growth stocks

Don’t give up on growth investing just yet. After a rough start to the year, there’s plenty of opportunity in beaten-down growth stocks – including in these top picks.Growth investing came to a crashing halt in the early going of 2022, but investors shouldn’t give up on beaten down stocks with high upside just yet, says the team at UBS Research Management.

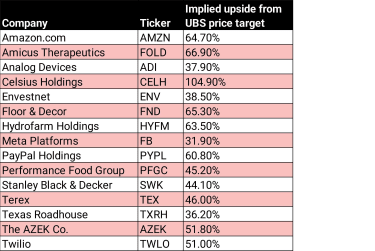

Working in coordination with the firm’s strategists and analysts, the UBS team came up with a list of 15 growth stocks they say look more attractive than ever amid the market’s weak start to the year.

The researchers screened the market for Buy-rated stocks forecast to increase operating earnings at compound annual growth rates of at least 10% through 2024. At the same time, they looked for cheap stocks, or shares trading at discounts to their own five-year averages. Lastly, they stuck to names with high upside, based on analysts’ price targets.

Adherents of growth investing looking for bargain names promising lots of upside should take note of the stocks UBS found. Among the highlights:

Envestnet (ENV, $73.83) kicked off the new year with a thud. Nevertheless, UBS – and much of the rest of the Street – says ENV remains an outstanding idea for a growth investing portfolio. Envestnet’s flagship product is an advisory platform that integrates services and software used by financial advisors in the wealth management segment. Bullish analysts like Envestnet’s ability to both scale and squeeze more sales out of its user base.Power- and hand-toolmaker Stanley Black & Decker (SWK, $176.14) has something adherents of growth investing don’t often find in a stock: A deeply compelling valuation. SWK stock trades at just 14.6 times analysts’ 2022 earnings per share (EPS) estimate, per S&P Global Market Intelligence. UBS analyst Markus Mittermaier notes that puts SWK’s valuation at a near-record low vs. the S&P 500 – and that, in turn, spells outperformance ahead.In addition to being one of UBS’s top growth investing ideas for high upside, Terex (TEX, $43.09) also makes the list of best industrial stocks to buy for 2022. Best known for its aerial work platforms (AWP) segment and materials processing (MP) segment, Terex also makes equipment such as concrete mixer trucks. As such, the bull case stands on the $1.2 billion Infrastructure Investment and Jobs Act, as well as already robust backlogs in the company’s AWP and MP businesses. Share prices as of Feb. 1. UBS’s implied upside is based on stock prices and price targets as of Jan. 21.

Have a look at the table below to see all 15 of UBS Research Management’s growth investing stock picks to buy now:

Courtesy of UBS Global Research as of Jan. 21