Investing in commercial real estate can be an effective way to mitigate a rising interest rate environment

Condo and office towers fill the downtown skyline in Vancouver. Photo by Darryl Dyck/The Canadian Press files Diversification is a key strategy for all investment portfolios, but it’s especially important for larger portfolios since the bigger a portfolio gets, the more it likely benefits from additional asset diversification.

Advertisement 2 This advertisement has not loaded yet, but your article continues below.

For investors with portfolios of at least $1 million, commercial real estate is one way to potentially own investments that behave differently from others (negative correlation) and enhance long-term returns. As well, speaking to a more recent concern, it can be an effective way to mitigate a rising interest rate environment.

FP Investor By clicking on the sign up button you consent to receive the above newsletter from Postmedia Network Inc. You may unsubscribe any time by clicking on the unsubscribe link at the bottom of our emails or any newsletter. Postmedia Network Inc. | 365 Bloor Street East, Toronto, Ontario, M4W 3L4 | 416-383-2300

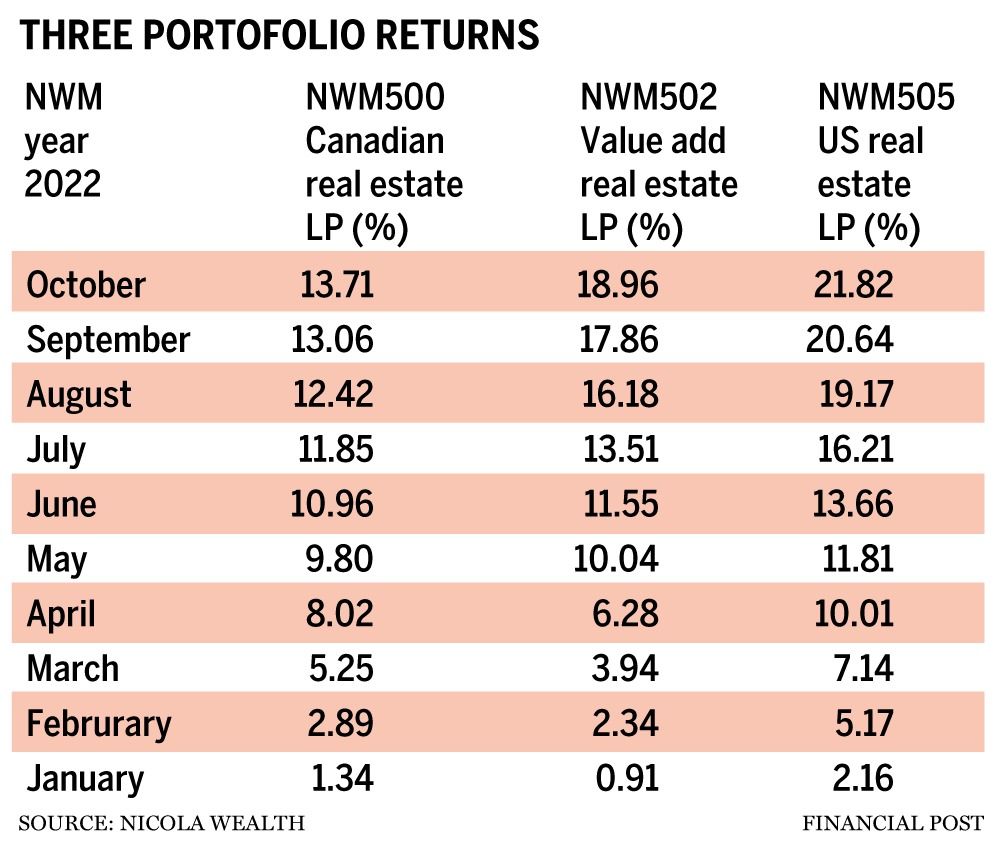

If current trends hold, certain types of commercial real estate seem as though they will end the year as the best-performing asset class in Canada. This, in turn, will likely catch the attention of many investors, especially those whose stock and bond portfolios took a thrashing for the year.

Of course, you shouldn’t just be following recent performance trends. You should also seek out investments that can be profitable over the long term and provide diversification in combination with other investments. Understanding this, let’s go through a common list of questions about investing in commercial real estate.

Advertisement 3 This advertisement has not loaded yet, but your article continues below.

What are the differences between residential and commercial real estate?

Here’s a simple way to think about it: you are investing in residential real estate when you buy a condo in an apartment building, but you are investing in commercial real estate when you buy the entire building.

Commercial real estate has many features in common with residential (for example, the ability to earn rent and to realize capital gains/losses when a property is sold), but what typically separates them is unit cost, scale, complexity, diversity, potential rental/tenancy base and how depreciation/carrying costs are applied.

Essentially, commercial real estate often has more barriers to entry than residential real estate, but is potentially a more robust, diversified asset class.

Advertisement 4 This advertisement has not loaded yet, but your article continues below.

How does one invest in commercial real estate?

You can invest directly by buying property yourself or with co-investors, or indirectly by purchasing share ownership of property investment pools. Direct ownership typically requires a large amount of capital that will be tied up in the property. Indirect ownership can require less capital and is more liquid, but may have higher management fees.

In Canada, the most common form of indirect ownership comes through real estate investment trusts (REITs), which can typically be bought and sold like stocks on public exchanges. While this is generally a useful feature, it does create a potential oddity: during market periods of high economic volatility, investor behaviour can cause price fluctuations beyond that of the underlying holdings, as measured by net asset value.

Advertisement 5 This advertisement has not loaded yet, but your article continues below.

This isn’t ideal for those who owned a REIT prior to a downturn. But it can represent a great buying opportunity for those looking to buy REITs at prices below their intrinsic values.

By comparison, if you partake in direct ownership, where valuations and trading are not done daily, asset prices should fluctuate less.

Why add commercial real estate to a portfolio?

In a word: diversification. The ultimate goal is to provide high relative returns with comparably low volatility. REIT performance, even with fees deducted, compares favourably with the S&P 500 index’s performance, according to Nareit data since 1972. And real estate funds typically have lower volatility than equity markets and maintain a low correlation to bond markets.

Advertisement 6 This advertisement has not loaded yet, but your article continues below.

Ownership of commercial real estate also diversifies income streams by creating another source of cash flow. Having multiple sources of income allows investors to better manage risk within a portfolio, especially given the recent relative underperformance of equity markets.

How diverse is commercial real estate as an asset class?

Commercial real estate might sound like a catch-all category, but there are myriad ways to invest. Commercial properties can include subclasses such as retail, industrial, multi-family rental, office towers, senior care and health facilities.

Different asset subclasses will have different characteristics from one another and will perform differently during economic cycles. For example, we’ve recently been quite bullish on industrial, self-storage facilities and multi-family rental apartment buildings. As with equities, choosing the right subclasses can have as large an impact as choosing the asset class itself.

Advertisement 7 This advertisement has not loaded yet, but your article continues below.

Another point to note is that commercial real estate generally provides many opportunities to create value through development. There are a variety of strategies that can be used with the goal of increasing the value of a property for either a future sale or to hold long term.

Recommended from Editorial Three investing lessons from Billions that could help save you a million headaches Five radical investing views and whether you should take advantage of them FP Answers: Should I hold onto my large portfolio of preferred shares or diversify? Some examples include raw land development, covered land plays (properties that have both existing rental income and future development potential) and rezoning/entitlement projects.

Overall, if 2022 has reminded us of anything, it’s likely that the quality of an investment portfolio matters over the long term. One means to achieve a high-quality portfolio is diversification through a variety of asset classes.

Investors with the profile to hold commercial real estate may want to consider it if they have not already. For those already invested in it this year, it may well have been their favourite investment.

Chris Warner, FCSI CFP CIM PFP, is a wealth adviser at Nicola Wealth.

_____________________________________________________________

If you liked this story, sign up for more in the FP Investor newsletter.

_____________________________________________________________