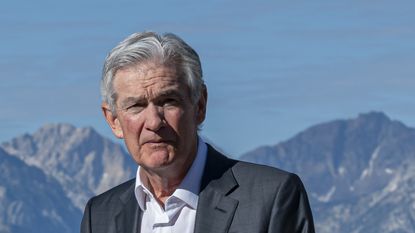

Federal Reserve Chairman Jerome Powell got to the point quickly in his speech at the central bank’s annual conference in Jackson Hole, Wyoming, on Thursday: “It is the Fed’s job to bring inflation down to our 2% goal, and we will do so.”

Powell acknowledged that inflation has fallen from its peak, but also stressed that it remains too high. As such, the central bank’s rate-setting group, the Federal Open Market Committee (FOMC), is “prepared to raise rates further if appropriate,” Powell said. The Fed will assess incoming data, the evolving outlook and risks, and proceed carefully, he added.

Powell’s comments at the Fed’s annual Economic Policy Symposium came as no surprise to Wall Street, as the Fed chief has been consistent in his messaging throughout the central bank’s rate-tightening cycle.

Subscribe to Kiplinger’s Personal Finance Be a smarter, better informed investor.

Save up to 74%

Sign up for Kiplinger’s Free E-Newsletters Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more – straight to your e-mail.

Profit and prosper with the best of expert advice – straight to your e-mail.

“Jerome Powell has focused on his standard outline that he’s resorted to during recent press conferences, which acknowledges that inflation is edging lower, but not quickly enough to declare victory,” Quincy Krosby, chief global strategist at LPL Financial, said in a note to clients. “He has maintained that price stability remains the Fed’s mandate. Still, he has made it clear that the Fed will continue to tighten if necessary as ‘agile’ policy is warranted.”

After its regularly scheduled policy meeting in July, the FOMC raised interest rates by 25 basis points, or 0.25%. The move, which followed a pause in June that came after 10 consecutive interest rate hikes, was widely expected – as was Powell leaving the door open to future hikes.

Powell told conference attendees in Jackson Hole that watching core personal consumption expenditures (PCE) – inflation for goods, housing services and nonhousing services – helps in understanding what will drive further progress.

Core goods inflation has fallenThe chief noted that core goods inflation has fallen sharply, particularly for durable goods, and he used the motor vehicle industry as an example of a sector that saw steep price hikes during the pandemic due to several factors including low interest rates. But vehicle supply fell due to the semiconductor shortage and prices spiked as pent-up demand grew.

In the aftermath of the pandemic, vehicle production and inventories have grown and supply has improved, but interest rates on auto loans have nearly doubled this year and are weighing on demand, Powell added.

“On net, motor vehicle inflation has declined sharply because of the combined effects of these supply and demand factors,” Powell said. “Similar dynamics are playing out for core goods inflation overall. As they do, the effects of monetary restraint should show through more fully over time.”

In the housing sector, inflation has begun to fall but still remains elevated. “Because leases turn over slowly, it takes time for a decline in market rent growth to work its way into the overall inflation measure,” Powell said.

Slowing growth in rents for new leases in the past year will affect measured housing services inflation in the coming year, the Fed chief noted. Should market rent growth settle near pre-pandemic levels, housing services inflation should fall toward its pre-pandemic level too.

Twelve-month inflation for non-housing services – which accounts for more than half of the core PCE index and includes services such as health care, food services, transportation and accommodations – has “moved sideways since liftoff,” Powell said.

In the last three to six months, however, inflation in the sector has begun a modest decline, partly because many of these services are less affected by factors such as global supply chain bottlenecks that influence other sectors and because these are labor-intensive services and the labor market remains tight, he said.

The Fed is watching for signs that the economy may not be cooling as expected, Powell said. Gross domestic product growth so far this year is above expectations, recent readings on consumer spending have been especially robust, and the housing sector appears to be picking up again, he noted.

While the labor market has continued to rebalance in the past year, it “remains incomplete,” and the Fed expects the rebalancing to continue. “Evidence that the tightness in the labor market is no longer easing could also call for a monetary policy response,” Powell said.

Commenting on the speech, Craig Erlam, a senior market analyst at Oanda, said that the Fed chairman delivered a “hawkish script boosting the dollar and rate expectations.” While another interest rate hike is far from certain, “I’m still of the view they’re done,” Erlam said. “Traders are increasingly accepting that they will likely stay there longer than they’ve expected at any point in the tightening cycle.”

Related Content When Is the Next Fed Meeting? Rising Prices: Which Goods and Services Are Driving Inflation? What Is the Federal Funds Rate?