Worries about slowdown in global economic growth

Author of the article:

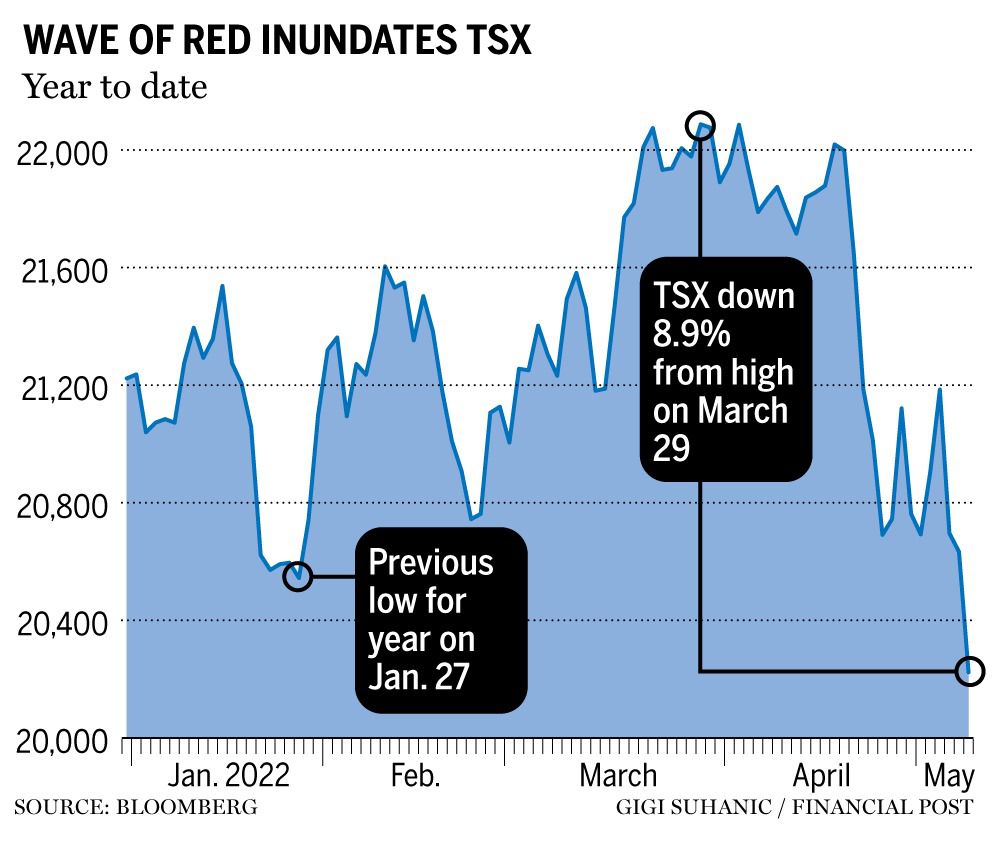

Canada’s main stock index touched a more than three-month low on Monday. Photo by Reuters Canada’s main stock index fell below a three-month low on Monday, pulled down by Shaw Communications and resource-linked stocks as commodities retreated on worries over a slowdown in global economic growth.

Advertisement 2 This advertisement has not loaded yet, but your article continues below.

By early afternoon, the Toronto Stock Exchange’s S&P/TSX composite index was down 548.33 points at 20,2084, passing its lowest level since Jan. 25 with all sub-sectors in red.

Shaw Communications Inc plunged 8.7 per cent to the bottom of the index after Canada’s Commissioner of Competition said it intends to oppose Rogers Communications Inc’s proposed $20 billion merger with the company.

The energy sector dropped 3.8 per cent, as oil prices fell, weighed down by a strong dollar and demand concerns on the back of extended coronavirus lockdowns in China, the world’s top oil importer.

The materials sector, which includes precious and base metals miners and fertilizer companies, lost 2.6 per cent as gold prices retreated 1 per cent as a firmer dollar and elevated U.S. Treasury yields weighed on the appeal of non-yielding bullion.

Advertisement 3 This advertisement has not loaded yet, but your article continues below.

“The rally in commodity prices on Friday helped to cushion the blow in Canada relative to the U.S., (on Monday) we see a reversal to that with stocks under pressure and with commodities under pressure,” said Colin Cieszynski, chief market strategist at SIA Wealth Management.

Toronto-listed technology stocks, down 2.9 per cent, fell for the third straight session, tracking weakness in the U.S. tech-heavy Nasdaq index.

The financials sector slipped 1 per cent, while the industrials sector fell 1.3 per cent.

More On This Topic Welcome to The Upside Down market, where strange things are the norm Martin Pelletier: Two common mistakes that can cost investors in these volatile times Why stock market forecasters are in need of a reality check Concerns around a slowdown in global growth amid lockdowns in China and prospects of aggressive policy tightening by major central banks pressured global investor sentiment.

Investors waited for earnings from major Canadian companies including Suncor Energy, Manulife Financial, Canadian Tire and Canada Goose due later in the week.

“Unless there is some huge surprise from a specific company, for most part macro forces will be driving the markets,” Cieszynski added.

© Thomson Reuters 2022

Financial Post Top Stories Sign up to receive the daily top stories from the Financial Post, a division of Postmedia Network Inc.

By clicking on the sign up button you consent to receive the above newsletter from Postmedia Network Inc. You may unsubscribe any time by clicking on the unsubscribe link at the bottom of our emails. Postmedia Network Inc. | 365 Bloor Street East, Toronto, Ontario, M4W 3L4 | 416-383-2300