The bear market rally in US stocks is done and the S&P 500 is headed for rough waters, Morgan Stanley said. The ISM’s March manufacturing report “does not bode well for the S&P 500.” The Nasdaq Composite and the S&P 500 have significantly pared this year’s losses. Loading Something is loading.

Many US stocks have climbed steadily after steeply sliding earlier this year but the bear market rally has petered out, according to Morgan Stanley, which said a key sign of a slowdown in US manufacturing activity bodes ill for US equities.

Stocks just wrapped up their worst quarter in two years, but the Nasdaq Composite, home to large technology stocks, has managed to pare its year-to-date loss to roughly 8%. It slumped into a bear market early last month when it lost more than 20%. The S&P 500 has cut its loss to less than 5% after it fell into a correction in mid-March, giving up 11% from its early January high.

“The rally was predictable from a technical perspective, but it was always a bear market rally in our view, and now we think it’s over,” said Mike Wilson, Morgan Stanley’s chief US equity strategist in a research note published Monday.

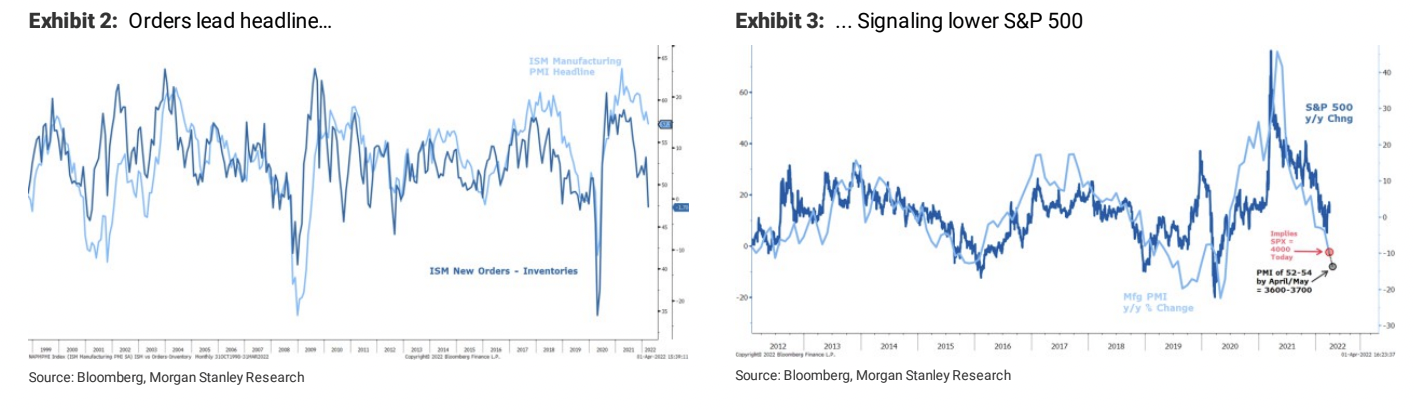

His note highlighted development in the “ice” portion of the bank’s “fire and ice” market scenario, in which “ice” represents risks of a downshift in higher-frequency macro data points. Wilson noted Friday’s March manufacturing report from the Institute for Supply Management. The headline purchasing managers index came in at 57.1%, down from 58.6% in February. The March reading missed expectations of 59% in an Econoday survey of economists.

Morgan Stanley said its analysis of the report shows the orders component is now below inventories for the first time since the expansion began.

“This book to bill proxy for the broader manufacturing sector suggests meaningful downside to the headline ISM over the next few months, which does not bode well for the S&P 500,” said Wilson.

“Bottom line, the rally in stocks over the past few weeks has been remarkable, but in our view it has all the characteristics of a bear market rally, and we view month/quarter end as the perfect spot for it to come to an end,” he said.

Bonds took steeper losses than stocks in the first quarter, which the bank said makes sense given investor concerns about “fire,” or inflation spiraling out of control and the Federal Reserve’s response to it. The Fed has started raising interest rates from ultra-low levels and has telegraphed six more interest rate hikes this year.

Morgan Stanley said it’s now “more constructive on bonds than stocks” over the near term as growth concerns move center stage – “hence our doubling down on a defensive bias.”

It said it remains overweight in the utilities, REITs and healthcare sectors while it is underweight consumer discretionary and cyclical tech. It’s staying equal weights “in everything else and focusing on stock picking,” said Wilson.

“Suffice it to say, we are also recommending Defensives over both cyclicals and growth,” he said.

Morgan Stanley charts point to figures on US ISM goods orders and the performance of the S&P 500 Morgan Stanley Deal icon An icon in the shape of a lightning bolt. Keep reading

More: MI Exclusive Stocks stock market news s&p 500 Chevron icon It indicates an expandable section or menu, or sometimes previous / next navigation options.