Matthew Fox

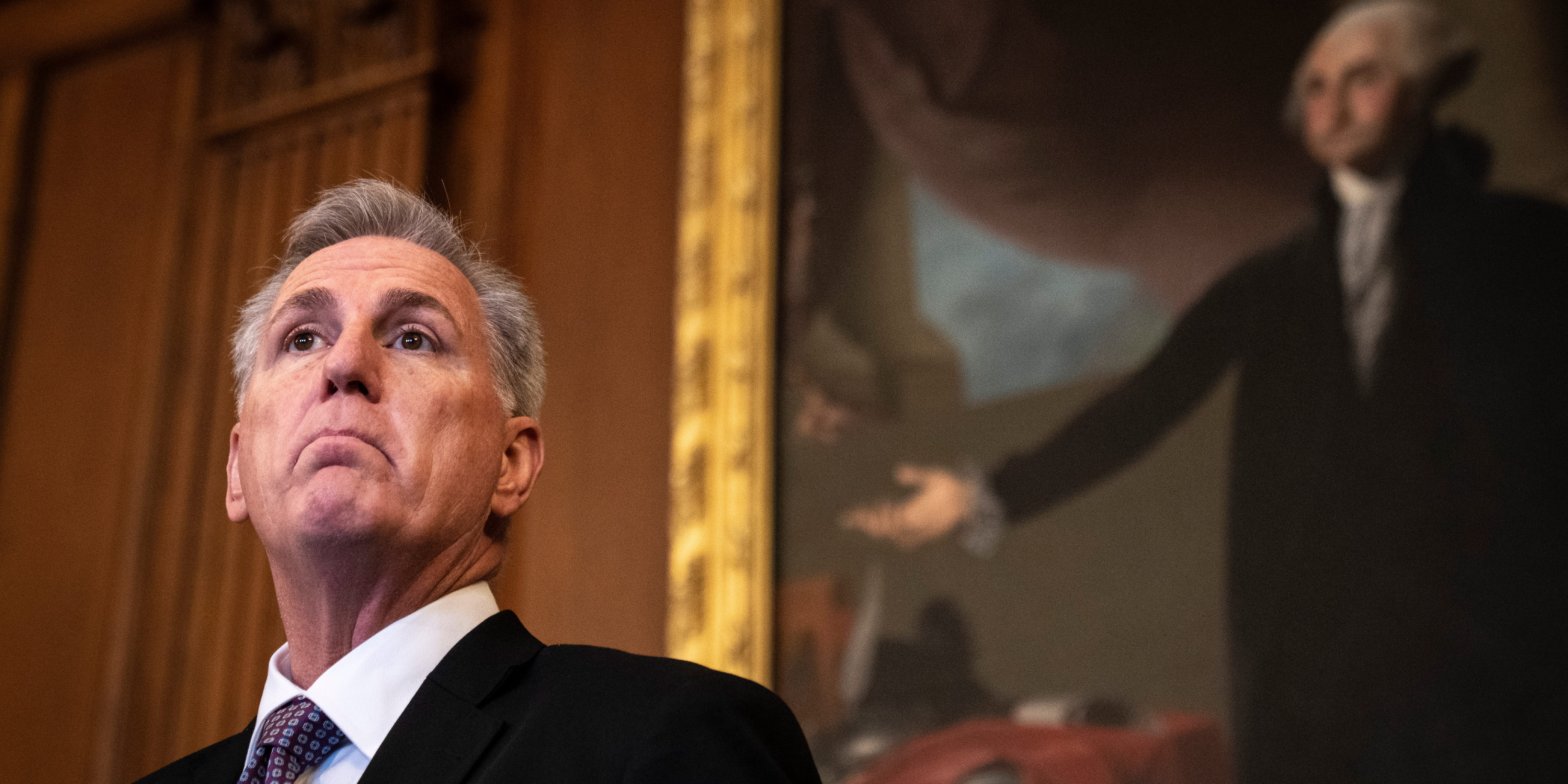

Speaker of the House Kevin McCarthy (R-CA) speaks during a bill signing at the U.S. Capitol March 9, 2023 in Washington, DC. Drew Angerer/Getty Images US stocks fell on Wednesday as investors grow weary of the ongoing debt ceiling standoff between Democrats and Republicans.Treasury Secretary Janet Yellen has warned that the government could run out of money as early as June 1.Recent negotiations between President Biden and House Speaker Kevin McCarthy have shown little progress. Loading Something is loading.

Thanks for signing up!

Access your favorite topics in a personalized feed while you’re on the go.

US stocks declined on Wednesday as investors grow increasingly concerned about a US debt default as President Joe Biden and House Speaker Kevin McCarthy make little progress on negotiations.

Treasury Secretary Janet Yellen has warned Congress that the US government could run out of money to pay some of its bills by as early as June 1, leaving just a week left for lawmakers to strike a deal.

Complicating matters further is a scheduled recess in Congress for the upcoming Memorial day weekend, meaning crunch time for a deal could happen just days before the estimated “X-date.”

While Democrats have made concessions to Republicans on limiting government spending for two years, Republicans reportedly want more from Democrats, including potential work requirements for food stamp recipients and a cancellation of Biden’s student loan forgiveness program.

Wednesday’s sell-off in the S&P 500 extended a more than 1% decline in the index on Tuesday.

Here’s where US indexes stood shortly after the 9:30 a.m. ET opening bell on Wednesday:

S&P 500: 4,126.61, down 0.46% Dow Jones Industrial Average: 32,927.58, down 0.39% (127.93 points)Nasdaq Composite: 12,506.81, down 0.43% Here’s what else is happening this morning:

The slump in house prices around the world might be nearly over despite central banks’ rapid tightening campaigns pushing up mortgage rates, according to a recent note from Goldman Sachs.Elon Musk offered a word of warning about dogecoin Tuesday, saying that investors shouldn’t pour all their wealth into the meme token.US regional banks are “certainly” going to face a credit crunch – and that will erode growth in the world’s largest economy, according to “Dr. Doom” economist Nouriel Roubini.Goldman Sachs CEO David Solomon warned yet again that US inflation will be prove stickier than expected, and that could lead to more interest rate hikes from the Federal Reserve.In commodities, bonds and crypto:

West Texas Intermediate crude oil jumped 1.84% to $74.25 per barrel. Brent crude, oil’s international benchmark, rose 1.68% to $78.13.Gold rose 0.24% to $1,979.30 per ounce.The yield on the 10-year Treasury fell 2 basis points to 3.68%.Bitcoin dropped 1.96% to $26,690, while ether fell 2.04% to $1,816. Read next

MI Exclusive Stock market news today stock market news More…