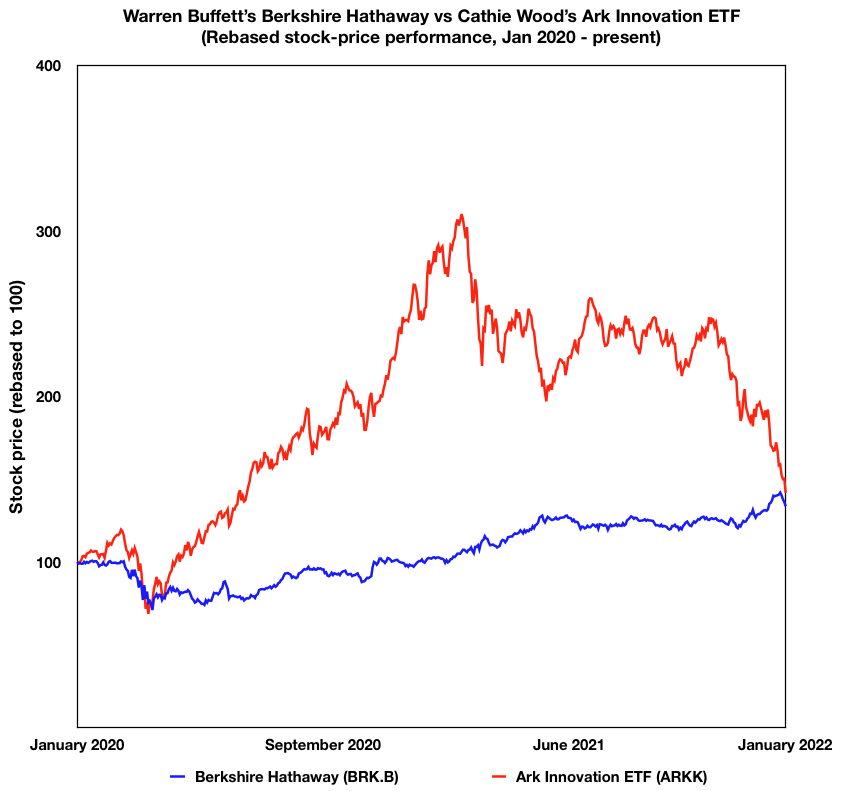

Warren Buffett has only lagged Cathie Wood by a small margin since the start of 2020. Berkshire Hathaway stock has climbed 34%, while the Ark Innovation ETF has risen 42%. Wood’s flagship ETF has been hit by investors selling growth stocks ahead of interest-rate hikes. Sign up here for our daily newsletter, 10 Things Before the Opening Bell. Cathie Wood eclipsed Warren Buffett in some people’s minds due to her stellar returns during the first year of the pandemic. However, the Ark Invest chief’s flagship fund has crashed back to Earth in recent months, meaning it has only outperformed Buffett’s Berkshire Hathaway by a small margin over the past two years.

Shares of Wood’s Ark Innovation ETF (ARKK) more than tripled in price between January 2020 and February 2021, as its bets on Tesla and other fast-growing, disruptive companies skyrocketed in value. However, ARKK shares have plunged by about 40% since last November, and are down about 55% from their peak.

A key driver of the decline has been investors pulling their cash out of growth stocks, and piling into value stocks and other safer assets instead, as they expect the Federal Reserve to hike interest rates this year to curb inflation.

Meanwhile, Berkshire “B” shares have steadily climbed over the past two years, and hit a record high earlier this month. They’re now up 34% since the start of 2020, compared to ARKK’s 42% gain over the same period. In other words, the performance gap between the two stocks has narrowed to only 8 percentage points — a fraction of the 200-point difference in February 2021.

The Financial Times highlighted the comparable performance of the two stocks in a recent story.

The striking reversal of fortunes underlines the differences between Buffett and Wood’s investing strategies. The Ark chief’s favorite holdings include Zoom and Coinbase, two tech companies that respectively capitalized on the shift to remote working and the boom in cryptocurrency trading during the pandemic.

In contrast, Berkshire owns a raft of proven, profitable, low-tech businesses. Its subsidiaries include Geico, See’s Candies, and the Burlington Northern railroad. It also holds multibillion-dollar stakes in Bank of America, Coca-Cola, American Express, and Kraft Heinz.

Berkshire stock has undoubtedly benefited from the conglomerate’s massive Apple stake, which has roughly tripled in value over the past few years to about $145 billion. Yet it’s fair to say that Buffett has placed much safer bets than Wood, and has still enjoyed a similar payoff in the pandemic era to date.

Read more: Warren Buffett is ready to deploy $80 billion if the market crashes this year. 7 experts say the investor should trim his Apple stake, acquire luxury brands, or buy some blue-chip stocks in the meantime.

Here’s the relative performance of the two stocks since the start of 2020, adapted from the Financial Times’ chart:

Markets Insider More: MI Exclusive Markets Stocks Warren Buffett Chevron icon It indicates an expandable section or menu, or sometimes previous / next navigation options.