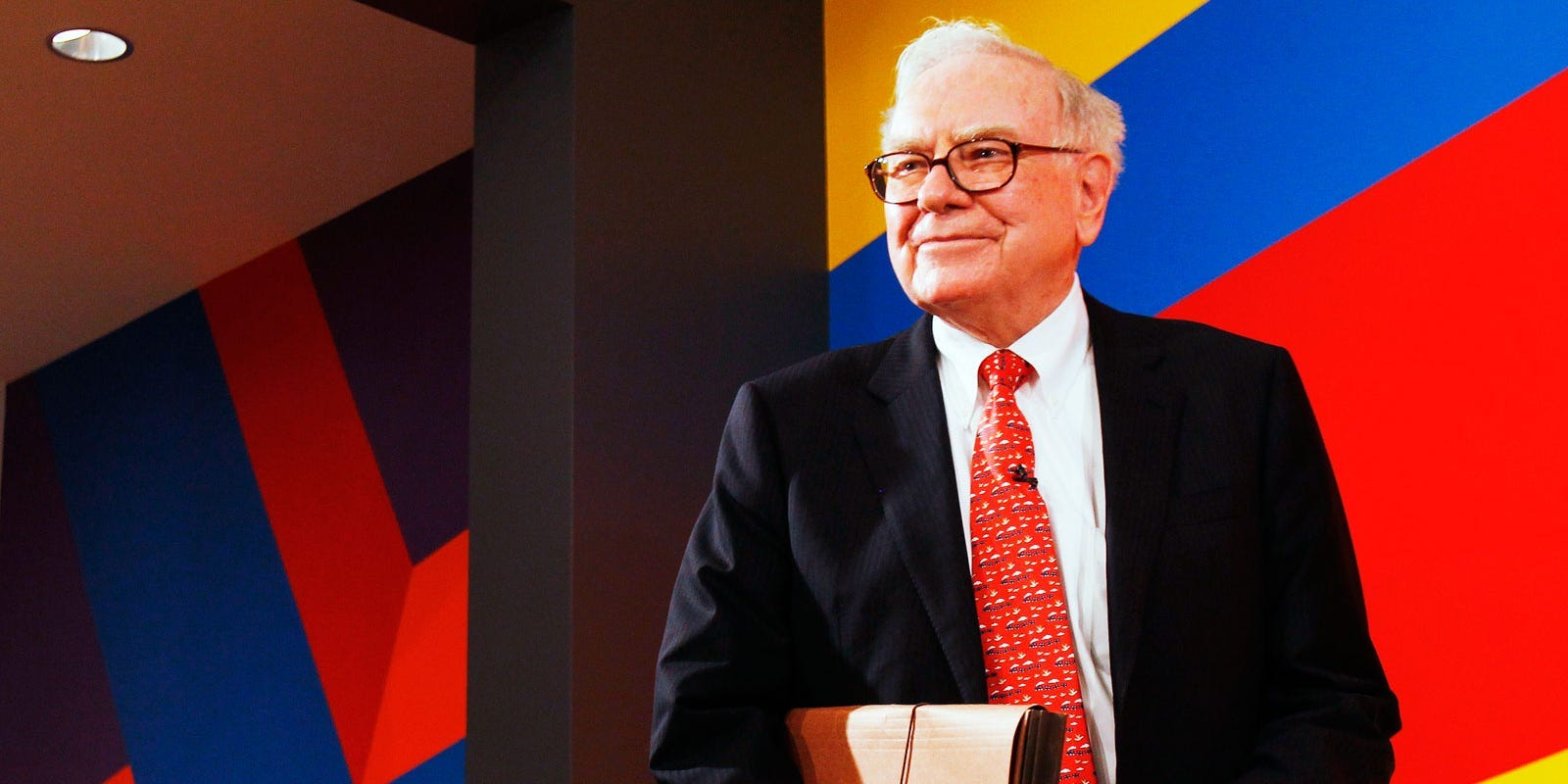

Warren Buffett and Charlie Munger let slip some interesting facts during the Berkshire meeting. Buffett likely has over $250,000 in a single bank account, and spotted red flags at First Republic. Munger pockets $70,000 a year from a $1,000 investment he made 60 years ago. Loading Something is loading.

Thanks for signing up!

Access your favorite topics in a personalized feed while you’re on the go.

Warren Buffett and Charlie Munger weighed in on dozens of hot topics during Berkshire Hathaway’s annual shareholder meeting last week, ranging from the current banking turmoil to the challenges in commercial real estate, and Apple’s strengths to Elon Musk’s dreams.

Berkshire’s billionaire CEO and vice-chairman also let slip a variety of notable facts. Buffett said he probably has over $250,000 stashed in a single bank account, while Munger collects $70,000 a year from a $1,000 investment he made six decades ago.

The pair also preferred banks to insurers at one point, and planned to own a bunch of lenders before the passage of a law stopped them.

Here are six interesting nuggets from the Berkshire meeting:

1. Unmatched assetsBerkshire held an astounding $504 billion in net assets on March 31.

“Now what might surprise you is that there’s no other company in the United States that has a number that is that large,” Buffett said.

The Berkshire chief noted that doesn’t necessarily mean Berkshire is the most valuable business in America. Other corporations might have even greater shareholders’ equity if they had repurchased fewer shares in recent years, he said.

2. Munger’s gusherMunger receives $70,000 a year from oil royalties he purchased for only $1,000 in 1962, he disclosed during the meeting.

Buffett’s 99-year-old business partner has likely raked in north of $1 million from the investment over the past six decades. He only got wind of the royalty auction because of a chance encounter during a husband-and-wife golf tournament.

3. Money in the bankBuffett likely has more than $250,000 in a single bank, he said.

The Federal Deposit Insurance Corporation doesn’t guarantee it will refund depositors beyond that amount if their lender fails — a key reason why people have been pulling their money out of regional banks after Silicon Valley Bank and Signature Bank collapsed in March.

“I’ve got my bank, I’ve got my own personal money, and I’m probably above the FDIC limit,” the investor said. “I’ve got it with a local bank, and I don’t worry about it in the least.”

The Berkshire chief was trying to reassure Americans that their government won’t allow depositors to lose any money in a bank failure. But the fact he’s not worried about cash isn’t surprising, given he ranks among the world’s 10 richest people with a net worth of more than $110 billion.

4. Red flags at First Republic Buffett underscored that First Republic, the embattled regional lender which JPMorgan recently acquired, was clearly at high risk of running into problems.

“You could look at their 10-K and you could see that they were offering non-government-guaranteed mortgages in jumbo amounts at fixed rates, sometimes for 10 years,” he said, referring to the bank’s annual report. “That’s a crazy proposition.”

“You don’t give options like that, but that’s what First Republic was doing,” he continued. “It was in plain sight. And the world ignored it until it blew up.”

5. Banks over insurersBerkshire finds its investments using “float” — the difference between premiums collected and claims paid out — from its insurers including Geico, Alleghany, Gen Re, and National Indemnity.

However, Buffett and Munger might have taken a different tack if allowed.

“If the Banking Holding Company Act of 1970 hadn’t been passed, we might have ended up owning a lot of banks instead of a lot of insurance companies,” Buffett said.

Indeed, Berkshire owned a bank in the 1960s but was forced to divest it after the law passed.

“We’ve done okay in insurance,” Buffett said. “But banking was more attractive to us. It was bigger and there were more targets to buy and you could run a perfectly sound bank then.”

6. An ode to Ben GrahamBuffett underscored his deep admiration for Benjamin Graham, his late mentor and former teacher and employer.

“Ben Graham did all kinds of things for me, and he never expected one thing in return,” he said.

The Berkshire chief noted that Graham’s seminal book, “The Intelligent Investor,” has been a mainstay among Amazon’s best-selling titles for many years, consistently ranking around 300th whereas most financial titles quickly drop off the list.

“I wrote Harper Collins a note the other day because they’re bringing out another edition,” Buffett said. “And I asked them how many copies have been sold, and they said the records didn’t go back far enough, but they had 7.3 million copies of this little book that changed my life.”

“Everybody keeps bringing out new books and saying a lot of other things, but they aren’t saying anything that’s as important as what he said in 1949 in this relatively thin, little book,” he continued.

Buffett added that he hopes Berkshire will enjoy similar longevity.

“There’s no reason why it can’t be perpetuated just like Ben’s book, and maybe be an example to other people,” he said. “And if so, we’ll be very happy.”

Read more: Warren Buffett’s businesses are battling historic inflation, hefty interest rates, and tighter lending. 5 Berkshire Hathaway CEOs break down why they’re thriving despite a brutal economic backdrop.