Jennifer Sor

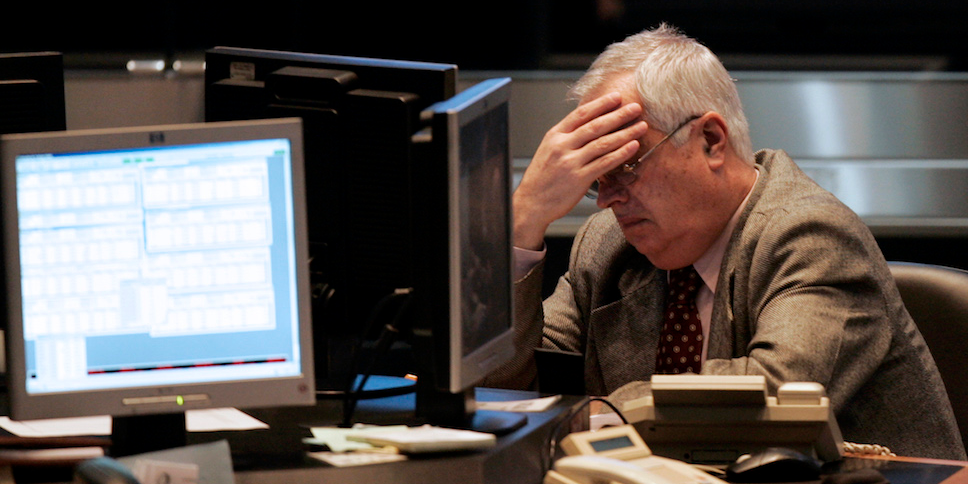

September marks the second straight losing month for stocks. Reuters / Marcos Brindicci US stocks traded mixed on Friday as a government shutdown looked increasingly likely. The session also closed out a dismal September, with the S&P 500 losing 5% to mark its worst month of 2023. For the third quarter, the benchmark index lost about 4%. Loading Something is loading.

Thanks for signing up!

Access your favorite topics in a personalized feed while you’re on the go.

US stocks traded mixed on Friday as investors initially cheered better-than-expected inflation news but grew jittery as a government shutdown appeared more likely.

The core personal consumption expenditure price index, which is the Fed’s preferred measure of inflation, rose 0.1% in the month of August, less than the expected 0.2% monthly increase.

September marked the second straight losing month for stocks. The S&P 500 slid around 5% to mark its worst month of 2023, while the Dow lost about 4%, and the Nasdaq sank 6%. For the third quarter, the S&P 500 and Nasdaq were down about 4%, and the Dow 3%.

“It may be an understatement to say it has been a rough month for stocks,” LPL Financial chief technical strategist Adam Turnquist said in a statement on Friday. “However, in terms of performance, nothing really qualifies out of the ordinary. Since 1950, the S&P 500 has historically declined in September 55% of the time, posting an average loss of around 3.8%. The VIX historically peaks on the year around week 40, suggesting next week could be a top for implied volatility.”

Here’s where US indexes stood shortly at the 4:00 p.m. closing bell on Friday:

S&P 500: 4,288.05, down 0.27%Dow Jones Industrial Average: 33,507.50, down 0.47% (158.84 points)Nasdaq Composite: 13,219.32, up 0.14%Here’s what else happened today:

US Treasury yields could hit 5% in “literally weeks,” according to Bill Ackman.Authorities are investigating LVMH billionaire Bernard Arnault in a potential money laundering probe.Russia and Saudi Arabia have likely made close to $3 billion this quarter due to rising oil prices.The Fed is throwing “kerosene on the fire” with its aggressive rate hikes, billionaire investor Barry Sternlicht said.Steep wage hikes for union workers mark the “final echo”of the inflation surge, according to Goldman Sachs.In commodities, bonds, and crypto:

West Texas Intermediate crude oil slid 1.05% to $90.75 a barrel. Brent crude, the international benchmark, dropped 3.51% to $92.05 a barrel. Gold fell 0.89% to $1,848.29 per ounce. The yield on the 10-year Treasury bond slipped three basis points to 4.567%. Bitcoin dipped 0.24% to $26,916. Read next

MI Exclusive Stock market news today daily market wrap More…