Ahead of the Fed’s anticipated interest rate hike next week, Wall Street investors are torn on the outlook for stocks.Some Wall Street strategists expect a sharp rebound in stocks by year-end as inflation cools off.That conflicts with the view of Ray Dalio and Scott Minerd, who say the S&P 500 can fall an additional 20%. Loading Something is loading.

Ahead of the Federal Reserve’s highly anticipated 75 basis point interest rate hike next week, Wall Street is torn as to where the stock market is headed next.

Concerns are growing that the Fed will over tighten interest rates at a time when the economy is showing signs of weakening, and that could lead to a massive stock market decline.

But persistent inflation leaves some professional investors to believe that the Fed needs to ignore stock market volatility and maintain its credibility by continuing to raise rates until inflation shows adequate signs of cooling off.

“Lessons from the 1970’s tell us that premature easing could result in a fresh wave of inflation, and that market volatility in the short-run may be a smaller price to pay,” Bank of America’s Savita Subramanian said on Friday.

Here’s where the bulls and bears of Wall Street stand on inflation, interest rates, and where the stock market is going into year-end ahead of next week’s FOMC meeting.

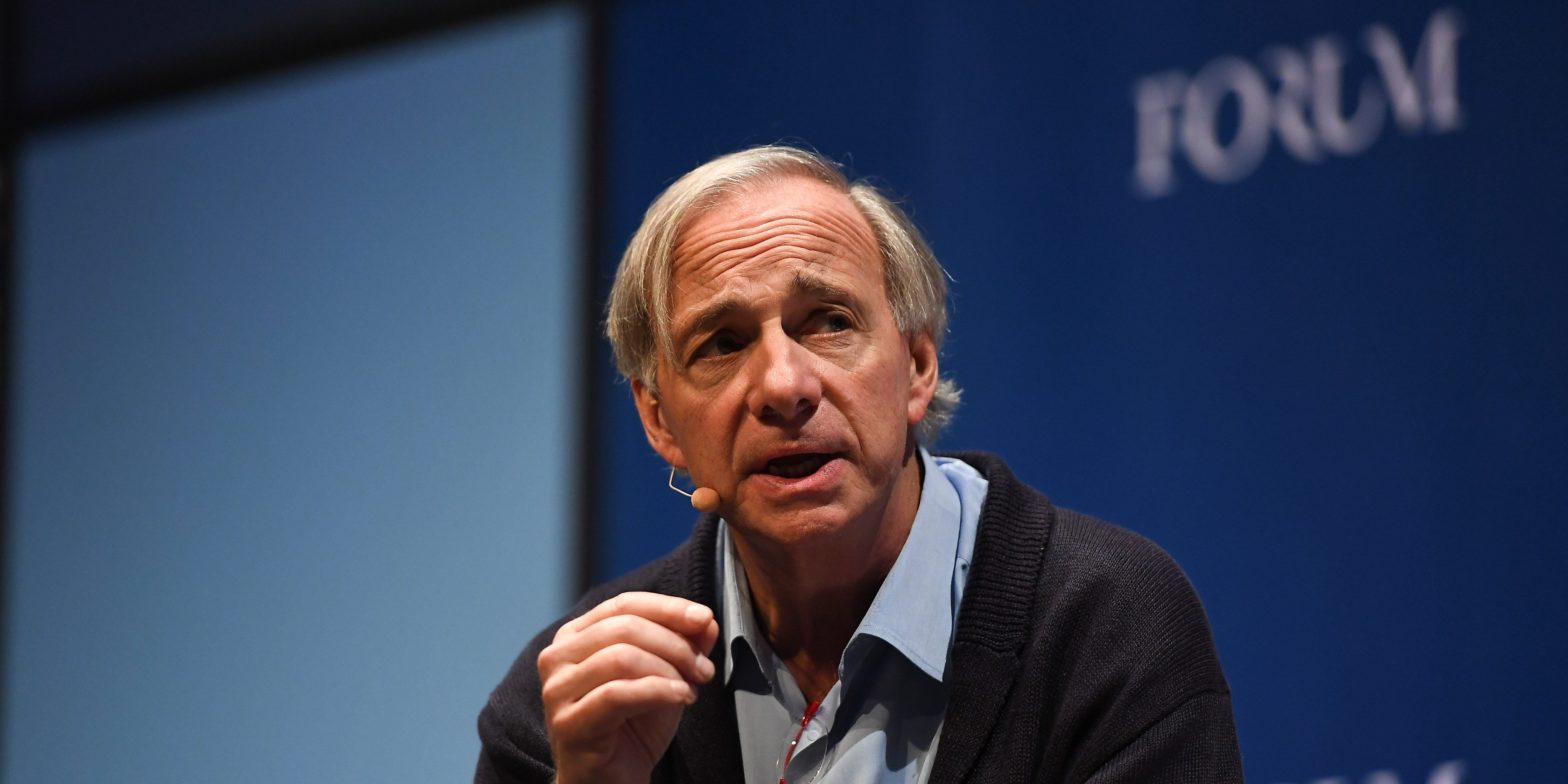

The Bears1. Ray Dalio: Expect a 20% sell-off in the stock market if rates keep rising.

Bridgewater Associates hedge fund manager Ray Dalio. Eoin Noonan/Web Summit via Getty Images

“With inflation well above what people and central banks want and the unemployment rate low, it’s obvious that inflation is the targeted problem, so it’s obvious that the central banks should tighten monetary policy. Everything will flow from that,” Dalio said on Wednesday.

“I estimate that a rise in rates from where they are to about 4.5% will produce about a 20% negative impact on equity prices,” Dalio said.

2. Scott Minerd: A 20% decline in the S&P 500 could happen by mid-October.

Guggenheim chief investment officer Scott Minerd. Photo by PATRICK T. FALLON/AFP via Getty Images

“It’s really stark to see the price-to-earnings ratio where it is… given where seasonals are, and how far out of line we are historically with where the p/e is, we should see a really sharp adjustment in prices very fast,” Minerd said last week.

“It appears people are ignoring the macro backdrop, monetary policy backdrop, which would basically indicate that the bear market is intact. We may very well already be in a recession… with YoY core PCE now at 4.6% and S&P 500 trading at ~19x, we should see stocks fall another 20% by mid-October,” Minerd said.

3. Jeff Gundlach: The credit market suggests both the economy and stock market are in trouble.

DoublelLine Capital founder Jeff Gundlach. Courtesy of Advisor Circle

“The action of the credit market is consistent with economic weakness and stock market trouble. I think you have to start becoming more bearish,” Gundlach said on Tuesday, adding that he agrees with Scott Minerd’s call that stocks can fall 20% soon.

“You always want to own stocks, but I’m a little on the lighter side…buy long-term Treasurys, because the deflation risk — in spite of the fact that the narrative today is exactly the opposite — the deflation risk is much higher today that it’s been for the past two years,” Gundlach said. Gundlach believes the Fed should hike interest rates by just 25 basis points next week.

The Bulls1. Tom Lee: Inflation has already peaked and that means you should buy stocks.

Fundstrat founder Tom Lee. Cindy Ord/Getty Images “Even for those in the ‘inflationista’ camp or even the ‘we are in a long-term bear’ camp, the fact is, if headline CPI has peaked, the June 2022 equity lows should be durable,” Lee said on Friday.

August’s higher-than-expected CPI report “does not mean stocks have to break below the June lows,” Lee said, as he reiterated his view that S&P 500 will rally more than 20% to new highs by year-end.

2. Jeremy Siegel: Inflation is falling and whoever wanted to get out of stocks already has.

Wharton professor Jeremy Siegel is a long-time market commentator. REUTERS/Steve Marcus

“It seems like everyone that wants to be out of the market is out, and everyone that wants to be tactical is short. Therefore the surprises are going to be to the upside… when everyone has sold, only the buyers are left, and the shorts are exposed,” Siegel said on Monday.

Siegel said if the Fed says rates will be higher for longer, “That would be a policy mistake. I think they’re going to look at the economy, and I hope they understand what the statistics are and what on the ground inflation is.”

3. Marko Kolanovic: The stock market will rally as inflation resolves itself.

JPMorgan’s chief global strategist Marko Kolanovic. Hollis Johnson/Insider

“Given the lag it takes for rate hikes to work through the system, and with just one month before very important US elections, we believe it would be a mistake for the Fed to increase risk of a hawkish policy error and endanger market stability,” Kolanovic said on Monday.

“Our expectation that the global economy will stay out of recession, increasing fiscal stimulus, and still very low investor positioning and sentiment should thus continue to provide tailwinds for risky assets, despite the more hawkish central bank rhetoric recently,” Kolanovic said.