The tax code bestows largesse upon low-income and high-net-worth taxpayers. This begs the question: which group gets the largest largesse? Low-income taxpayers can receive refundable credits, like the Earned Income Tax Credit, which makes it possible to get more money back than is paid in. Wealthy taxpayers greatly benefit from the step-up in basis that wipes out unlimited amounts of capital-gain tax. An unlimited tax absolution is rather generous and quite impossible to max out!

So, who gets what? And what does it mean to each of us?

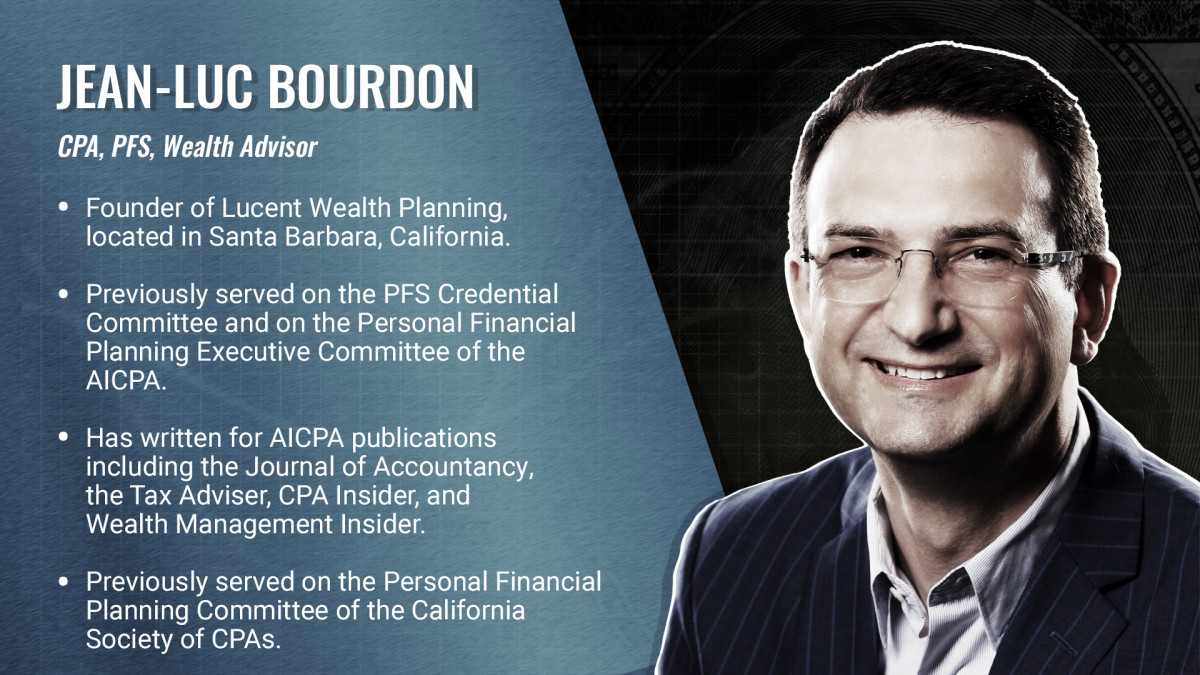

BIO| More About Our CPA and Tax ExpertBio: Jean-Luc Bourdon, CPA, PFS, Wealth Advisor

Who gets the most valuable tax breaks?It’d be fun to survey both groups and ask who they think Uncle Sam’s favorite nieces and nephews are. But for a more reliable answer, let’s turn to the Government Accountability Office. The GOA evaluated tax provisions that are family-oriented, which benefit taxpayers below certain income thresholds, and compared them to wealth-oriented provisions.

Recommended Read: What Are Tax Codes

The conclusion: “Tax expenditures for some provisions that are more beneficial to wealthy households (…) are larger than expenditures for family-oriented provisions.” For example, the table below shows wealth-oriented provisions total approximately $252 billion, while family-oriented credits total about $187 billion in revenue loss.

Source: U.S. Government Accountability Office

The GOA points out that it hasn’t considered every provision in the tax code of course. But I’d say this is good enough to give us a general idea.

Scroll to Continue

What the tax code means to youYou might conclude that to get the greatest tax advantages, it’s better to be wealthy than a low-income taxpayer. Not so fast. Can’t we be both? Actually, this opportunity is quite common. Of course, we’ve all heard of billionaires with little taxable income. But tax loopholes for tycoons are exclusive boons. The increasingly common situation results from a confluence of widespread retirement trends. That means it could be available to the rest of us.

Reaching tax planning’s Golden Age Let’s consider three elements that affect modern retirement. First, instead of getting a pension to pay for retirement, Americans commonly accumulate wealth in tax-advantaged accounts, like a 401(k) or IRA. Second, when applicable, we must start taking Required Minimum Distributions (RMD) from retirement accounts at age 72. Third, Social Security can make it appealing to delay retirement benefits until age 70. As a result, there could be several years between the time we retire and the time we must claim social security and take RMDs. Indeed, according to Gallup, Americans retire in their early 60s.

During this gap period, retirees could have a high net worth but manage a low income. Think of it as reaching a tax-planning golden age to explore some of the tax code’s most generous provisions. For example, some retirees could enjoy the 0% capital-gain tax rate and harvest gains to make the most of it. Some who retire before qualifying for Medicare at age 65 might even qualify for a sizable health-insurance Premium Tax Credit. More generally, it’s an opportune time to consider Roth conversions.

Overall, the multitude of options available for retirement saving, including taxable, tax-deferred, and tax-free accounts, provide various money spigots that could be adjusted as needed to optimize taxation throughout retirement. Financial complexity fosters opportunity.

Other low-taxable income planning opportunitiesAt the edge of life, high medical deductions might cause low-taxable income. Expanded longevity and expensive long-term care make this situation all too common. Then, looking to fully utilize medical deductions can be very valuable. Low income can also temporarily result from taking a sabbatical, starting a business, or caregiving. Any time our income falls, the tax code is the juicer for pressing the proverbial lemonade.

To get the most generous tax breaks, it’s wise to build wealth and optimize periods of low taxable income. Modern retirement often begins and sometimes ends with such periods. Self-funded retirement also calls for wealth building, and the tax code provides considerable incentives for it. Wealth-building incentives and low-income tax benefits may mightily merge when we attain planning’s golden age, and the tax code bestows upon us the best of both worlds.

More Tax Advice From Our Partners at TurboTax.com:

How to Find a Good CPA for Your Taxes5 Facts About the Earned Income Tax CreditWhat is the Savers Credit?When to Use Tax Form 1099-R: Distributions From Pensions, Annuities, Retirement, etc.Editor’s Note: This article is for general information and educational purposes only and is not intended to serve as specific financial, accounting, legal, or tax advice. Individuals should speak with qualified professionals based on their individual circumstances. The analysis contained in this article may be based upon third-party information and may become outdated or otherwise superseded without notice.

The content was reviewed for tax accuracy by a TurboTax CPA expert.