stocks

The 2020 TSLA split sparked an 80% run in shares. But is Tesla set up for another rally after its proposal for a new share split?Tesla (TSLA, $1,010.64) on Monday signaled its second stock split in less than two years and became the third company in the trillion-dollar market cap club to propose a split in the past couple of months. Shares in the electric vehicle maker predictably popped at the opening bell.

The company’s notice of a Tesla stock split follows Amazon.com’s (AMZN, $3,295.47) proposed 20-for-1 AMZN stock split announced earlier this month, as well as Google parent Alphabet’s (GOOGL, $2,833.46) 20-for-1 GOOGL stock split disclosed in early February.

Tesla’s announcement came in a regulatory filing that was light on details, but that didn’t stop shares from adding well more than 6% in the first 15 minutes of trading.

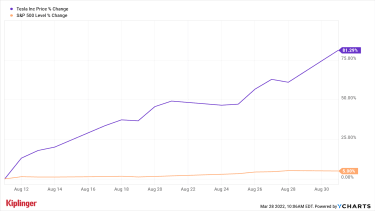

Fair enough. The last time Tesla split its stock, TSLA shares gained more than 80% between the early August 2020 announcement and the day the 5-for-1 split went into effect at the end of that month:

YCharts

If shares don’t go quite as crazy this time around, that will be understandable. After all, TSLA actually said very little in its filing.

What (Little) Is Known About the Tesla Stock SplitHere’s the deal: The company plans to request stockholder approval at its upcoming annual meeting “for an increase in the number of authorized shares of common stock … in order to enable a stock split of the Company’s common stock in the form of a stock dividend.”

That’s it. The date of the annual meeting has yet to be disclosed, but in 2021 it was held in October, if that’s of any help.

The almost certain outcome, however, is that the Tesla stock split will make shares more accessible to retail investors who currently balk at the four-figure sticker price. True, brokers are happy to sell their clients fractional shares for free, but a stock with a high dollar price is simply tougher for traders, investors and insiders to sling around.

Slicing the price of admission to any stock helps increase liquidity and volume. Those are not necessarily bad things. Just be aware that volatility will likely increase as a result, too.

The Last Split Triggered Buying. Will History Repeat?The downside to stock splits is that a company’s stock usually goes up even though nothing under the hood has changed. A stock split is essentially the same thing as making change: swapping, say, a $5 bill for five $1 bills. A company’s fundamentals, its prospects and its shares’ valuation remain the same.

That’s why some strategists are telling investors they should take any pop from the Tesla stock split as a chance to get out while the getting is good.

“Tesla’s desire to pursue a stock split doesn’t change the fact that its stock is still trading at a valuation completely disconnected from fundamentals,” says David Trainer, CEO of New Constructs, an investment research firm based in Nashville.

Trainer fears that by dramatically reducing its price post split, TSLA will become even more attractive to “unsuspecting” retail investors.

“This could further fuel the bubble in Tesla’s stock that has been brewing over the past two years,” he adds. “We advise investors to sell the rally in Tesla shares, as the stock faces no fundamental upside catalysts.”

For context, here’s how TSLA stock has fared against the S&P 500 over the past two years:

YCharts

After a 900% run vs. just 86% for the border market over the past couple of years, Trainer isn’t alone in his concerns. Wall Street gives TSLA stock a consensus recommendation of Hold, per S&P Global Market Intelligence. A number of less optimistic or even bearish analysts do cite valuation as a major worry.

Indeed, Tesla’s stock trades at nearly 95 times analysts’ fiscal 2022 earnings per share (EPS) estimate. True, the Street forecasts the company to generate average annual EPS growth of almost 40% over the next three to five years, but TSLA still commands a pretty hefty premium. That’s especially true if you buy the bears’ argument that an onslaught of electric vehicle industry competition isn’t being adequately priced into TSLA shares.

Here’s the pros’ bottom line: Of the 35 analysts issuing opinions on Tesla stock surveyed by S&P Global Market Intelligence, 11 rate it at Strong Buy, six say Buy and nine call it a Hold. Notably, TSLA also gets six Sell recommendations and three Strong Sells.

Sell calls are remarkably rare on the Street, so make of that what you will.

The Lowdown on Living Trusts

estate planning

The Lowdown on Living TrustsA trust can solve a lot of problems. But like all tools, it can also be misused.

March 24, 2022

Your Guide to Roth Conversions

Special Report

Tax Breaks

Your Guide to Roth ConversionsA Kiplinger Special Report

February 25, 2021

Surprising Stocks to Buy for Dividends, Defense and Inflation Protection

stocks

Surprising Stocks to Buy for Dividends, Defense and Inflation Protection Soft drink equities could be a great place to hide out amid heightened market volatility and rapidly rising prices.

March 21, 2022

20 High-Volatility Stocks for the Market’s Next Swing

stocks

20 High-Volatility Stocks for the Market’s Next SwingActive or tactical investors and traders might want to lean into the market’s volatility via high-quality, high-vol stocks.

March 28, 2022

BofA’s Savita Subramanian: Stocks Are in for a Volatile Year

stocks

BofA’s Savita Subramanian: Stocks Are in for a Volatile YearA lot has happened already in 2022, says the head of equity and quantitative strategy at BofA Securities. But the market’s roller-coaster ride is far …

March 28, 2022

Micron (MU) Earnings on Tap as End of Q4 Season Approaches

stocks

Micron (MU) Earnings on Tap as End of Q4 Season ApproachesOur preview of the upcoming week’s earnings reports includes Micron (MU), Lululemon (LULU) and Walgreens (WBA).

March 28, 2022

Stock Market Today (3/25/22): Major Indexes Post Weekly Gains

Stock Market Today

Stock Market Today (3/25/22): Major Indexes Post Weekly GainsStocks largely traded flat Friday amid a slow news day and a trickle of economic datapoints.

March 25, 2022