stocks to buy

UBS gathered the top stock ideas from its North American analysts to compile a list of its highest-conviction ideas in this tumultuous environment.It’s a well-worn cliche that investors are supposed to buy when there’s blood in the streets. In an apparent effort to help clients follow that counsel, the strategists at UBS Research Management recently went looking for the top stocks to buy amid this year’s market carnage.

In late May, as stocks were reeling through their longest stretch of consecutive weekly declines in decades, the strategy team at the UBS Global Research and Evidence Lab put out a call to the firm’s North American industry analysts, asking for their highest-conviction stocks.

The strategists collected scores of names, and then focused on top stocks where UBS analysts have “a truly differentiated view vs. the consensus, and where we have interesting or proprietary data sources.”

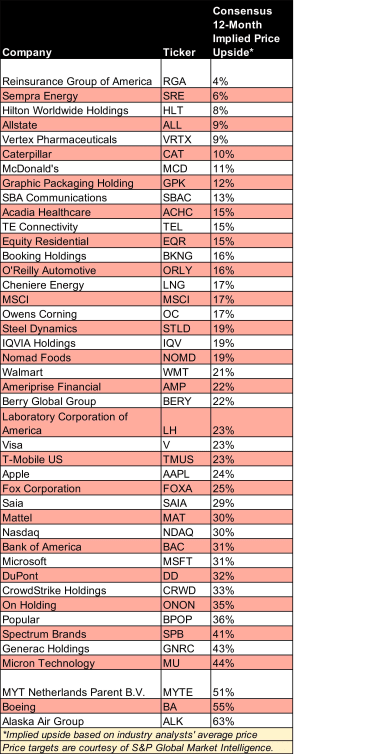

The process produced what UBS calls its “highest-conviction calls in a volatile market,” which we lay out in a table below.

Note that the stocks, all of which are Buy-rated by UBS, are listed by Wall Street’s consensus implied price upside, from lowest to highest. That is, we used industry analysts’ average 12-month price targets rather than target prices provided solely by UBS.

The idea was to inject a little “wisdom of crowds” into the process.

Before we get to the table of UBS’s top stocks to buy now, let’s have a look at what their analysts have to say about some of the names that Wall Street as a whole likes the best, too:

Alaska Air Group (ALK, $48.88): “We’ve maintained ALK as our top pick in U.S. airlines in 2022 given they navigated COVID-19 particularly well by avoiding shareholder dilution and shoring up their balance sheet/improving net debt,” writes UBS analyst Myles Walton. “The cost side of the equation is a bit more opaque given general inflationary concerns, but ALK is better protected than most due to their hedge portfolio.”Micron Technology (MU, $69.94): “We are structural bulls on memory and on MU in particular as DRAM demand remains levered to markets such as cloud computing, 5G and autos, all of which have a long runway of growth,” writes UBS analyst Timothy Arcuri. “We believe that as fundamentals and cycles prove to be more durable, there is a significant re-rating potential.”Generac Holdings (GNRC, $268.88): “GNRC provides a relatively uniquely diversified opportunity to which investors can gain exposure to the rapidly growing solar and storage market with underlying earnings stability from GNRC’s core business of recession-resilient home standby power,” writes UBS analyst Jon Windham. “Dominant market share and strong demand for home stand-by power have insulated already high residential product margins from inflationary cost pressures.”Here’s a look at the rest of UBS’s top stocks for a volatile market:

UBS