The marriage tax penalty is mostly dead. Long live the marriage tax benefit.Married couples often share many things: a home, a bed, and tax brackets. Until 2018, couples were often squeezed into joint tax brackets less than twice the single size. That was dubbed the marriage tax penalty and was often erroneously thought to negatively impact all married couples. A false assumption was that each spouse had equal income, and consequently the couple needed twice the single tax bracket to avoid a punitive squeeze.

Understanding the marriage tax benefitTo understand why that might be wrong, imagine a couple gets a king-size bed about twice as large as the twin beds they had before marriage. Now humor me and imagine only one spouse sleeps and uses the bed. Can you picture that lone sleeping spouse with lots of room to spread out? Even a queen-size bed would add comfort to the sleeping spouse.

That would be like a married couple getting wider tax brackets, but only one spouse is working. The working spouse’s income would have more room to spread across low-tax brackets and would be taxed more comfortably.

Today, most married taxpayers get comfy “king-size” joint tax brackets with only the highest-income taxpayers getting “queen-size” brackets. The bracket squeeze is mostly gone. But the potential benefit persists.

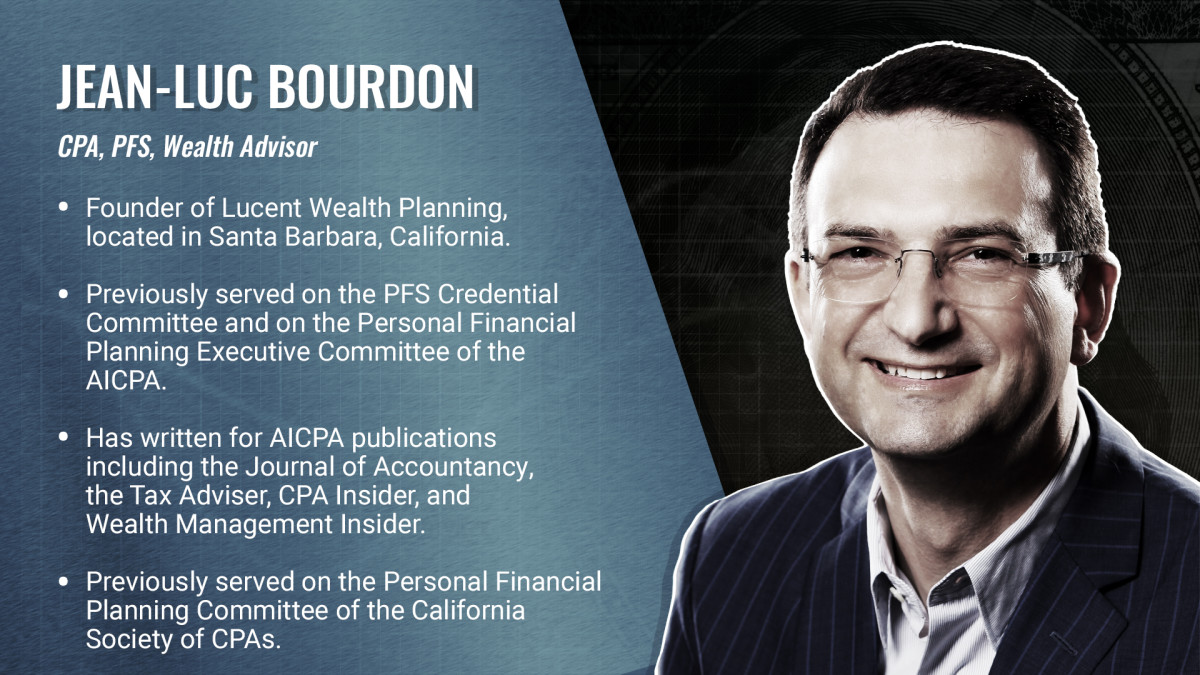

BIO| More About Our CPA and Tax ExpertBio: Jean-Luc Bourdon, CPA, PFS, Wealth Advisor

Who gets the marriage tax benefit?Tax brackets for married couples filing jointly tend to be most beneficial when one spouse has no income, low income, or negative income (e.g. business losses). Here, I’m assuming spouses would otherwise use the single filing status if they weren’t married. As a simple example, let’s take a couple who, in 2021, jointly earns $160,000 in wages, nothing else. If they’re married and filing jointly, they roughly pay $21K in taxes—regardless of who earns what. If they’re not married and earn $80,000 each, their individual taxes would add up to about $21K as well. Then, there’s no marriage penalty to speak of. By contrast, if they aren’t married, one of them earns $160K and the other has no income, their respective taxes would add up to over $29K total. Then, the tax benefit of being married and filing jointly is worth an impressive $8K.

When both spouses work and there’s a large income disparity between them, I’d generally expect some marriage tax benefit (compared to the single filing status). Overall, the tax code is complex, and many factors come into play to make each person’s situation unique. You can evaluate specific scenarios with an online tax calculator such as Turbotax’s TaxCaster.

Since 2018, the joint tax-bracket penalty disappeared for most but the highest-income taxpayers. For them, there is still a point when the income difference between spouses is small enough to cause a penalty. Consequently, there’s a tipping point between penalty and benefit. For example, spouses who each earn $400K in wages would face a $4K marriage tax penalty on their $800K joint income. The penalty disappears if one spouse earns $630K and the other earns $170K. If instead one spouse earns $800K and the other has no income, being married and filing jointly has a benefit worth nearly $33K.

Scroll to Continue

Tax brackets aren’t everythingAlthough joint tax brackets create a marriage benefit for many taxpayers, it’s not always the case. For instance, when one or both partners qualify for the head of household filing status, the tax dynamic changes. Also, there are other financial factors that may benefit couples that don’t get married.

For other benefits of not getting married, read Weddings & Taxes: 4 Reasons to Reconsider ‘I Do’

On the flip side, many tax goodies are for married couples only. To start, married couples may pay less in tax preparation because they only need one tax return. Also, a non-working spouse may qualify to make contributions to an IRA, for example.

In addition to tax, there might be compelling financial, legal, estate, and work-benefit reasons to get married. Yet, as much as a change in marital status is valuable to plan for, I know of a few situations where a financial analysis was the driving factor. Personal finance is first and foremost personal. As mathematician philosopher Blaise Pascal said: The heart has its reasons of which reason knows nothing.”

Planning to lose the marriage tax benefitAt the death of a spouse, the loss of any marriage tax benefits may come as an untimely bad surprise. Ideally, all retirement plans should consider scenarios where one spouse outlives the other, and potentially pays higher taxes under the single filing status, for a long time. Losing marriage tax benefits also commonly happens when a couple gets a divorce and former spouses subsequently file under the single status. All divorcing spouses should have a tax plan for post-divorce life. Unfortunately, tax planning is a frequently overlooked aspect of divorce.

As a romantic tax-planner, I like to believe couples marry to have and to hold community property, for better or for worse tax brackets, for richer, for poorer, in sickness and in health, to love and to cherish, until forced by death to use the single tax-filing status. At each of life’s turning points, I hope individuals and families make informed decisions and the most of their opportunities along the way.

More Tax Advice From Our Partners at TurboTax.com:

Should You and Your Spouse File Taxes Jointly or Separately?When Married Filing Separately Will Save You TaxesHow Changes in Your Life Can Save You Money7 Tax Advantages of Getting MarriedEditor’s Note: Jean-Luc’s articles are not intended as tax, legal or financial advice for any particular individual. They’re information only. The ideas mentioned may not be right for you. The content was reviewed for tax accuracy by a TurboTax CPA expert.