Theron Mohamed

Warren Buffett. Reuters Warren Buffett, Michael Burry, and other top investors revealed their Q2 stock portfolios this week. Ray Dalio, Stanley Druckenmiller, George Soros, Jim Simons, and Bill Miller made some notable moves. Here are the key trades that seven elite investors made last quarter. Loading Something is loading.

Warren Buffett, Michael Burry, and other leading investors filed portfolio updates this week, revealing which stocks they bought and sold in the second quarter.

Ray Dalio doubled down on Big Tech, while Stanley Druckenmiller cut his exposure to America’s largest technology companies. George Soros purchased a stake in Tesla, whereas Jim Simons halved his bet on Elon Musk’s carmaker.

Meanwhile, Buffett piled into oil stocks, Burry virtually liquidated his portfolio, and Bill Miller trimmed his wager on Bed Bath & Beyond.

Here are 7 elite investors’ most striking trades last quarter: Michael Burry sold virtually all of his stocks

Michael Burry attends “The Big Short” New York premiere at Ziegfeld Theater on November 23, 2015 in New York City. Andrew Toth/Getty Images Michael Burry, the investor of “The Big Short” fame, effectively liquidated his US stock portfolio in the second quarter.

The Scion Asset Management boss sold all of the 11 holdings he disclosed at the end of March, and only added a single position. Those moves slashed the value of his portfolio from $165 million to $3.3 million.

Burry has repeatedly warned of a historic bubble in asset prices, and predicted an epic market crash. He may well have dumped his stocks in anticipation of a devastating downturn.

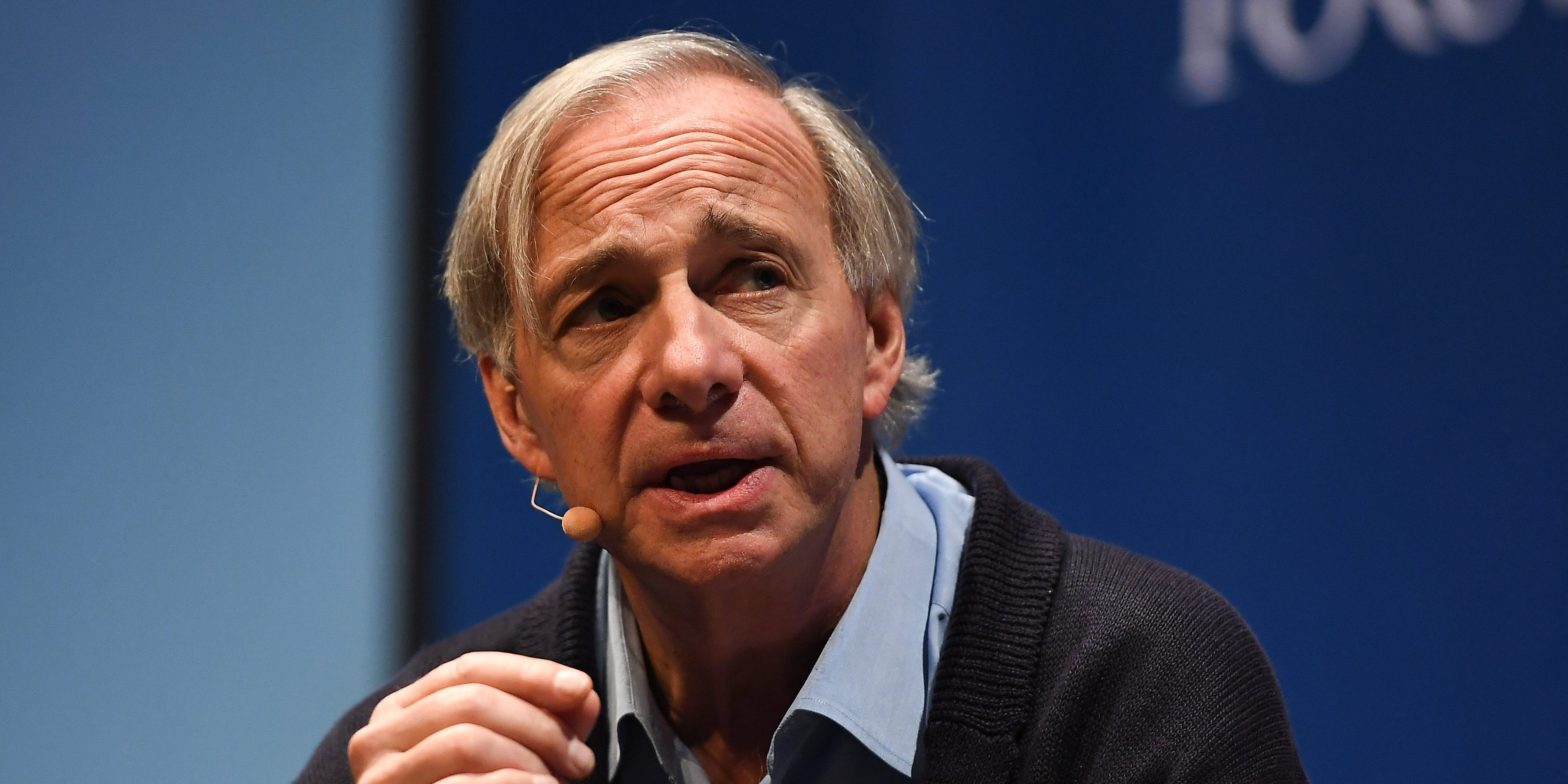

Ray Dalio piled into Big Tech

Eoin Noonan/Web Summit/Getty Images Ray Dalio’s Bridgewater Associates ramped up its Big Tech bets in the second quarter.

The billionaire investor’s hedge fund grew its Meta Platforms stake more than 50-fold, and its Alphabet position by over 25-fold. It boosted each position’s value to roughly $100 million as of June 30.

Dalio and his team also raised their bets on Apple, Microsoft, and Netflix, and took a new position in Amazon. They may have determined some of the biggest tech stocks were oversold, as the Nasdaq slumped 22% last quarter.

Stanley Druckenmiller bailed on some key tech stocks

Getty Images/ Scott Olson Stanley Druckenmiller and his team sold their entire stake in Amazon, and slashed their Microsoft holdings by about 25% last quarter.

His Duquesne Family Office counted those two bets as its second- and fourth-largest positions at the end of March, when they were valued at $199 million and $315 million respectively. The fund may have sold in anticipation of a deeper tech sell-off in the coming months; Druckenmiller said in June that the bear market was far from over.

George Soros took a stake in Tesla

George Soros REUTERS/Bob Strong George Soros’ family office established a stake in Tesla last quarter. It bought 30 million shares of Elon Musk’s automaker, which were worth $20 million on June 30. It may have decided the stock was in bargain territory, as it dropped by 38% in the period.

Soros Fund Management also slashed its bet on Rivian by nearly a third, perhaps indicating it sees the company as overvalued, or it’s more bullish about Tesla’s prospects in the electric-vehicle market. The startup’s stock price also halved in the period, cutting the position’s value from $1.3 billion to $459 million.

Bill Miller cut his bet on Bed Bath & Beyond

Investor Bill Miller, co-founder, CIO and fund manager for Miller Value Partners Fox Business Bill Miller’s fund pared its stake in Bed Bath & Beyond, a favorite of meme-stock traders, in the first six months of this year.

Miller Value Partners reduced its position from a peak of 171,000 shares to 136,000 shares in the period. The holding was worth as much as $4 million at Wednesday’s intraday high of $30 a share, but is now valued at a fraction of that amount following the retail stock’s sell-off this week.

Bed Bath & Beyond’s first-quarter earnings in May showed a sharp decline in year-on-year sales, bigger losses, and a shrinking cash pile in the first quarter, which may have prompted Miller’s fund to slash its position.

Jim Simons halved his Tesla stake and exited GameStop and AMC

TED Jim Simons’ Renaissance Technologies halved its Tesla holdings, and exited meme stocks GameStop and AMC Entertainment last quarter.

The quantitative hedge fund’s Tesla sales, coupled with the automaker’s stock plunging 22% in the period, reduced the value of its position by more than two-thirds to $504 million.

RenTech disposed of its GameStop stake despite growing it by 118-fold in the first quarter. It also sold its remaining AMC shares after cutting that position by 61% between January and March.

Simons’ fund largely relies on algorithms to determine its moves, so its purchases and disposals likely reflect market volatility and trading patterns more than company fundamentals.

Deal icon An icon in the shape of a lightning bolt. Keep reading

More: MI Exclusive Markets Stocks Warren Buffett Chevron icon It indicates an expandable section or menu, or sometimes previous / next navigation options.