stocks to buy

UBS views pricing as a lever to fight inflation. Those companies with strong pricing power can ably deal with rising prices. Those without might struggle.It’s understandable, even forgivable, if our current environment of rapidly rising prices has left investors at a loss.

After all, with inflation running at levels not seen in four decades, few folks have firsthand experience managing their portfolios against this kind of backdrop of rising prices.

Probably the first thing an investor needs to know about investing for rising prices is that some stocks actually benefit from inflation. Companies that have pricing power can have distinct advantages at times like this.

Conversely, companies with weak pricing power are at the mercy of rising prices. Rising prices increase their costs, which saps their margins and, by extension, their profits. A company that can’t pass its rising costs onto customers by raising prices tends to be a bad bet when inflation runs hot.

Ideally, investors want to own stocks in companies with strong pricing power, and avoid those with weak pricing power. Helpfully, UBS Global Research has developed a proprietary framework to assess pricing power at the stock level.

UBS’s Tactic for Tackling InflationPricing is a lever to fight inflation, UBS says. Unfortunately, it’s not one that every firm or industry can use.

“With inflation pressures surging, pricing power relative to cost exposures will be a key theme and source of [absolute outperformance] for global equity markets,” writes the UBS Equity Strategy team.

Indeed, UBS finds that historically, whenever the two-year U.S. breakeven inflation rate has topped 2.5%, “companies with strong pricing power have outperformed their weak counterparts by nearly 14% on average over the next 12 months.”

If shares in companies with strong pricing power have delivered those sorts of returns in the past, well, investors would do well to adjust their portfolios accordingly.

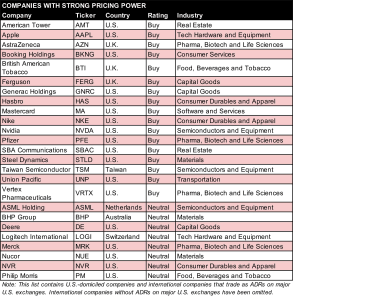

Let’s explore UBS’s best and worst stocks to buy for rising prices. The best stocks have pricing power and are Buy- or Neutral-rated by UBS industry analysts, while the worst stocks have weak pricing power and receive Neutral or Sell ratings.

You can see the full list of stocks below, with a few highlights of companies with the strongest (and weakest) pricing power.

The Best Stocks for Rising Prices Include…Apple (AAPL, $170.40) gets a Buy rating from UBS analyst David Vogt, who cites its ability to maintain and raise prices. “End-market demand has been improving year-over-year leading to elevated ‘wait times’ despite increased product procurement/production,” the analyst says. Hasbro (HAS, $83.80) enjoys “pricing power because demand has held up well, while supply has been constrained given port congestion and difficulty to get product into the U.S.,” notes UBS analyst Arpine Kocharyan (Buy). Nvidia (NVDA, $222.03) “is increasingly monetizing its software solutions more directly which should translate to higher margins and a greater component of revenue from recurring sources,” writes UBS analyst Timothy Arcuri (Buy). “It continues to use software to open new markets for its unique hardware solutions which should provide headroom in terms of pricing.”UBS

The Worst Stocks for Rising Prices Include…Campbell Soup (CPB, $45.81) gets a Sell rating from UBS analyst Cody Ross. “Since 2017, packaged food companies’ pricing power diminished as barriers to entry eroded,” Ross writes. COVID-19 boosted demand and gave the industry a pricing-power boost, but Ross expects that to “diminish and revert to historical levels over the long-term.”International Paper (IP, $47.05) suffers from the fact that pricing power for containerboard and paper products is mixed. “Paper products are largely commoditized and traded globally,” notes UBS analyst Cleve Rueckert (Sell). “Producers rely heavily on third party logistics and freight in their domestic markets where inflationary pressures have been difficult to pass on.”Universal Health Services (UHS, $148.96) struggled to control costs in Q4, “something we expect to continue through at least Q1,” says UBS analyst Andrew Mok (Sell).” While the nursing labor market should improve throughout the year, we’re normalizing to a market that’s structurally weaker than it was in 2019. Even then, labor had already been a multi-year headwind for UHS.”UBS

12 Good Reasons to Cancel Amazon Prime

Amazon Prime

12 Good Reasons to Cancel Amazon PrimeAmazon Prime membership recently jumped to $139 a year. That’s one good reason to cancel your Amazon Prime membership. There are 11 others.

April 7, 2022

Your Guide to Roth Conversions

Special Report

Tax Breaks

Your Guide to Roth ConversionsA Kiplinger Special Report

February 25, 2021

What Are the Income Tax Brackets for 2021 vs. 2022?

tax brackets

What Are the Income Tax Brackets for 2021 vs. 2022?For both years, there are seven different federal income tax brackets – each with its own marginal tax rate. Which bracket you end up in depends on yo…

April 10, 2022

The 22 Best Stocks to Buy for 2022

stocks to buy

The 22 Best Stocks to Buy for 2022The lesson of the past two years: Be ready for anything. Our 22 best stocks to buy for 2022 reflect several possible outcomes for what is turning out …

April 13, 2022

All 30 Dow Jones Stocks Ranked: The Pros Weigh In

blue chip stocks

All 30 Dow Jones Stocks Ranked: The Pros Weigh InThe Dow Jones Industrial Average comprises 30 blue-chip stocks that are tops in their industries. But some Dow Jones stocks are better buys than other…

April 13, 2022

Buy Now, Pay Later: 5 BNPL Stocks to Buy

stocks to buy

Buy Now, Pay Later: 5 BNPL Stocks to BuyThe popularity of buying via ‘buy now, pay later’ has exploded of late, propping up pure plays and drawing the interest of larger fintech firms.

March 30, 2022

12 Best Consumer Staples Stocks to Buy for 2022

stocks to buy

12 Best Consumer Staples Stocks to Buy for 2022There are plenty of challenges facing retailers and manufacturers right now, but these top-rated consumer staples stocks could serve as a steady hand …

March 11, 2022