The S&P 500 communications services sector has started 2023 as the top-performing group on the broad index. The sector that’s home to Meta, Netflix and Match has picked up 12% after sliding 40% last year. The rotation in market leadership has extended to other hard-hit groups including consumer discretionary. Loading Something is loading.

Thanks for signing up!

Access your favorite topics in a personalized feed while you’re on the go.

The communications services group has emerged as the S&P 500’s best-performing sector in early 2023, highlighting the shift in market leadership after stocks sank into a bear market last year.

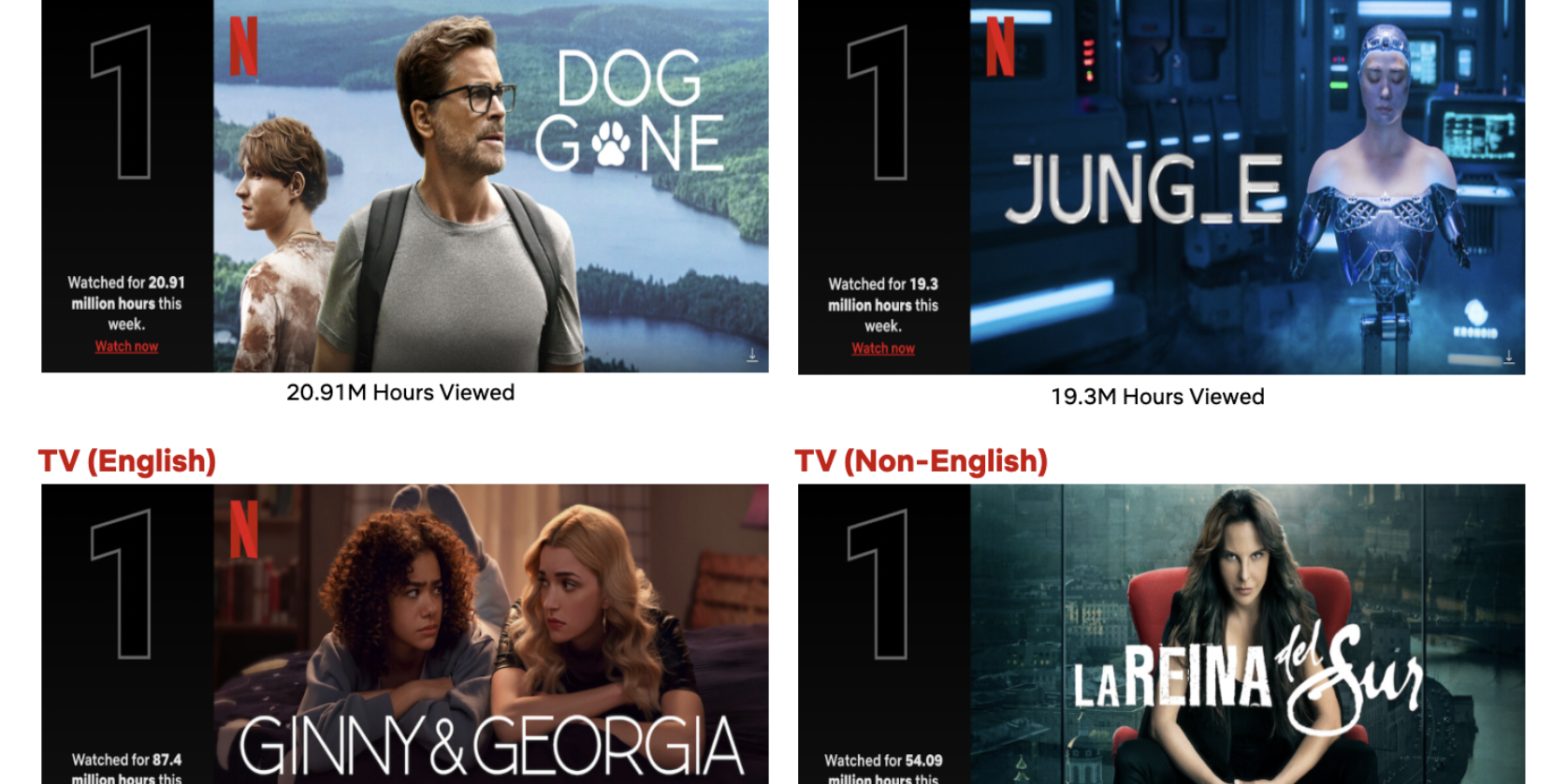

The S&P 500 communications services sector has gained more than 12% since trading in the new year began. Most of the group’s constituents have been rebounding. Early winners include Warner Bros Discovery and Netflix as shares have soared by 50% and 23%, respectively.

The upswing in the sector that hosts communication and media companies arrived after it sank 40.4% in 2022. It was the worst performer of the S&P 500’s 11 groups last year.

Investors have been bargain-hunting after the sector was hammered down by a mix of macroeconomic headwinds and company-specific issues. The prospect of high inflation hurting consumer spending contributed to stock losses last year for Netflix and Match. The parent of Tinder and other dating sites tumbled 69% in 2022 but it has picked up 23% in 2023.

And Facebook parent Meta has jumped 18% after losing more than 60% last year. Meta and Match were among the top 10 biggest losers on the S&P 500 in 2022.

The rotation in market leadership is also on display in the consumer discretionary, information technology, and real estate sectors, among others. Gains in 2023 for those groups range between 9% and nearly 7%.

By contrast, the S&P 500 consumer dictionary sector fell 37.6% last year, the second-worst performance on the broad index.

“While much of the communication services sector has experienced gains in 2023, the three-week rally has done little to remedy substantial market capitalization losses since the end of 2021,” S&P Global Market Intelligence said Tuesday. The group’s five largest companies have lost about $1.4 trillion in market cap since the end of 2021, it said.

Disclosure: Mathias Döpfner, CEO of Business Insider’s parent company, Axel Springer, is a Netflix board member.