Phil Rosen

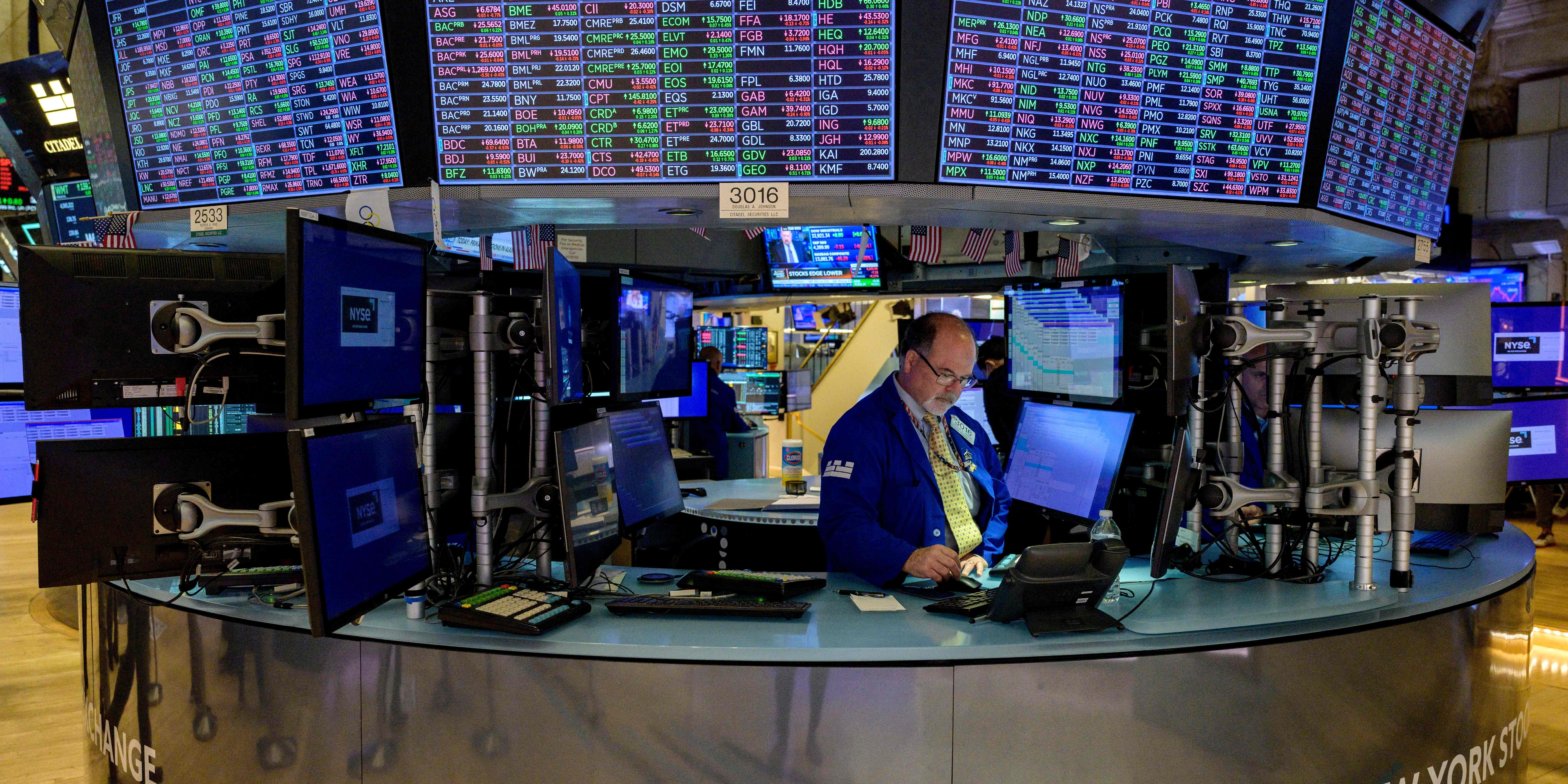

Gen Z is putting more stock into careers in finance, with one in four recent graduates considering the field a top career sector. Photo by ANGELA WEISS/AFP via Getty Images Stocks dropped Tuesday, with the Dow sliding more than 160 points and the Nasdaq shedding more than 120. Moody’s bank downgrades late Monday added to the uncertain macroeconomic landscape. Bank stocks moved lower, and investors will look ahead to Thursday’s CPI report. Loading Something is loading.

Thanks for signing up!

Access your favorite topics in a personalized feed while you’re on the go.

US stocks declined on Tuesday, with Moody’s downgrade of nearly a dozen US lenders pulling bank stocks lower.

The ratings giant also put a handful of larger banks on review notice, including US Bancorp, Bank of New York Mellon, and Northern Trust. The smaller lenders that Moody’s officially downgraded include Pinnacle Financial, Webster Financial, and M&T Bank.

“US banks continue to contend with interest rate and asset-liability management (ALM) risks with implications for liquidity and capital, as the wind-down of unconventional monetary policy drains systemwide deposits and higher interest rates depress the value of fixed-rate assets,” Moody’s analysts wrote in a Monday note.

Meanwhile, corporate earnings continue to surprise to the upside. Already, 89% of S&P 500 companies have reported for the second quarter, and nearly 80% have beaten Wall Street expectations, FactSet data shows.

On Thursday, investors will get the Consumer Price Index report for July, which will help inform the Federal Reserve’s next policy move.

Here’s where US indexes stood as the market closed 4:00 p.m. on Tuesday:

S&P 500: 4,499.38, 0.42%Dow Jones Industrial Average: 35,314.49, down 0.45% (158.64 point)Nasdaq Composite: 13,884.32, down 0.79%Here’s what else is going on:

US companies are barreling toward a $1.8 trillion wall of maturing corporate debt.Markets are betting on a soft landing, but the economy still faces three key hurdles.A new class of weight loss drugs is powering massive stock gains for Novo Nordisk and Eli Lily.Bank of America said rising interest rates could threaten stock gains.These four sectors arebest-positioned for the second half of the year, according to JPMorgan.Home prices this summer have hit a new all-time high in most of the US. In commodities, bonds, and crypto:

Oil prices climbed, with West Texas Intermediate up 107% to $82.82 a barrel. Brent crude, the international benchmark, inched higher 0.84% to $86.05 a barrel.Gold edged lower 0.50% to $1,960.20 per ounce.The 10-year Treasury yield ticked lower by five basis points to 4.018%.Bitcoin moved higher 2.74% to $29,861.01. Read next

MI Exclusive Markets stock market news More…