Deutsche Bank’s chief US equity strategist says strong corporate earnings and a weakening greenback will help stocks rally. Binky Chadha predicts the S&P 500 will increase 2.5% in the near-term to about 4,250. There’s still a lot of uncertainty for markets moving forward, he said, noting the economy could “suddenly crash.” Loading Something is loading.

Thanks for signing up!

Access your favorite topics in a personalized feed while you’re on the go.

Stronger-than-expected first quarter earnings and a weakening US dollar will help the stock market rally in the near term, according to Deutsche Bank’s US stock chief.

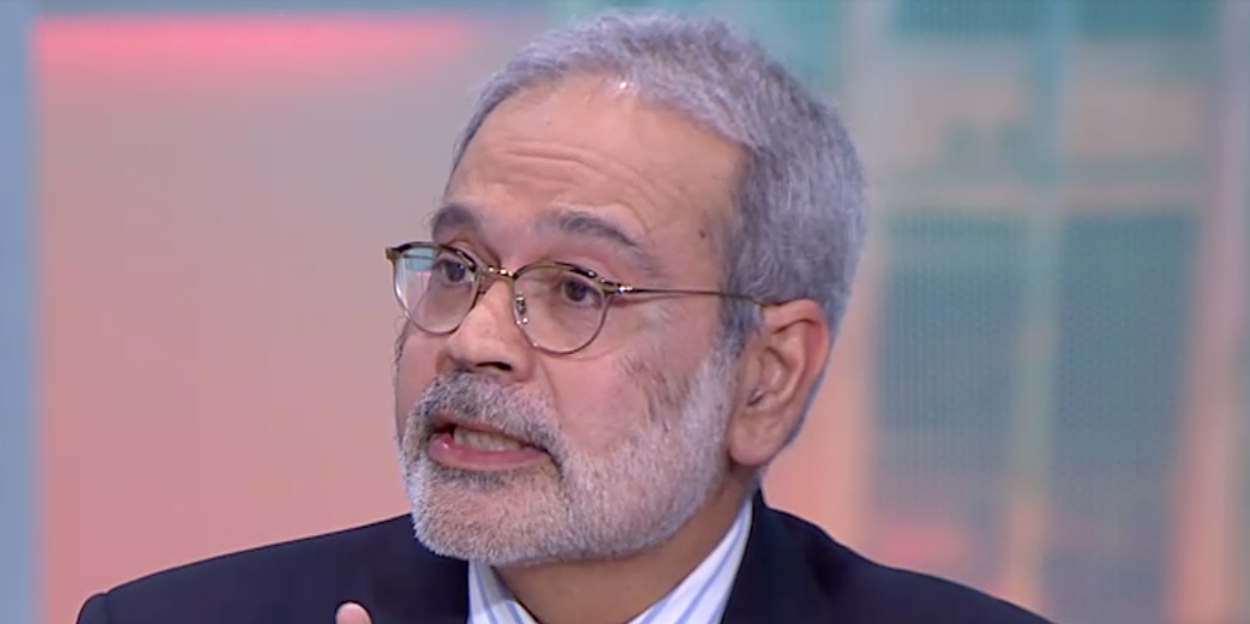

Bankim “Binky” Chadha, chief US equity and global strategist at Deutsche Bank, predicts the S&P 500 will trend upwards by approximately 2.5% in the near-term to above 4,250. Equities historically tend to rise as companies report fiscal results, Chadha says, and a series macro drivers are stacking up in the markets favor.

As the US dollar weakens, companies that do business overseas should see a boost in sales. Last week, the greenback slumped to a one-year low against a basket of other currencies.

“We had upgrades to growth in the US, in Europe, in China, [and] in Japan. We had the dollar come down. All of that argues basically for upside or a rebound [in earnings],” Chadha told Bloomberg TV on Monday.

He added: “There’s this narrative out there that the bottom of consensus is forecasting the worst [earnings] season ever and down 7%. I think [they] should careful with that hypothetical because the earnings beat is almost always by 5%.”

Still, there is considerable uncertainty for the market moving forward, Chadha says, adding that the US economy could either “start growing” or “suddenly crash.”

Many on Wall Street are warning of a painful recession as the Federal Reserve continues to hike interest rates to combat sticky inflation. Bank of America’s Michael Hartnett says there are plenty of recession signals in manufacturing and labor data, along with a steepening yield curve which all typically precede a severe economic slowdown.