Tempting targets, shareholder unrest and devastated sectors have created a climate where many activists believe companies would rather settle than fight

Iamgold’s Côté Gold Project. Photo by Supplied Baker Steel Capital Managers LLP, a large resource investment fund based in London, boosted its stake in Canadian miner Iamgold Corp. by nearly 40 per cent in 2021, reasoning that there was value to be unlocked in the gold miner with operations in Canada and Africa.

Advertisement This advertisement has not loaded yet, but your article continues below.

So it came as a shock to Mark Burridge, chief executive and managing partner of Baker Steel, when news broke last month that Iamgold’s chief executive, Gordon Stothart, was leaving abruptly after less than two years in the top job.

“When the announcement came with the CEO leaving, yeah, we got a little bit uncomfortable,” Burridge said in a recent interview.

“We’re not the guys who build the big position just to then, you know, knock on their door and say, ‘Hey, you know, we’re the big shareholders, you need to do what we say.’ That’s not our style at all.”

But with a 2.8 per cent stake in hand as of the end of 2021, they felt they had to do something, so they contacted management and the board with suggestions on how to turn the company around. They weren’t alone.

Advertisement This advertisement has not loaded yet, but your article continues below.

Iamgold’s chief executive Gordon Stothart at Laurentian University in Sudbury, Ont., on March 15, 2018. Photo by Gino Donato/Sudbury Star/Postmedia Network files Around the same time, another investment fund, Denver-based RCF Management LLC, was also reaching out to Iamgold, hoping to use its five per cent stake in the company to pressure for change.

Robin Bienenstock, RCF’s Canadian representative and a member of the international fund manager’s investment committee, said her fund isn’t a traditional activist player either. Yet the institutional investor felt compelled to act — and quickly.

Behind closed doors, discussions about how to improve Iamgold’s governance and performance quickly turned to negotiations with the company — and their lawyers — about replacing directors, Bienenstock said in an interview.

It became apparent that friendly negotiations were breaking down when changes seemingly agreed to were suddenly rejected later the same day.

Advertisement This advertisement has not loaded yet, but your article continues below.

“It felt like negotiating with a bag of cats,” she said.

It felt like negotiating with a bag of cats

Robin Bienenstock

On Feb. 1, RCF took its battle public. In an open letter, a partner at RCF named Martin Valdes accused the company of “massive value destruction and chronic underperformance” and called for an immediate leadership change.

Iamgold pushed back, accusing RCF of putting its interests ahead of those of other shareholders “with demands that would result in a five per cent shareholder taking de facto control” of the company.

Both sides issued press released defending their positions. The battle was on.

Though institutional investor activism has been on the radar for Canadian companies for years, it is still relatively rare for disputes to turn into public spectacles. The lion’s share of proxy campaigns — at least two-thirds — still remain largely out of the public’s view, said Ian Robertson, chief executive of Kingsdale Advisors in Toronto, which advises public companies on shareholder, governance, and transaction-related matters.

Advertisement This advertisement has not loaded yet, but your article continues below.

It is more common for investors to engage with management teams and boards in private, quietly pushing for changes to governance, strategy, and, more recently, better management of environmental risks and sufficient inclusion of historically underrepresented groups such as women, people of colour, and the disabled.

In recent months, however, public clashes and proxy battles have encompassed not only Iamgold but also 103-year-old Canadian National Railways Ltd. and debt-laden cannabis company HEXO Corp.

A Canadian National Railway locomotive pulls a train in Montreal. Photo by Christinne Muschi/Bloomberg files The three battles are very different in some respects: The CN unrest, for example, sprung from a disagreement about acquisition strategy, while HEXO is caught up in the cannabis sector’s wider decline from its post-legalization heyday, on top of its own issues.

Advertisement This advertisement has not loaded yet, but your article continues below.

But there are some common elements as well, according to people who provide legal and other advisory services to companies and investors.

Andrew MacDougall, a partner at law firm Osler Hoskin & Harcourt LLP who specializes in corporate governance and shareholder activism, said the pandemic and its economic fallout have exposed companies that are underperforming peers within their sectors, which are now targets of institutional investors, even some that are not well known for taking an activist stance.

“The pandemic was a litmus test for the management teams of most corporations, and some corporations were better at weathering its effects than others,” he said.

“I think Warren Buffett was right when he said that, ‘Only when the tide goes out do you discover who’s been swimming naked.’”

Advertisement This advertisement has not loaded yet, but your article continues below.

MacDougall said he expects increased levels of activism to continue this year, adding that generally strong stock markets over the past year have made institutional shareholders “less forgiving” when it comes to giving boards and management time to address disappointing performance.

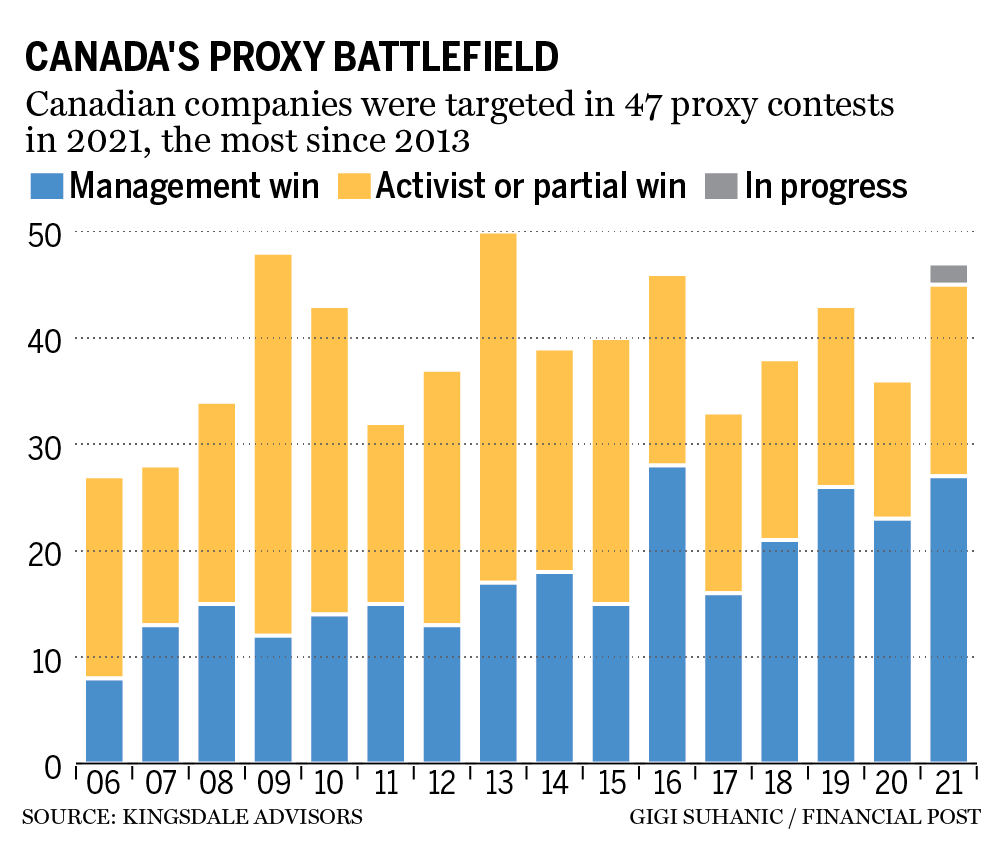

Kingsdale’s Robertson, too, said circumstances surrounding the pandemic are feeding the activist pipeline. According to Kingsdale, there were 47 proxy contests launched in Canada in 2021, the most since 2013.

“A post-COVID landscape where some companies may have been weakened is a near-ideal scenario,” he said, adding that many investment funds that spent the past couple of years building up positions at low prices now find themselves with a foundation on which to campaign for change.

Advertisement This advertisement has not loaded yet, but your article continues below.

“Tempting targets, shareholder unrest due to low valuations, and devastated sectors created a climate (with) many activists believing that companies would rather settle than fight,” he said.

A post-COVID landscape where some companies may have been weakened is a near-ideal scenario

Ian Robertson

As activist activity and pressure increases, momentum builds to make changes in corporate boardrooms and strategy. This, in turn, attracts greater participation, sometimes from less sophisticated and resourced investors known within the shareholder advisory world as “ankle biters.”

“Ankle biters are smaller funds who have seen the success of the activists and think hey, you know what, this is a great idea. I’ve read a couple of books on this and some newspaper articles I can be an activist too, and then they try and initiate activist campaigns,” said Robertson.

Advertisement This advertisement has not loaded yet, but your article continues below.

Canada is unique in that it also generates activism driven by individuals, primarily at smaller companies and sometimes driven by as few as one or two investors — sometimes identified as ‘Concerned Shareholders — as opposed to a formal activist fund, he said.

Examples of companies targeted by such activity in the past year include Mason Graphite Inc., FSD Pharma Inc. and cannabis company Aleafia.

Aleafia Total Health Network in Vaughan, Ont. Photo by Ernest Doroszuk/Toronto Sun/Postmedia Network files In all battles, including the larger ones playing out recently, activist activity tends to be kicked off by a discrepancy in value — what the investor thinks the company or its assets are worth versus where the shares are trading on stock markets. Dig a little deeper, though, and concerns usually extend beyond the company’s management to focus on corporate governance. While CEOs are often shown the door when investors take an activist stance, challenges also tend to focus on the board of directors: Are directors steeped enough in the industry to be making the right decisions? Do they have “skin in the game” in terms of owning significant shares themselves? Are they too connected to management? Have they been there too long to see that the company needs to change its strategy?

Advertisement This advertisement has not loaded yet, but your article continues below.

Such governance concerns become “an explanation or proof point for why a company is not achieving its best,” Robertson said.

Increasingly, activists have found a toe-hold in such discussions when a company undertakes an acquisition, such as occurred last year when CN attempted to snatch the U.S. railway Kansas City Southern away from rival suitor Canadian Pacific Railway. TCI Fund Management Ltd. took the opportunity to accuse the company of being out of its depth, pushing for a CEO of its choosing and changes to the board of directors. The M&A deal fizzled and a compromise was reached with TCI, meaning CN did not have to face an embarrassing public proxy contest.

A CP Rail employee walks past locomotives in the Alyth yards in Calgary. Photo by Gavin Young/Postmedia files Canada saw more cases of transaction-related activism in 2021 than it has in the past five years, according to data collected by Kingsdale, which was retained by TCI’s to advise the fund in its campaign targeting CN.

Advertisement This advertisement has not loaded yet, but your article continues below.

Robertson said activism around M&A transactions provides investment funds with a relatively inexpensive way to influence a company’s governance and strategy, with limited downside since there’s already a transaction on the table.

“The best-case scenario is you put out one press release and you get a bump (in the offer), so I think people have tuned into that and see it as a viable tactic to use in these situations,” he said. “It’s not like you have to actually run an activist campaign. You simply put your hand out publicly and say, ‘I’m opposing, I’m voting against for the following reasons,’ and usually that has a trickle-down effect where other shareholders will join that rally crying for pressure on the company to pump the offer.”

Advertisement This advertisement has not loaded yet, but your article continues below.

In the coming year, an increasing amount of activism is expected to extend beyond governance and into environmental and social issues, according to Dexter John, chief executive of strategic advice and shareholder services firm Morrow Sodali Canada in Toronto.

This will include not only making sure risks are adequately accounted for in cost and profit budgets, but also ensuring that returns to shareholders are balanced with taking care of the communities in which the companies operate, he said. John also expects greater emphasis on increasing participation of under-represented groups in boardrooms and management suites.

“I think that is going to be a really a major focus for a lot of institutional shareholders … how they allocate their funds, and the expectation of boards of directors,” he said.

Advertisement This advertisement has not loaded yet, but your article continues below.

More On This Topic David Rosenberg: Global recovery unhealthily hitched to bubbly housing, especially in Canada, New Zealand Five reasons women are better investors than men Canada’s big banks positioned for years of dividend growth: Brian Belski Shortly after it became public that institutional investors were seeking to shake up Iamgold, Baker Steel’s Burridge told the Financial Post that it was crucial to his fund that the miner maintain its ESG commitments amid the corporate turbulence.

“A critical point for us is to be certain that Iamgold, along with any incoming directors and executives, clearly reinforce their commitments from an ESG perspective to all stakeholders at a time of uncertainty and transition,” he said.

This advertisement has not loaded yet, but your article continues below.

Article content RCF is continuing to push Iamgold to overhaul its board with directors who are “independent in more than just a superficial way.” The fund is also pushing to install its choice of chair, seasoned mining executive Maryse Bélanger, something the gold miner has opposed but which has won support from at least one other key investor: A spokesperson for Van Eck Associates Corp., Iamgold’s largest shareholder, said the fund supports RCF Management’s push for a board overhaul and new chairperson.

When asked recently how he feels about the calls for change at Iamgold playing out in public, Baker Steel’s Burridge was pragmatic.

“While it’s uncomfortable the way happened, it’s a change that I think companies need to embrace and work through relatively quickly because (then) you could get on with the job — and I hope that’s what happens here.

• Email: bshecter@nationalpost.com | Twitter: BatPost

Financial Post Top Stories Sign up to receive the daily top stories from the Financial Post, a division of Postmedia Network Inc.

By clicking on the sign up button you consent to receive the above newsletter from Postmedia Network Inc. You may unsubscribe any time by clicking on the unsubscribe link at the bottom of our emails. Postmedia Network Inc. | 365 Bloor Street East, Toronto, Ontario, M4W 3L4 | 416-383-2300