was generated solely by the top-performing 2.4% of stocks.

Investors were highly unlikely to buy and hold a concentrated portfolio of the market’s vanishingly small handful of outsized wealth creators. At the same time, the market’s biggest wealth destroyers were out there helping to crush investors’ long-term plans and goals.

If the lists of greatest wealth creators and wealth destroyers tell us anything, it’s the supreme importance of having a diversified portfolio.