US stocks climbed and the Nasdaq snapped a seven-session losing streak Wednesday as traders took in fresh economic indicators.

The Beige Book survey found that US economic growth is set to weaken further, while inflation is showing signs of cooling off. Fed Vice Chair Lael Brainard said policymakers will fight inflation “for as long as it takes” but also noted “risks associated with overtightening.” Loading Something is loading.

US stocks climbed and the Nasdaq snapped a seven-session losing streak Wednesday as traders took in fresh economic indicators.

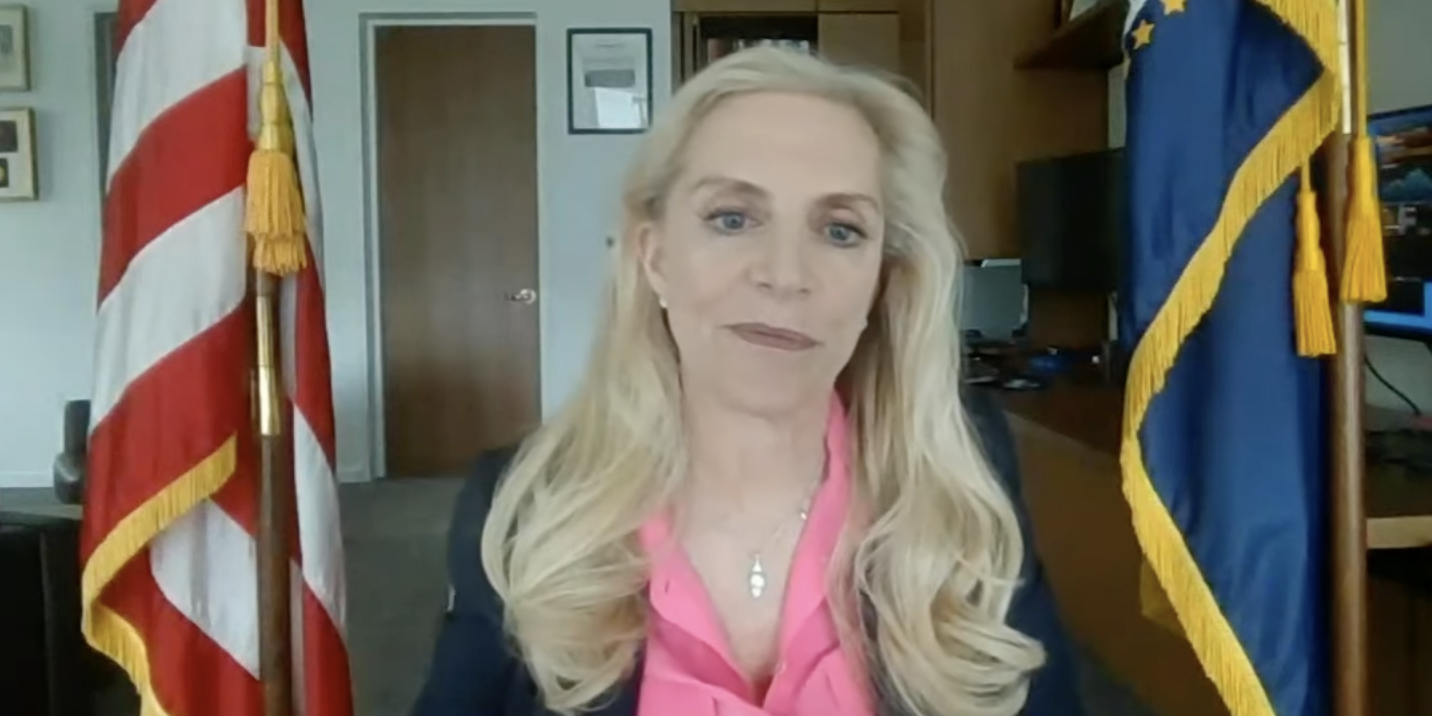

The Federal Reserve’s Beige Book survey found that US economic growth is set to weaken further over the next year, while inflation is showing signs of cooling off. That could give policymakers some leeway to be less hawkish. Fed Vice Chair Lael Brainard said the central bank will fight inflation “for as long as it takes” but also noted “risks associated with overtightening.”

Early Wednesday, a Wall Street Journal article suggested that a 75-basis-point rate hike loomed in September, based on Fed Chair Powell’s commitment to reduce inflation. That would mark the third straight increase of that size.

Here’s where US indexes stood as the market closed 4:00 p.m. on Wednesday:

S&P 500: 3,979.88, up 1.83%Dow Jones Industrial Average: 31,581.28, up 1.40% (435.98 points)Nasdaq Composite: 11,791.90, up 2.14%US stocks are set to overcome international headwinds and outperform their global peers moving forward, according to top economist Mohamed El-Erian. He added that the West is “set to suffer quite a bit” in the next one to two years, but overall is in a good spot to consolidate gains.

Russia is set to restrict retail investors from buying foreign securities from “unfriendly” countries that have imposed sanctions. The Bank of Russia said more than 5 million investors had their holdings in foreign securities frozen as a result of sanctions.

Meanwhile, natural gas prices could soar even higher as European and Asian suppliers race to charter LNG tankers.

Citigroup’s global head of commodities, Ed Morse, told Bloomberg that Russia may actually have to start selling natural gas back to Europe soon as alternative markets may not suffice. Plus, doing so would be a way for Moscow to maximize its profits.

RBC’s commodity chief, Helima Croft, added that a total Russian gas shutoff would plunge Europe into a “multi-winter” crisis.

In currencies, the strengthening dollar has resulted in China’s foreign exchange reserves hitting their lowest level since 2018. Data from the People’s Bank of China showed reserves fell by the equivalent of $49.2 billion to $3.0549 trillion at the end of August.

Oil prices plunged, with West Texas Intermediate down 5.27% to $82.30 a barrel. Brent crude, the international benchmark, fell 5.02% to $88.17 a barrel.

Gold edged higher 0.88% to $1,727.90 per ounce. The 10-year yield tumbled 8 basis points to 3.26%.

Bitcoin rose 1.01% to $19,055.55.

Deal icon An icon in the shape of a lightning bolt. Keep reading

More: MI Exclusive Markets Stock market news today Fed Chevron icon It indicates an expandable section or menu, or sometimes previous / next navigation options.